Importing pharmaceuticals into the U.S. can be a lucrative endeavor. However, the strict regulations surrounding these commodities present a challenge for even the most seasoned importers.

Key Takeaways:

Join us as we review the fundamentals of importing pharmaceuticals into the United States.

If you’re planning on importing pharmaceuticals into the United States, registering with the FDA is the first and most important step. Specific information must be included in order for your registration to be accepted, including:

If you are a foreign enterprise attempting to import pharmaceuticals into the U.S., you would be required to supply the name and DUNS of a U.S. agent and all importers.

Once you’ve registered, your imported pharmaceuticals will need to be tested by the FDA. This process can take weeks and even months, but it’s important for the safety of American consumers. If your imports have already been tested, you’ll be able to skip this step. However, the FDA will still periodically check in to ensure the drug or drugs keep their efficacy and do not become less safe for the American public.

To summarize, you will not be able to import pharmaceutical items unless they have already been cleared by the FDA.

If you’re unsure about any aspect of the importing process, it’s wise to consult an importing professional. Our team of licensed experts will review the details of your shipment and go over everything that is required. Additionally, we can provide with numerous supply chain services including warehousing, order fulfillment, domestic & international transportation, and more.

While it’s obviously important to register and get FDA approval for your goods first, it’s also important to make sure your shipment clears U.S. Customs. Like any other process created by the government, this means dealing with plenty of paperwork.

Here are the most important documents you will be required to include with your shipment

You should also be aware that CBP can choose to search your cargo for any reason. If this occurs, they will bill you for the cost of doing so.

The United States has a robust pharmaceutical industry in all aspects — development, research and manufacturing. The first two parts of that equation are dealt with domestically, but not all pharmaceuticals are manufactured in the country. To understand why, it’s important to consider the size and scope of this industry.

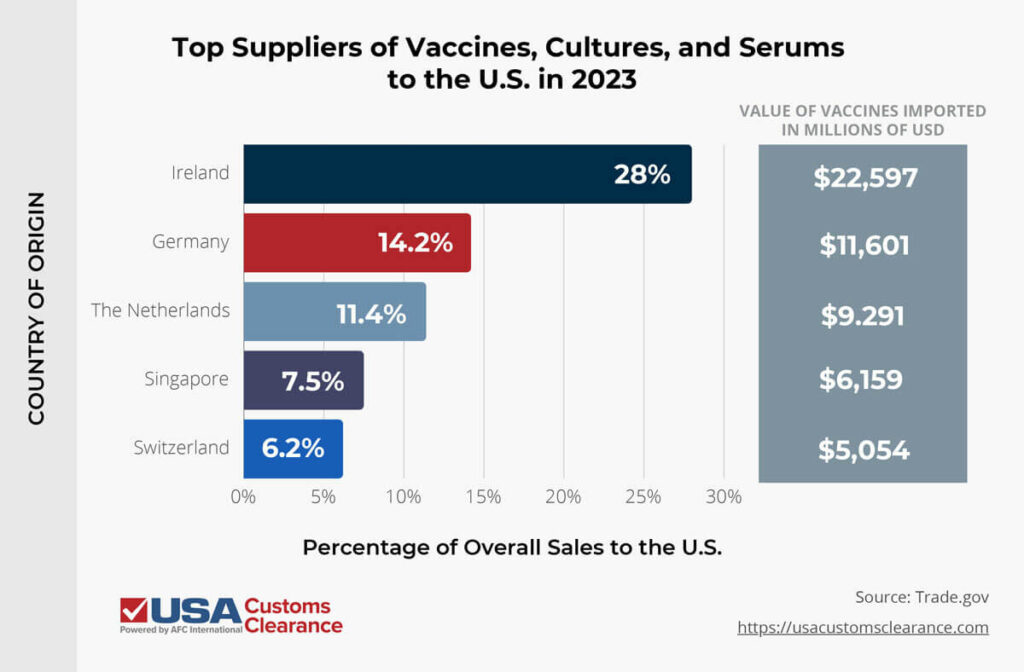

In 2023, the U.S. imported over $81 billion worth of vaccines, cultures, and antiserums alone, with the countries listed below supplying the majority of them.

All told, the United States imported over $176 billion worth of pharmaceutical products in 2023.

The pharmaceutical industry in America is made up mostly of generic drugs to manage the high cost for consumers. To further drive down the financial impact on the U.S. public, much of the manufacturing is done overseas.

Despite the United States’ robust trade partnership with our neighbor to the north, importing pharmaceuticals from Canada isn’t an option for most importers. However, that’s starting to change.

The following states have developed or are developing programs to import certain medicines and medical equipment from Canada.

If you want to source pharmaceuticals from Canada, be sure to see if your state has laws in place to allow you to do so. If it doesn’t, standard FDA rules will apply, and you’ll need to seek alternative sources.

The U.S. government announced new tariffs on Liberation Day, which was April 2nd, 2025. Starting on April 5th, 2025, the U.S. will place a 10% universal tariff on different nations. On April 9th, 2025, country specific tariffs will take effect.

For the time being, pharmaceuticals are exempt from both of the Liberation Day tariffs. The U.S. government is exempting pharmaceuticals to avoid disrupting healthcare supply chains. That said, there’s no indication as to how long the exemption will stay in place.

The current presidential administration is contemplating a Section 232 investigation into pharmaceuticals that could lead to tariffs. As an importer, you should continue to monitor this situation closely to stay updated on any changes.

You will need a customs bond to import any pharmaceuticals into the U.S.

Bonds are required for any shipment valued $2,500 or more and for regulated good of any value. Since pharmaceuticals are among the most strictly regulated commodities in the country, you’ll need a bond regardless of how much your shipment is worth.

Between the strict regulations and paperwork, importing pharmaceuticals can seem overwhelming.

A customs broker can help you with every step of this often confusing process.

They can fill out the necessary documents with the correct information provided by you and file them on your behalf. Many importers take this approach, since customs brokers deal with the forms regularly and know exactly how to complete them.

Once your items reach their port of entry, a customs broker can then help you clear your items so that you can receive and distribute them domestically. On top of that, many brokers work for logistics firms that can arrange transport and warehousing of your goods.

Pharmaceuticals are big business in the U.S., but they are among the most difficult commodities to import. If you need help with this difficult process, you’ve come to the right place.

The brokers and customs experts at USA Customs Clearance have extensive experience helping importers like you cut through the red tape of government regulations. We can help you avoid delays and fines that arise from mistakes in importing.

Our services include:

When you’re ready to star bringing pharmaceutical goods, let the import experts help. Call us at (855) 912-0406 or contact us online today!

Copy URL to Clipboard

Copy URL to Clipboard

Interested in import of generic drugs

I am looking for a customs broker who can help with importing pharmaceuticals. Can you connect me with one?