Customs bonds are used to import goods into the country. Despite their frequent use in international transactions, many people have a hard time figuring out which one they require. Before you learn about each type, you’ll need to understand a few essential points first.

Key takeaways:

In this guide, you’ll learn all the essentials regarding the different types of bonds you will come across when importing.

Customs bonds are used as a surety contract between Customs and Border Protection (CBP) and an importer. However, other parties like transportation providers or port employees may use a customs bond as well, particularly when brokering shipments on behalf of others.

The purpose of the bond is to guarantee the importer will adhere to all applicable regulations set by CBP. It also guarantees CBP will be paid all applicable duties and taxes.

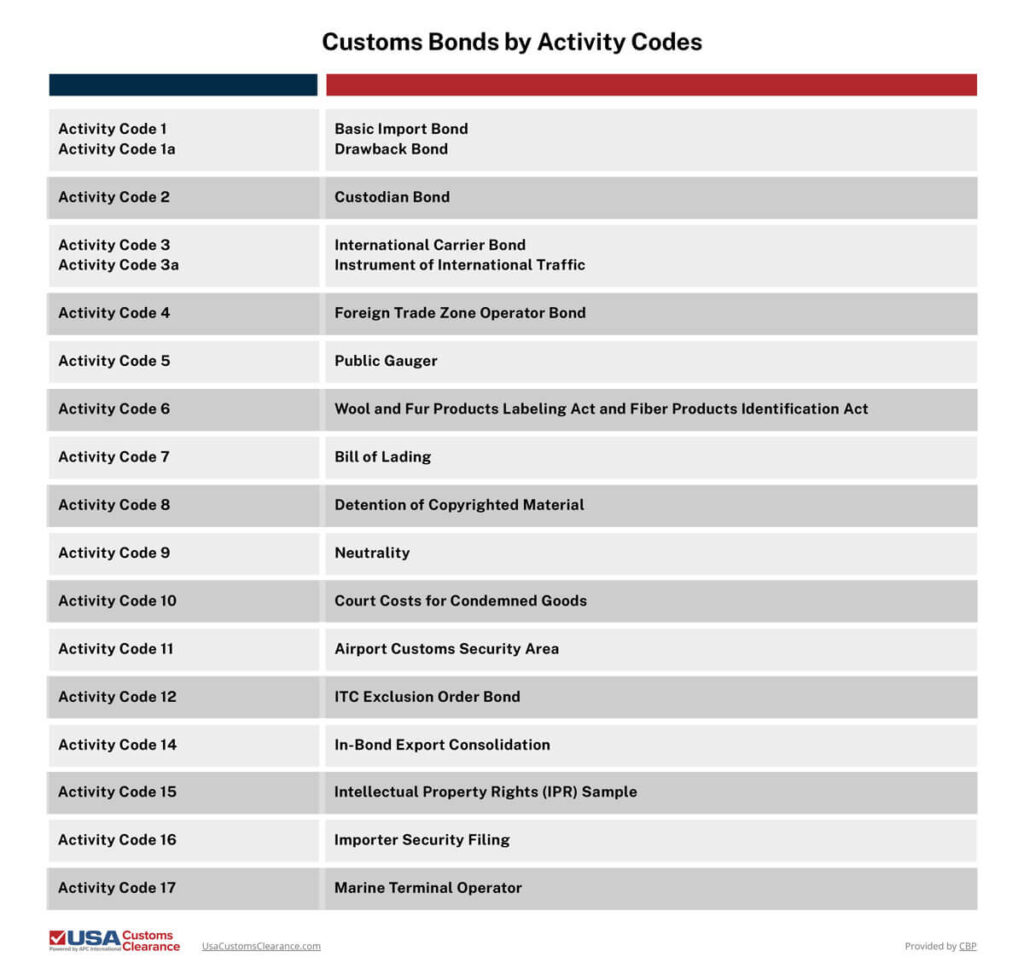

Each type of customs bond has a designated activity code. The designated activity code organizes the customs bonds by function. To help visualize these better, I’ve listed each one in a graphic.

