Are you importing goods into the United States on a truck? If so, chances are you’re going to need a PAPS number. Join hundreds of importers sourcing goods a little closer to home and saving on shipping costs.

Key Takeaways:

I’m going to review the basic definitions and requirements surrounding the U.S. application of PAPS and how importers and shippers can benefit.

A PAPS number is a kind of Shipment Control Number (SCN) assigned to goods entering the United States. It helps Customs and Border Protection (CBP) tell shipments apart and serves to identify the carrier moving the goods.

Officially, it’s the Pre-Arrival Processing System, and it was put in place for customs brokers to file entry information through the Automated Broker Interface (ABI) when goods come in by highway carrier.

What we refer to as a PAPS number is actually a combination of a few different identifiers.

The complete PAPS number, or more often the generated barcode, is then added to the truck’s eManifest (CBP Form 7533) and the shipment’s invoice.

The carrier assigns a PAPS number to a shipment that requires pre-arrival clearance. The SCAC portion is used to identify carriers and transportation companies. This is a requirement of the CBP for them to cross the border into the U.S.from Canada or Mexico with their goods.

PAPS numbers can be reused every three years. Many carriers use sequential PAPS numbers to prevent numbers from being reused.

PAPS is the primary method used to transmit advance information for imports to CBP for overland shipments. Obtaining a PAPS number is therefore the default option when you are bringing in commercial goods by highway carrier.

The system was put in place to speed up the release of commercial import shipments while still allowing each load to be processed by CBP mandates and rules.

There is a second option for ABI formatted information to be submitted in advance to the CBP, but it only applies to in-bond shipments identified by CBP Form 7512.

CBP does allow certain carriers to bypass advance cargo notice, and therefore PAPS, by accepting their cargo information at the time they cross the border. In such cases, there are two other data interchange systems in place:

To determine whether your cross border imports qualify, it’s best to reach out to a qualified customs broker familiar with such systems. USA Customs Clearance offers personalized consulting for importers where such information can be reviewed.

Our experienced customs brokers can help.

Find out what your best options are for cross border transportation.

The PAPS process is fairly simple and starts when the carrier accepts the shipment.

CBP must have the broker’s entry information and the carrier’s ACE eManifest for the goods to cross the border. Delays occur if the PAPS number isn’t the same on both documents, resulting in possible fines or even seizure of goods.

Completing an ACE eManifest is a critical part of the PAPS process because it provides the details of each shipment of imports to CBP. It is mandatory for all carriers crossing into the U.S. by land. Without a complete eManifest, the imports must turn around and go back.

To that end, I’m going to go over some of the basic requirements that carriers and brokers need to uphold when shipping imports into the country.

The CBP official will double-check the information on the manifest. The carrier needs to make sure the PAPS number on the ACE eManifest form perfectly matches the PAPS number on the shipment. Even a one character difference can cause serious problems.

Additionally, the ACE eManifest also requires a formal entry submitted by a licensed customs broker working with the carrier and importer on the shipment. The broker’s number must be on the eManifest with the PAPS shipment.

From there, the shipment might be referred for a secondary inspection, but hopefully, you’ll be in the clear. A signed proof of delivery document will prove that the shipment was released by CBP.

Importing Starts With a Contract.

You Must Pay Import Duties & Taxes for your Goods.

The PAPS number and ACE eManifest submissions aren’t the only pieces of documentation you’ll need when bringing goods from across the border. Required documents for an overland import include:

Shipments heading to a warehouse under an Immediate Transportation (IT) entry agreement need to make sure they have all their in-bond documentation handy.

Related: Documents Needed for Export and Import

While I don’t wish to state the obvious, if you’re importing goods to the U.S. by truck, they’re either coming from Canada or Mexico. After all, those are the only nations the U.S. actually shares a border with.

