Despite their beauty and delicate appearance, there’s a variety of regulations governing the entrance of flowers into the United States. Keeping track of these requirements can be a complicated task to undertake. Consider some important information we’ve listed about importing flowers.

Key takeaways:

We’ll get into more detail on these points and more in the article. Once you’re done, you’ll be armed you with the information necessary to import flowers.

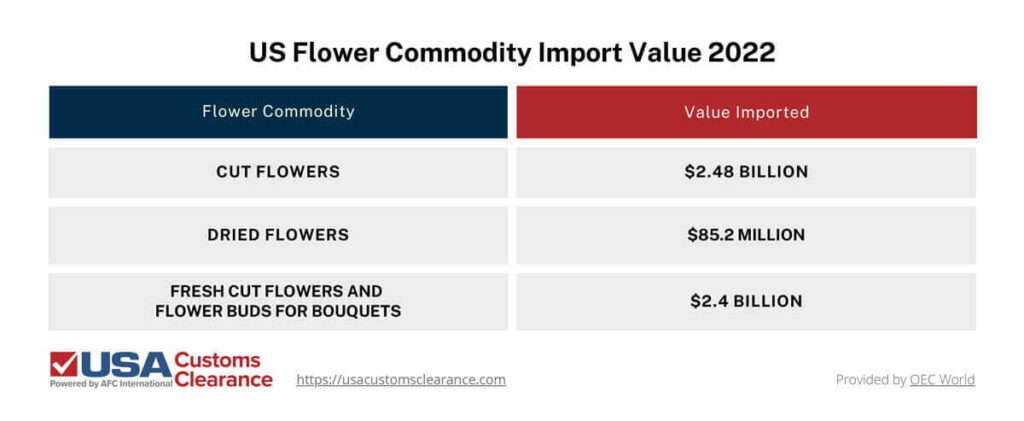

You are allowed to import flowers into the United States. In fact, these delicate and beautiful plants are frequently brought into the country each year. Consider some data that shows the import value of different types of flower commodities in 2022.

For reference, cut flowers refer to flowers or flower buds that have been cut from parent plants to be used for decorative purposes. Dried flowers have been dehydrated to remove their moisture. They’re also used for decorative purposes, but last much longer.

There are numerous countries that supply the U.S. with floral commodities. First, I’ll show you the top five countries that supply the U.S. with cut flowers.

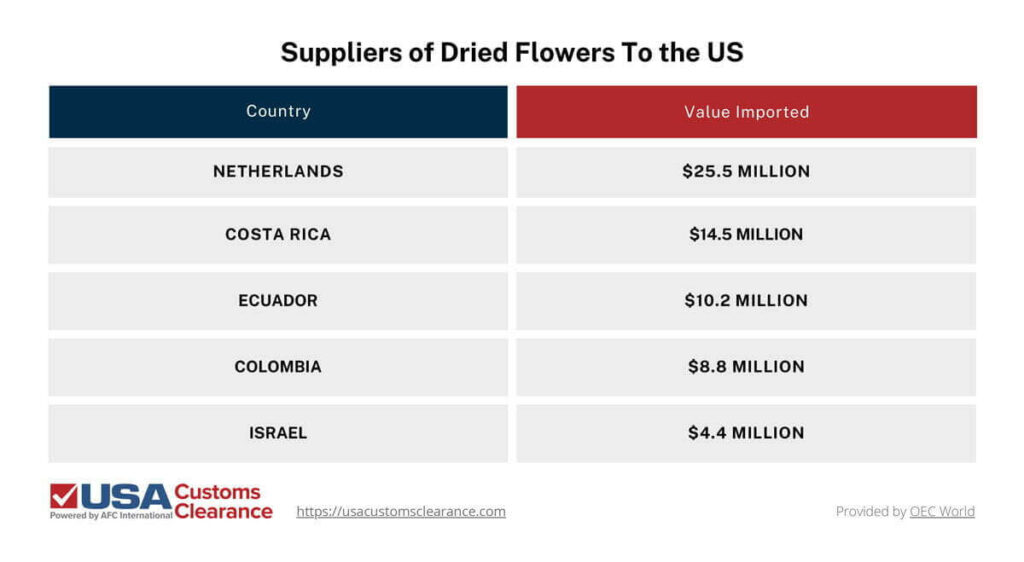

Now, I’ll provide you with a list of the top suppliers of dry flowers and the value imported by the United States. You’ll notice that many of the countries from the previous graphic will appear in this one.