Customs bonds vary in price. Figuring out how much they cost is often frustrating. Luckily for you, we have an article that will show you what you need to know about calculating customs bonds.

In the following sections, we’ll discuss each activity code. However, we’re going to skip the in-bond export consolidation (Activity Code 14) because it was terminated in 2022.

To avoid confustion it should also be noted that a continuous bond can double as an ISF.

The Basic Customs Import Bond is the most common bond you’ll encounter when importing. They can be used for single transactions or continuously.

Single transactions are good for only one import, while continuous bonds will cover any number of any imports for an entire year. Continuous bonds can renew automatically each year after their purchase.

Basic Import Customs Bonds are necessary for imports that have a value of $2,500 or when goods are regulated by a Partner Government Agency.

The minimum amount of a continuous basic import bond is $50,000 or 10% of total estimated duties, taxes, and fees. They’re set in increments of $10,000 up to $100,000 and then in increments of $100,000 for larger bonds.

The minimum amount of a single transaction basic import bond is a bit more complicated. Typically, the minimum amount shouldn’t be less than the total value of the import, plus applicable duties, taxes, and fees.

We offer Continuous Customs Bonds that will cover all of your imports. The best part? It renews automatically every year.

Duty drawback is a refund for customs duties, certain Internal Revenue taxes, and other fees that were lawfully collected at the time of importation. It is given after the imported goods have been destroyed or re-exported.

There are numerous types of drawback you can obtain, which cover the following:

Drawback bonds are typically not required for duty drawback, unless you’re trying to apply for accelerated payment (AP).

The drawback bonds are available in continuous and single transaction formats. The minimum amount of a continuous drawback bond is set at $50,000. They’re set in increments of $10,000 up to $100,000 and then increments of $100,000 for more expensive bonds.

The minimum amount of a single transaction drawback bond is set at $100.

Related: Customs Duty Drawback

Custodian bonds are used by entities that handle that haven’t been cleared by CBP.

Entities that use this bond include:

Custodian bonds can only be used continuously. The minimum for a custodial bond is $25,000 and set in increments of $10,000 to $100,000 and then increments of $100,000 for more expensive bonds.

The international carrier bond allows all activities related to the entry or clearance of vessels, vehicles, or aircraft that arrive from any location outside of customs territory.

Continuous international carrier bonds will have varying amount requirements based on the type of vehicle entering the country. I’ve provided a graphic that shows the minimum bond amounts for each one.

The minimum amount for a single transaction international carrier bond is set at $25,000.

The Instruments of International Traffic bonds guarantees compliance with regulations on the movement and clearance of shipping containers into the country. It can only be used on a continuous basis.

The minimum amount for this bond is set at $20,000.

Foreign Trade Zones (FTZ) are areas secured and supervised by CBP. The FTZ operator bond guarantees that operators will maintain the regulations of the FTZ they’re operating in.

FTZ bonds can only be used continuously. The minimum bond amount is $50,000, but the maximum amount is up to the port director.

Duties, taxes, and fees that would normally have to be paid for foreign goods are deferred when they are in the foreign trade zone. It isn’t until these foreign goods come within U.S. customs territory for resale or consumption that duties will have to be paid.

A commercial gauger can be an organization or a group of individuals who are authorized by CBP to measure, gauge, or sample merchandise coming into the country. Gaugers provide this bond to prove they’ve followed the testing requirements laid out by CBP.

Typically, this merchandise arrives in bulk and is made up of some of the following items:

This type of bond can only be used continuously. The minimum amount for this variant is set at $20,000.

As the name suggests, this particular customs bond requires the importer to adhere to three different federal acts.

This bond guarantees products that fall under these three acts will abide by all applicable regulations and is available for single transactions only.

