If you’re considering importing rice from India, you’re not alone. Rice is the foundation of many cuisines around the globe. However, you’ll need to follow certain rules if you want to import this valuable commodity.

Key takeaways:

I’m going to share the importing knowledge and expertise of USA Customs Clearance to help you with importing rice from India.

On April 2nd, 2025, the U.S. government announced that it would implement tariffs against numerous countries. As a result of this announcement, India will receive a 27% reciprocal tariff starting April 9th, 2025, at 12:01 AM.

The only way Indian imports will be exempt from this requirement is if they’re loaded and in transit prior to the implementation date. Any goods you purchase from India, including rice, will be exceptionally more expensive once the 27% tariff is implemented.

On April 9th, 2025, the day reciprocal tariffs were supposed to take effect, president Donald Trump made the decision to instate a 90-day pause. Except for China, India and all other countries will be subject to a flat 10% tariff.

Changes in the international trade environment can happen quickly. For the most up-to-date information, schedule a consulting session with one of our Licensed Customs Brokers or give our team a call at (855) 912-0406.

Whether you are allowed to import rice into the United States depends on whether you are bringing it into the country for personal or commercial purposes. It also depends on if the country you’re importing from is infested with Khapra beetles.

Personal (or noncommercial) imports of rice from India into the United States are prohibited. Likewise, uncooked rice that’s from a country infested with Khapra beetles is forbidden. Unmilled rice for commercial or personal use is generally prohibited as well.

However, commercial imports of Indian rice into the United States are allowed when the importer has followed all federal rules and regulations. We’ll discuss these requirements in the following sections.

The importation of rice into the United States involves the jurisdiction of multiple government agencies. Food is one of the most scrutinized categories of imports.

The U.S. government wants to ensure that all foods that enter the country are safe, sanitary, and up to all other standards. After all, improperly handled or produced food can cause significant problems for anyone who eats it.

The following agencies have a say in whether your rice is allowed into the country:

To make sure you’ve checked all your boxes, let’s run down the expectations of each federal agency individually.

APHIS requires that rice importers obtain a permit for their goods. You can apply for one using a PPQ Form 587. This can be completed online, or you can print the form and submit it through the mail. You should apply at least 30 days before your shipment is set to arrive, as it can take that long to receive the document.

If you plan to continue to ship the same item into the country, the permit remains valid until the listed expiration date. You don’t need to reapply for a permit every time you have a shipment.

Only United States residents with street addresses in the country can receive a permit.

Commercial rice imports will need a phytosanitary certificate if they’re traveling from a country with a Khapra beetle infestation. The certificate will also need the statement, “The shipment was inspected and found free of Khapra beetle (Trogoderma granarium).”

For context, the Khapra beetle has a reputation for destroying grains. There are numerous countries that are infested with this insect, including India.

The FDA has a variety of requirements that you’ll have to follow to get your Indian rice into the country.

All commercial imports of foods require prior notice with FDA. When you arrive at the port of entry, Customs and Border Protection will need proof or prior notice (known as “PN”) to release the food shipments at the border. This is in addition to usual CBP entry documents.

HACCP is a management system to ensure food imports are safe. Your rice will need to abide by the requirements set out by this regulation.

The FDA requires food imports to be reviewed by a third party before it enters the country. This will help address safety issues before the rice arrives in the U.S. and ensure the food was produced in accordance with U.S. safety standards.

You’ll also be required to verify that your foreign supplier made rice that abides by Section 418 and 419 of the Food Drug & Cosmetic Act. The FDA also wants you to ensure your supplier didn’t send food that was adulterated or misbranded.

Keep in mind, the FDA doesn’t approve individual shipments. Instead, the food either needs to have an FDA sanction or the facilities that handle the products have to be registered with the FDA.

Importing food into the United States is complicated. Because of the number of the intricacies involved, CBP recommends using a licensed customs broker to navigate the process for you. However, you can handle it yourself instead if you choose.

Customs brokers are experienced in the ins and outs of importing a wide variety of items into the United States, and they will know exactly the documents you need for your shipment to be imported successfully. Licensed customs brokers are also skilled at calculating customs bond amounts.

In any case, you should contact the port of entry you intend to ship through in advance to make sure you know the requirements and necessary information. CBP advises that you can consult with one of their import specialists at the port of entry.

The specialist will run through the requirements based on the type of food, country of origin and other restrictions. CBP entry forms needed to be filled out within 15 days of the shipment’s arrival. After 15 days, they will be sent to a warehouse where storage fees could be charged.

