With its many uses, light weight, and impressive durability, it’s no wonder that aluminum is big business in the United States. If you’re in that business, it’s likely you’ll explore importing aluminum With its many uses, light weight, and impressive durability, it’s no wonder that aluminum is big business in the United States. If you’re in that business, it’s likely you’ll explore importing aluminum from foreign sources.

Key Takeaways

In this article, we’ll review the ins and outs of importing aluminum into the United States.

While China is the number one producer of aluminum in the world, the U.S. sources most of its aluminum from other countries. This is largely due to high tariffs on aluminum and other goods from China, which we’ll review a little later in the article.

In 2023, the United States imported aluminum products to the tune of over $22 billion. Most of those products came from Canada, making them the primary supplier of aluminum to the U.S.

Other countries from which the U.S. imports substantial quantities of aluminum include:

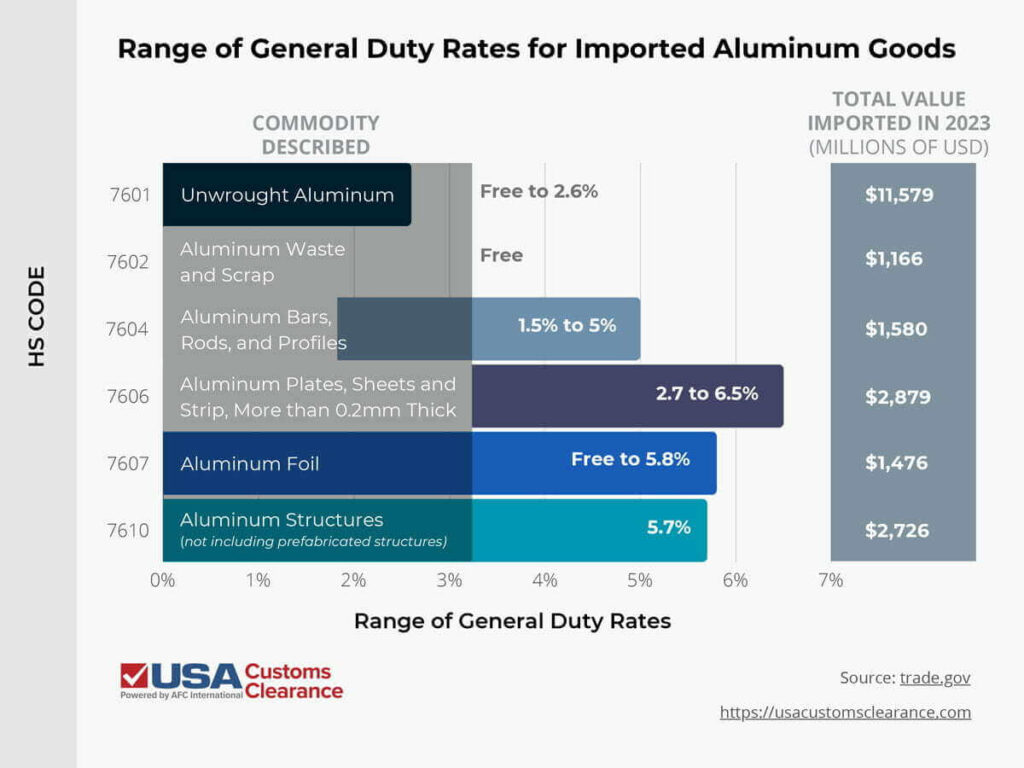

Most aluminum goods are classified in chapter 76 of the Harmonized Schedule (HS), which plays a part in determining their Harmonized Tariff Schedule (HTS) number. In the table below, I’ve listed the HS codes for some of the most commonly-imported aluminum products and the commodities they describe.

Aluminum importers face many challenges in 2025. Notably, while Canada has long been a top supplier of aluminum to the USA thanks to the United States-Mexico-Canada Agreement (USMCA), tariffs of 25% on most aluminum imports has complicated this trade relationship.

Despite this hurdle, imported aluminum is nearly guaranteed to be in demand, since U.S. manufacturers are unable to keep up with the country’s need for this versatile metal.

Related: Explaining the Difference Between HTS Codes and HS Codes

While global availability is in good shape, the U.S. faces a domestic production shortage of aluminum.

In March 2024, Missouri-based Magnitude 7 Metals ceased operations at their plant in the Show Me state’s city of Marston. The plant, which is purportedly capable of supplying up to 30% of the aluminum needed in the U.S., is the third such location to close in the last several years.

While this is obviously a blow to domestic production, importers can benefit by meeting the gap in demand.

Thinking about diversifying your selection of imported metal goods? Check out our guide to importing copper into the United States.

This is a fluid situation, as tariffs have been repealed, increased or even expanded to cover additional aluminum products over an extended period of time.

In May 2024, the Biden Administration announced a new set of tariffs on aluminum imports from China, raising the rate of tariff to 25%. The administration also indicated that they’re in favor of even higher tariffs on Chinese steel and aluminum, so it’s unlikely that these extra fees will disappear any time in the near future.

As a Section 232 tariff, it can stack on other import taxes the U.S. has assessed on Chinese goods, such as reciprocal tariffs enacted by the Trump Administration. This drives the effective rate of tariffs on Chinese aluminum goods over 145% in most cases.

Since imports of aluminum from China have become so volatile, sourcing from other nations is vital. However, importers should keep in mind that aluminum imports from any other country are still subject to a 25% tariff imposed via Section 232 of the Trade Expansion Act.

Canada and Mexico are still viable sources of aluminum, despite rising tensions stemming from recent U.S. tariff policies.

Accurate documentation is at the heart of customs clearance. Some of the most important documents required are:

Considering the complexity of these documents (and the potential penalties associated with inaccuracies), it’s often wise to leave this aspect of importing up to a licensed customs broker.

Related: What Documents Do I Need To Import and Export?

In short, yes. Customs bonds are required for any shipment valued at $2,500 or more, so if you’re importing aluminum for commercial purposes, you’ll almost certainly exceed that value.

However, imported aluminum must be covered by a bond regardless of value since each shipment requires a specific license per rules established by the International Trade Administration.

Related: How to Get a Customs Bond: A Guide for New Importers

An experienced U.S. customs broker can provide a number of services to your business that allow you to focus on growing your business without getting buried in the minutiae of customs clearance reAn experienced U.S. customs broker can provide a number of services to your business that allow you to focus on growing your business without getting buried in the minutiae of customs clearance regulations.

Some of the tasks a customs broker can offer include:

In some cases, brokers can even arrange to pick up your aluminum at port once it passes CBP’s muster and ship it directly to you. This is because brokers often work for firms that provide third-party logistics (3PL) services.

Given the demand for aluminum in the United States, importers will find themselves in a lucrative but competitive business space. By partnering with experts in customs clearance, you can give yourself a leg up on that competition.

At USA Customs Clearance, you can schedule a 1-on-1 consulting session via phone or video conference with one of our import specialists. You’ll receive personalized guidance and be able to ask anything about the customs clearance process.

In addition to consulting, our services include:

If you’re ready to begin importing aluminum, give us a call today at (855) 912-0406 or fill out a contact form online. Our customs experts are standing by to help you avoid the potential pitfalls of importing this in-demand metal.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post