The importance of silk to the development of international trade is hard to overstate. Today, hundreds of years after the founding of the Silk Routes that connected The Far East with the Middle East and Europe, importing silk is still a profitable venture.

Key Takeaways

In this article, I’ll cover which countries export the most silk to the United States, which U.S. government agencies oversee silk imports, and how the right import partner can help you avoid issues during the customs entry process.

Worried about strict rules and regulations?

Our Licensed Expert Consultants Will Personally Guide You.

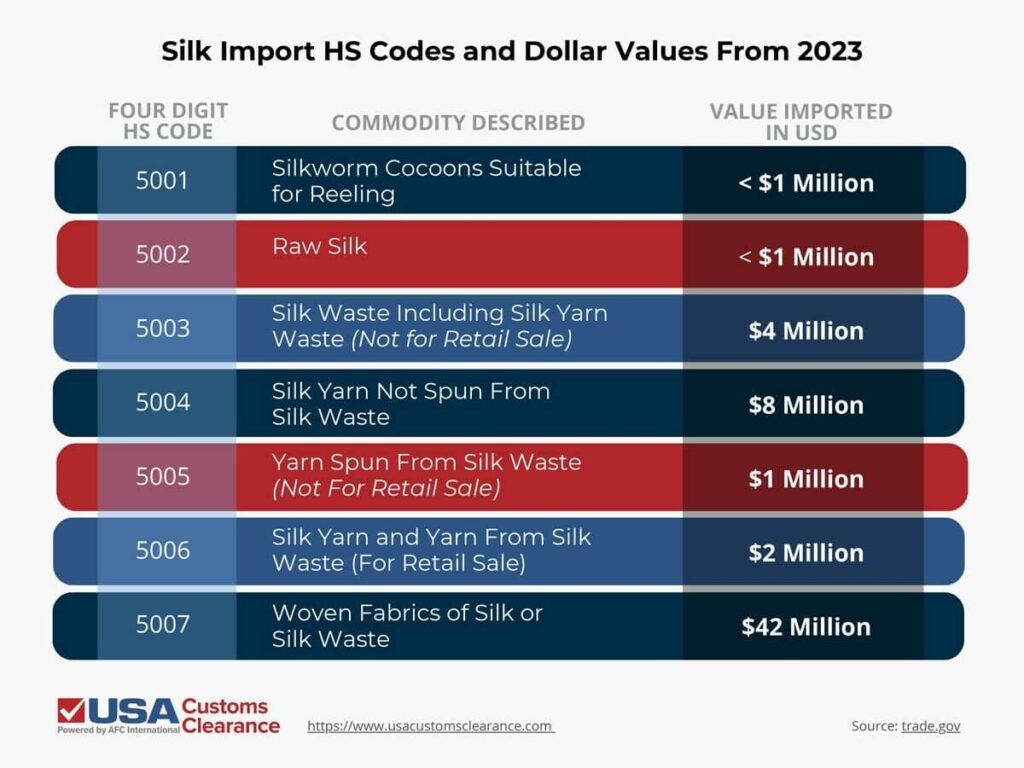

Silk has its own chapter in the United States Harmonized Tariff Schedule (HTS), and is broken down into just seven four-digit subcategories. I’ve laid these out in the table below, along with the USD value of each subcategory imported into the United States in 2023.

In most cases, silk can be imported into the U.S. free of duties. However, certain varieties will incur duty rates of 0.8% to 3.9%.

Many first-time importers assume China should be their first choice for sourcing silk due to the country’s historic significance in the international silk trade. However, in the modern era, China doesn’t have quite the stranglehold on this commodity they once boasted.

The U.S. mostly imports silk fabrics and yarn for the making of clothing and other textile goods, rather than the raw material itself. While China does produce a significant portion of those imports, other countries account for the majority.

In 2023, China exported approximately $12 million worth of silk and silk products to the United States. Going by four-digit HS codes, the only silk commodity they ranked number one for overall was silk yarn not spun from silk waste.

China is still synonymous with this luxurious fabric due to its long and well-recorded history of silk production, but importers in the U.S. usually source silk from other areas.

Related: Importing Wool to the US

By USD value, South Korea, Italy, and India were the top three exporters of silk fabrics to the United States in 2023, with China coming in fourth. For silk yarn, Mexico, Switzerland, and Japan trail behind China, but only slightly.

These aren’t the only countries that produce and export silk. France, the United Kingdom, and Thailand also export millions of dollars worth of silk to the U.S., but not nearly as much as the top three countries mentioned above.

Worried About the Strict Regulations?

Our Licensed Expert Consultants Will Personally Guide You.

You’ll find that a handful of government agencies have a hand in regulating silk imports. These agencies include:

Additionally, the Office of Textiles and Apparel (OTEXA) keeps import data about silk coming into the U.S. Their resources can help you determine if your silk is subject to preferential tariff treatment.

If your shipment of imported silk meets or exceeds $2500 in value, you will need a customs bond to ensure all duties and fees are paid at the port of entry. Smaller shipments for personal use are not subject to this requirement.

Related: How to Get a Customs Bond

You Must Pay Import Duties & Taxes for your Goods.

A strategic partner can make importing silk a smooth process at every step. If you’re unsure about any aspect of clearing your shipment through U.S. customs, we’re here to help.

USA Customs Clearance can ensure that you don’t encounter surprises at your port of entry. Importers handling things on their own, especially when new to the process, can miss a step and incur hefty fines due to even the most honest mistakes. Working with a licensed customs broker ensures a smooth importing process and guarantees your transaction is smooth as silk.

Our services include:

Need help ironing out the wrinkles in the silk importing process? Give us a call at (855) 912-0406 or submit a contact form online today!

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post