The amount of the bond must not be less than two times the value of the merchandise plus applicable duties.

Don’t waste your valuable time and resources struggling with customs on your own. Let our importing specialists take that burden off your shoulders.

One of the CBP’s functions is to make sure that imports coming into the country don’t infringe on the copyright of other products. However, CBP doesn’t always make the right judgment and might detain a product that is not in violation of copyrights.

The Detention of Copyrighted Material bond will protect CBP and the importer from any loss that occurs due to the detention of the articles and any material depreciation. It can only be written for single transactions.

In most cases, the amount of the bond will be 120% of the value of the articles, plus any estimated duties and taxes.

Importers use the Neutrality Bond when an armed vessel brings their goods into the country. This bond guarantees the armed vessel will not commit any hostile actions against the U.S. or its allies.

Neutrality bonds can only be used for single transactions. The amount can be no less than two times the value of both the vessel and cargo on board.

Imports might be condemned as a result of judicial proceedings. A Court Costs for Condemned Goods bond guarantees the payment of related expenses.

The bound amount must be at least $5,000 or 10% of the value of the claimed property. Whichever is lower will be the applied amount. The court costs for condemned goods bond can only be used for single transactions as well.

Outsourced service companies use Airport Security Bonds (ASB) to give their employees access to secure areas of an airport.

The ASB applies to the following types of employees working at an airport::

Essentially, the ASB guarantees that all personnel given entry to secure areas of an airport will follow CBP guidelines. If the company or its employees violate CBP rules, all damages will have to be paid.

The amount of the bond will vary based on the number of workers that need access to secure areas of the airport.

The ASB is used as a term bond. This means the bond can only be used for one year. After the year is up, a new bond must be submitted.

Related: The Complete Guide To Customs Bond Renewal

An ITC Exclusion Order Bond is required when an imported product is subject to an exclusion order. Exclusion orders are given by the International Trade Commission and prohibit the importation of certain goods into the country.

They’re typically given after an investigation under Section 337 of the Tariff Act of 1930. The ITC is responsible for deciding how much the bond will cost.

An ITC exclusion bond is only applicable for single transactions. The bond amount is set by the ITC.

The Intellectual Property Rights (IPR) Sample is a bond that’s tailored for IPR holders. An IPR holder can use the bond to obtain samples of merchandise that might be suspected of infringing on their IP.

CBP and the importer or owner of the goods won’t be held responsible for any losses that occur from providing the sample. The bond also guarantees the IPR holder will send the sample back to CBP. This bond can be used for single transactions or continually. The minimum amount for variants is set at $5,000.

The ISF bond must be submitted to CBP24 hours prior to the loading of cargo on a U.S.-bound vessel. An ISF must contain multiple pieces of important data about the cargo.

ISF bonds are available in both single transaction and continual offerings. The minimum amount for this bond is set at $50,000. The minimum amount for single transaction ISF bonds are set at $10,000.

The purpose of Marine Terminal Operators (MTO) Bond is to provide ocean carriers a place to wharf, warehouse, and dock at marine facilities. The bond guarantees the MTO will act in accordance with CBP regulations.

An MTO can be used continuously, but it won’t be necessary if there is already an international carrier bond in place. The minimum amount for MTO bonds is at least $100,000, but it can be raised up to $250,000.

With all these types of customs bonds to choose from, it might seem difficult to know which ones you’ll require.

The most common types of bonds you’re likely to encounter as an importer include the:

If you need more assistance in determining what type of customs bonds you need, our team at USA Customs Clearance will be able to help you.

USA Customs Clearance is ready to serve as your personal import specialist. We have continuous customs bonds available that can cover an unlimited amount of imports with a value of $2,500 or more for an entire year. We can also provide a variety of other services to help you out.

Start your import journey with USA Customs Clearance by your side. Use one of our services or contact our team at (855) 912-0406. You can also contact us through the site for additional questions.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post