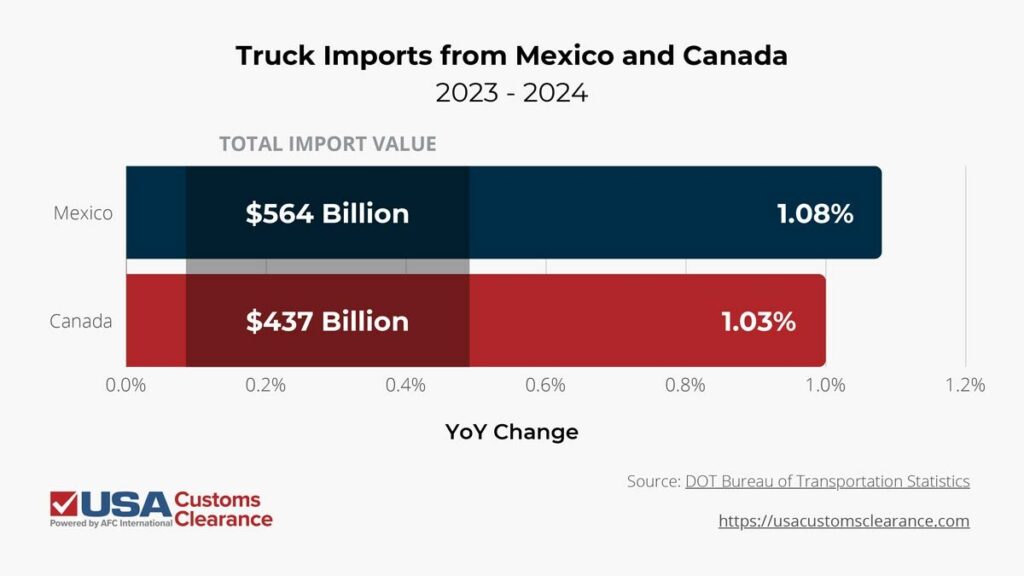

Improved trade between the three nations because of the U.S.-Mexico-Canada Trade Agreement (USMCA) also means truckload imports, among others, are likely to keep growing year over year as evidenced by data tracking from the U.S. Bureau of Transportation Statistics.

Remember too, that many products made in Canada or Mexico are duty-free due to the USMCA, but you’ll still need to have the applicable Certificate of Origin.

Related: NAFTA vs USMCA

Before we move on from documents, I’d also like to clear up a commonly confused term, especially when it comes to importing from Canada. Like the U.S., our northern neighbor has been working to smooth out over-the-road trade, and it just so happens they use a very similar acronym.

Canada Border Services Agency (CBSA) implemented the Pre-Arrival Review System (PARS) to function much the way PAPS does. It takes in information about shipments before they cross over to the Canadian market.

PARS numbers and PAPS numbers are not interchangeable.

They are issued by two different governments and must be used accordingly. A PARS number is also formatted differently, and can be up to 25 characters long, consisting of both digits and letters.

PAPS numbers are, at most, 16 digits and don’t contain any letters.

If your business manages both imports and exports between the U.S. and Canada, I would suggest double-checking these numbers frequently to avoid confusion when finalizing your documents.

Related: Import Costs From Canada

All imports must be accompanied by a customs bond if they are valued at over $2,500 or are regulated by a federal agency beyond CBP. A bond makes sure that all fees, duties and taxes are paid on the imports, regardless of how they enter. The process of getting a PAPS number helps to communicate duty fees, but it does not cover payment.

For that, you must still purchase a customs bond separately. You can choose between two types, depending on your import practices.

Related: Types of Customs Bonds

Importing from Mexico, Canada or both has proven to be very profitable for many getting into the international trade business. Between the tariff breaks and proximity, it’s worth it for many to pay the slightly higher product prices to avoid lengthy shipping times and trade war politics.

USA Customs Clearance can help you sort out your cross border carrier needs with our team of experienced customs brokers, licensed in both the U.S. and Canada.

We offer:

Call us today at (855) 912-0406 to speak with someone directly. Have a specific request for information? Leave us your question on our online contact form and one of our import experts will reach out to you.

Copy URL to Clipboard

Copy URL to Clipboard

Can I ask the CBP FOR a temporary PAPS NUMBER?

Picking up ICF block. 4 bundles for personal use building our home. Will be driving F-350 with light utility trailer. Does PAPS apply?

Hello, I have picked up a phamacutical load in Canada going back to the US. Where do I put the PAPS barcode sticker? On the bill of lading?

Thanks,

Craig

Hi Craig,

The PAPS label is actually placed on the commercial invoice before it is then sent to the U.S. based Customs Brokers for futher processing.

Hello my name is Jonathan Heiland, I am one of the Customs Specialists with USA Customs Clearance. We will gladly assist you with your import but we will need more information about your shipment. For immediate attention please reach out to consulting@afcinternationalllc.com. We look forward to working with you!

I will be driving a truck with a 35ft gooseneck trailer from Omaha to Canada in January to pick up a greenhouse I purchased for my farm here in the Omaha area. The greenhouse will be disassembled and loaded on the trailer for the return trip. What documentation and compliance do I need.

Hello, I replied to your inquiry by email. Please let me know if you have more questions.