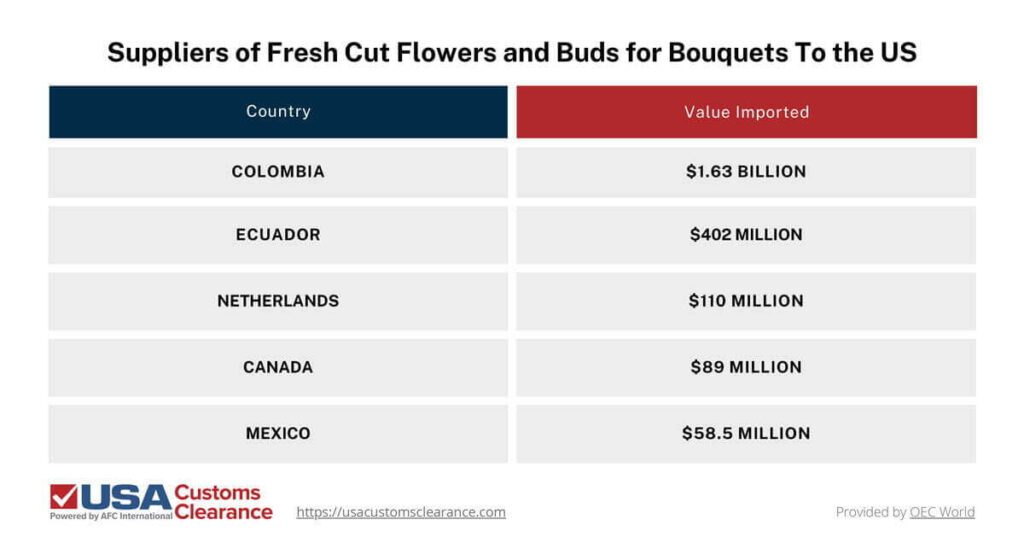

Finally, I’ll show you the U.S.’s top suppliers for fresh cut flowers and flower buds for bouquets.

Many of the countries that provide the U.S. with floral commodities are located in Central and South America. These countries benefit from climate conditions and soil quality that’s favorable for growing plants.

Colombia, Costa Rica, Mexico, and Canada also share free trade agreements (FTA) with the United States.

The respective agreements include:

The CTPA provides duty-free treatment for most flowers imported from Colombia. Flowers are also duty-free under CAFTA-DR and the USMCA thanks to the agricultural provisions in each one.

Related: What Is the USMCA?

Even if you know what country you want to import flowers from, looking for a supplier can be overwhelming. Fortunately, there are numerous online directories that you can use to find foreign flower suppliers.

Notable ones include:

Floranext has a comprehensive list of florist wholesalers in the U.S. and internationally. Trademo also has a list of global flower suppliers. They offer various insights like shipment activities, trade volumes, and trading partners. Fleurop is an international flower delivery service, but they can also connect importers with suppliers.

As with all imports that come into the U.S., you’ll need to satisfy the requirements of different federal agencies when you bring flowers into the country.

We’ll explain the requirements for each agency in the sections that follow.

According to CBP, all fresh cut flowers will be inspected by one of their agricultural specialists before they make entry into the United States. However, flowers that are citrus relatives or that have berries attached will be prohibited. Seasonal greenery is regulated for a variety of pests and diseases they could be carrying.

CBP will also want you to provide a variety of documents that are essential for importing. This includes paperwork like a bill of lading, packing list, commercial invoice, and similar items.

APHIS, which is part of the United States Department of Agriculture (USDA), is the primary federal authority that oversees the importation of agricultural products. In regard to importing flowers, you’ll need to follow APHIS’s Agricultural Commodity Import Requirements (ACIR).

The specific ACIR rules you’ll have to follow will vary based on the type of flowers you want to import and their country of origin.

