Industries and hobbies from arts and crafts to automotive and aerospace are dependent on graphite. For importers in the U.S., this can provide a lucrative opportunity. However, it’s important to first understand how this mineral is regulated and which countries export the most graphite to the United States.

Key Takeaways

In the United States HTS, graphite is broadly separated into two headings:

There is no general rate of duty applied to the import of natural graphite, while duties on artificial graphite range from 3.7% to 4.9% of the shipment’s value, depending on what form the graphite takes (powders, pastes for electrodes, etc.) These duties are in addition to any active tariffs, which I’ll cover later in this article.

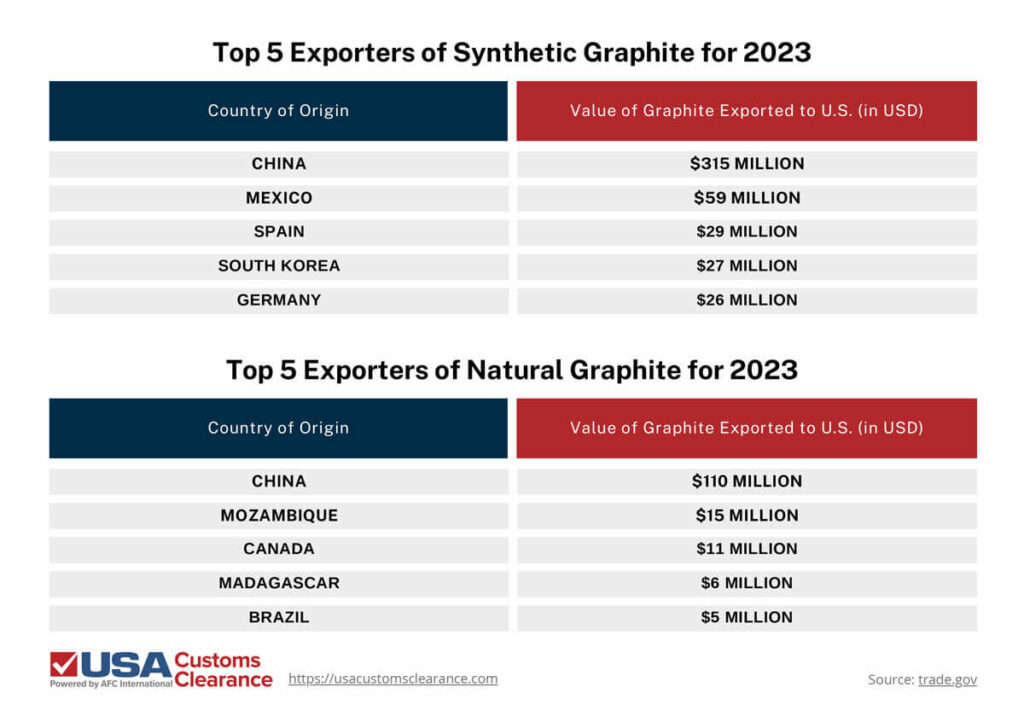

In 2023, the U.S. imported approximately $563 million worth of artificial graphite and $157 million worth of natural graphite. I’ve laid out the top five suppliers of each type of graphite in the charts below.

As you can see, China was the top supplier of natural and artificial graphite to the USA in 2023 by a significant margin. While the Asian economic powerhouse’s capacity for the production and distribution of graphite is unmatched, importers in the U.S. may begin seeking alternative sources soon due to new regulations from China and increased tariffs on Chinese goods imposed by the office of the United States Trade Representative (USTR).

Graphite is a key material for the construction of anodes, a vital component of electronic vehicle (EV) batteries. This has made the international trade of graphite a common point of contention in economic disputes between the U.S. and China.

In December 2024, China further tightened its export controls on natural and synthetic graphite. This is less of a problem for stateside importers than it is for Chinese exporters, as they will come under greater scrutiny when it comes to the export of dual-use graphite (that which has potential military applications.)

However, importers of Chinese graphite will still feel some hiccups in the supply chain as Beijing enforces these tighter restrictions.