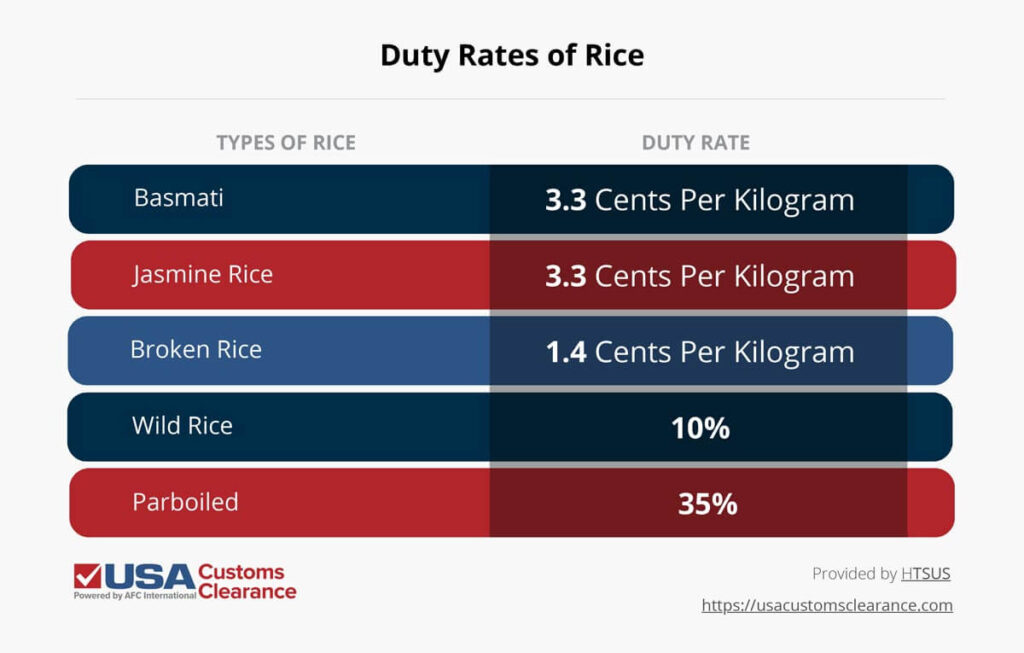

The duty amount owed on rice varies depending on the type of rice being imported. I’ve provided several of the most popular types of rice commonly sourced from India, and the duty rates owed on each. Notably, the duty rate on some rice is calculated on a per kilogram basis, while others simply use a flat rate.

Budgeting is an essential part of importing. That’s why you should check the duty rates for your rice prior to purchasing it.

To import your rice into the United States, you will have to complete a number of documents. These are the documents required by the U.S. government to allow your shipment into the country:

You should also need the following import documents so that your shipment can cross the border successfully:

Having the right import documents ready will help prevent any delays when your rice arrives.

Meet with one of our Licensed Customs Brokers and discuss the regulations you need to follow to bring your goods into the country.

In a press release dated 7/20/2023, India’s Ministry of Consumer Affairs, Food and Public Distribution mandated that exporting non-Basmati white rice is “Prohibited with immediate effect.” This rice export ban was issued in response to rising prices in India’s domestic market and to “Ensure adequate availability of non-Basmati white rice” for citizens of the subcontinent.

India also imposed a 20% duty rate on parboiled rice. Exports of broken rice have been banned since August 2022.

Given India’s position as the world’s largest exporter of the popular grain, this ban could have significant ramifications.

Why is one country’s ban on exporting rice so significant to the international rice trade? Take a look at the following statistics.

This new ban comes at a time when rice prices have already seen a 36.5% increase since January 2022. With no decrease in demand for rice in the global market, prices are likely to continue increasing if the ban persists.

According to S&P Global, India’s rice export ban will likely stay in place until at least until October 2024. However, there’s no guarantee if the ban will be renewed or not.

This is not the first time India has imposed a ban on rice exports, and examining historical data offers some insights into how long this ban may last.

From 2007 to 2008, a global rice crisis saw a dramatic jump in the price of rice on the international market. India’s initial response to the crisis was similar to what they’ve done this past week.

In October 2007, the export of non-Basmati rice was banned. However, three weeks after the ban, India changed tactics to allow the formerly banned rice to be exported if minimum purchase thresholds were met. This lasted until April 2008 when the ban was put back into place.

Once back in place, the ban lasted well into 2012. One of the main reasons the ban was finally rescinded was a bumper crop that resulted from an ideal monsoon season. With steady rains from June to September, rice crops flourished.

Unfortunately, meteorological predictions show that the amount of rainfall is unlikely to happen again this year, and it’s equally unlikely that the ban is going away any time soon.

In fact, other high-volume rice exporting countries in Asia may follow suit to ensure sufficient domestic availability. It’s safe to say that, at least in the short term, the formerly stable rice market will join corn and other grains that have seen drops in availability and commensurate price spikes.

Taking these historical and meteorological factors into account, it would be prudent for rice importers in the U.S. to prepare for substantial difficulties.

As part of that preparation, consider scheduling some time to consult with one of our customs experts at USA Customs Clearance. We’re up-to-date on all the rules and regulations pertinent to importing foodstuffs to the U.S., and we can help you stay one step ahead of your competitors during this critical moment in the international rice trade.

If you are interested in importing rice for commercial purposes, you are not alone. India is the world’s top exporter of rice. The country exports about 16.5 million metric tons of rice in a year, according to Statista. That’s about a quarter of the entire amount of rice supplied through exporting worldwide.

Thailand, the second-biggest exporter of rice, exports about 8.2 million metric tons. Even though India is the largest global exporter of rice, the United States actually imports more rice from Thailand than it does from India. This is because the United States is largely importing jasmine rice, which is grown in Thailand.

Vietnam is another alternative to explore. They exported around 7.6 million metric tons worth of rice between 2023 and 2024. The U.S. and Vietnam also share a bilateral trade agreement, which enhances trade between each country.

Related: Import Costs From Vietnam: Taxes, Duties, and Other Fees

As you can see, importing rice from India is no easy undertaking. Make the process easier on yourself by hiring USA Customs Clearance to help.

Our team is full of licensed customs brokers and other import specialists with the knowledge you need to trade successfully. We offer different services that will make your import experience much easier.

Don’t put off importing your Indian rice any longer. Get started with one of our services or contact us through the site. We also have representatives that are ready to receive your call at (855) 912-0406 and assist with any importing questions you want to ask.

If you plan to import regularly, there's no point in filling out a single entry bond for each shipment.

Obtain one of our continuous customs bond to cover all your imports for an entire year.

Copy URL to Clipboard

Copy URL to Clipboard

we are exporting rice from pakistaN .If you have any inquiry pls ask free.awaiting your

feed back will be apprecitated.

thanks best regard

shahbaz ahmed

alshahbaz corporation

Dear Sir/Madam

What are import and other duties/taxes in importing Rice into USA.

Regards

I need expert guide for basmati rice import to usa from india