To find out which requirements apply to your shipment, you should follow these steps:

After hitting the search button, the ACIR will generate a variety of results that apply to the criteria you’ve entered. Simply find the result that best fits your import and click the view button. This will reveal all the requirements you’ll need to follow.

You can also perform a variety of alternate searches within the ACIR that will give you more or fewer results. If you need further assistance, we recommend meeting with one of our Licensed Customs Brokers. They can help you find out which regulations apply to your flowers.

Our licensed customs brokers can help you identify the ACIR

flower regulations apply to your imports.

You can find the duty rate for flowers under the Subheading 0603 in the Harmonized Tariff Schedule of the United States (HTSUS). You’ll find duty rates anywhere between 3.2% to 7% ad valorem. In some cases, your flowers will be free of this tax.

Depending on where you’re importing your flowers, you might be able to circumvent applicable duties by applying for preferential tariff treatment under an FTA. If you’re still not sure which HTS code applies to your import, then use our HTS Lookup Tool!

Our easy-to-use tool will help you find the HTS code that applies to your flower import.

Knowing the duty rate on your flowers is only part of the battle. You’ll need to know how to factor it in with your other import costs to determine how much you’ll spend when importing your floral products. Keep in mind that its accuracy will depend on the correct HTS code being applied, which you should confirm with an import professional.

The formula for calculating customs duties looks like this:

Duty = Value of Goods × (Duty Rate ÷ 100)

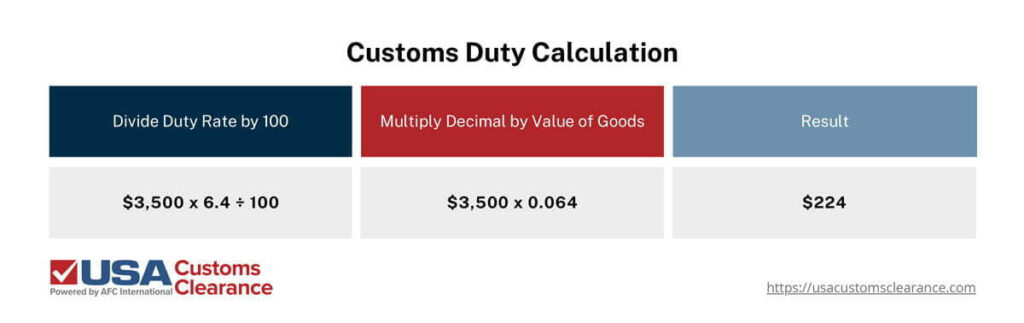

When you perform this calculation yourself, make sure to perform the division portion first. For our example, let’s consider you’re importing flowers that have a value of $3,500 and the duty rate is 6.4%.

The calculation will look like this:

Duty = $3,500 × (6.4 ÷ 100)

I will now perform this hypothetical calculation in the graph I’ve provided.

For our example, the duty rate you’ll have to pay is $224. You can use this same formula for the value and duty rate that applies to your flowers.

Related: A Guide To U.S. Import Taxes

USA Customs Clearance can help you bring your flowers into the country. We have a team of licensed customs brokers and import specialists with years of a vital experience. They’ll use their expertise to help guide you through the importing process. You can access their knowledge and a variety of other services that we offer.

Start your importing journey by using one of our services today. If you have any questions, contact our team at (855) 912-0406.

Schedule a 1-on-1 session with one of our Licensed Customs Brokers and get the importing help you need.

Copy URL to Clipboard

Copy URL to Clipboard

My name is Ryne from Botswana Africa, l wish to partner with a company in the USA to supply flowers and other gro products apon an agreement.

Company: The Ten Keys

Botswana

I have specially nurtured an edible rose which is very popular in China, I'd like to import either the fresh rose, dried rose, or seeds to the US and become a supplier for major food processing and cosmetics vendors. If anyone is interested, please get in touch with Stan at ssgus81@gmail.com. Thanks!

Hi I’m interested in importing flowers from Mexico. I need information to help guide me. Thank you

Hi iam from India

I have lot flower avilable. So

Iam intrested in export. So anybody help me. Then I will pay amount.

Hello Satish,

My name is sapan from USA. I want to startup flower business and looking for vendors from India who can ship flowers to USA.