Imported shipments of graphite, like any other good or raw material, must be brought into the country according to rules and regulations set and enforced by United States Customs and Border Protection (CBP).

Some elements of CBP customs regulations that apply to most or all imported shipments include:

Speaking of import licenses, there is no specific license or certification required by a CBP partner government agency for importers to bring graphite into the USA. However, those who bring in graphite which they intend to use for nuclear energy applications may require a license from the United States Nuclear Regulatory Commission to operate in the U.S. Re-sellers and importers of graphite for non-nuclear purposes will not need a special license to trade in this mineral.

Learn more about documents needed to import and export in this dedicated article.

As of this writing, there is a 25% Section 301 tariff in place on natural graphite powder and artificial graphite from China. However, U.S. importers should anticipate increases to this rate (and the specific forms of graphite to which it applies) even as soon as January 2025.

This is primarily due to President-elect Trump’s stance on trade with China. He has proposed tariffs as high as 60% on all imported Chinese goods, while graphite miners in the U.S. have called for tariffs of up to 920% in order to remain competitive with Chinese exporters.

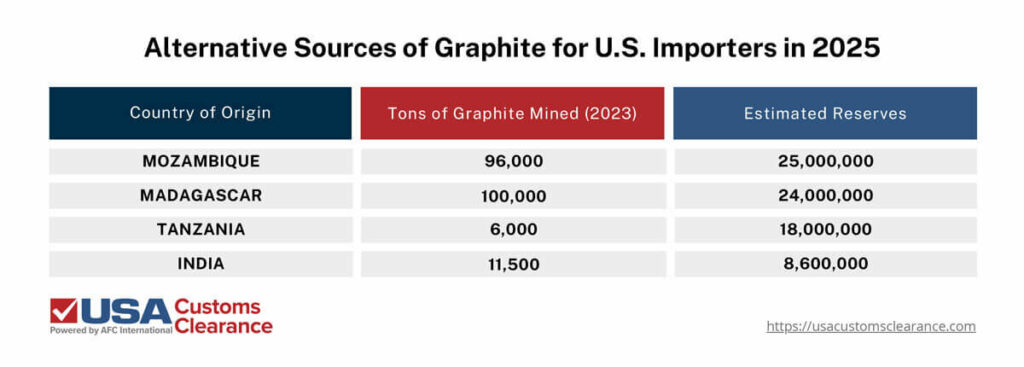

While China has historically accounted for the vast majority of graphite imported to the U.S. over the last several years, the aforementioned tariffs and export controls should compel importers to consider alternative sources of the mineral. Thankfully, there are other sources available.

A report from the United States Geological Survey indicates that Brazil, while having only mined approximately 73,000 tons of graphite in 2023, likely has up to 74,000,000 tons of the mineral in reserves. This is only four million fewer tons than China’s estimated reserves of 78,000,000, making Brazil a top prospect for sourcing graphite outside of China in the coming years.

I’ve included a few more notable countries with high estimated reserves of graphite in the table below.

Keep in mind that it’s China’s unparalleled capacity for mining and production along with its natural reserves that position the country so strongly on the graphite supply chain.

Other countries must expand their mining and refining facilities, if importers in the U.S. are to find ample supplies of the mineral available from alternative suppliers.

Related: Importing Potash to the United States

Worried about the Strict Regulations? Ask Our Experts.

Our Licensed Expert Consulting Session Will Personally Guide You.

Given how instrumental graphite is to multiple electronics sectors (particularly EVs), demand for the mineral in raw or manufactured states won’t decrease any time soon. However, importers need to navigate a slew of export controls while avoiding or mitigating tariffs to import graphite legally and profitably. That’s where partnering with a customs broker can prove invaluable.

At USA Customs Clearance, our team of brokers and customs experts have years of experience assisting importers with the complexities of successfully bringing foreign goods into the United States. We can help you cut through the red tape and avoid fines and delays from improperly filed paperwork or incorrect HTS codes.

Our full list of services includes:

Give us a call at (855) 912-0406 or submit a contact form online today. We’re standing by to help you electrify your importing business.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post