Sunflower oil is a hot commodity, not just in the United States, but all over the world. Due to challenges arising from supply chain issues and political actions, this seemingly everyday ingredient may be harder to obtain.

Key Takeaways:

Importing sunflower oil can be a complex process. Our guide below will help familiarize you with how to get started.

To begin, several federal organizations have established rulesets and guidelines that must be followed in order to legally import sunflower oil. The four principal organizations involved in this process are:

Ultimately, the biggest hurdles for the importation of your goods in this case are going to be the FDA and CBP. The USDA and APHIS will typically only come into play when importing a hybrid sunflower oil that is new or has not been registered.

Related: Importing Olive Oil into the U.S.: What are the Requirements?

The following requirements are set by the FDA, and can serve as a basic checklist of steps to take when importing food of any type, including sunflower oil.

As always, it is best to speak with a consultant in order to clarify these requirements or any other questions you may have regarding importing sunflower oil. The last things you want upon entry are fines, delays, or even a refusal of goods by the CBP.

Looking for assistance importing sunflower oil into the United States?

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

All foreign food facilities that wish to export goods are required to register with the FDA prior to doing so. Importers can then bring food goods into the country from the FDA-registered facility without prior sanction from the administration.

The following points of interest ensure that foreign suppliers are in compliance with the FSVP Final Rule.

The FDA has an online portal where importers can electronically upload FSVP records, speeding up compliance and communication.

Under the Public Health Security and Bioterrorism Preparedness and Response Act of 2002, the FDA requires a prior notice filing by any importer/registered facility. This is to give both the FDA and CBP advanced notice of all incoming shipments and to better safeguard the U.S. food supply.

The FDA has an established set of rules and guidelines as it pertains to the labeling conventions for food goods. As it stands, sunflower oil falls into the category of vegetable oil. The following is a list of pertinent information required for the label of imported sunflower oil.

The labeling requirement must be followed, or the importer runs the risk of being in violation of FDA regulations.

Related: The Complete Guide to FDA Customs Clearance

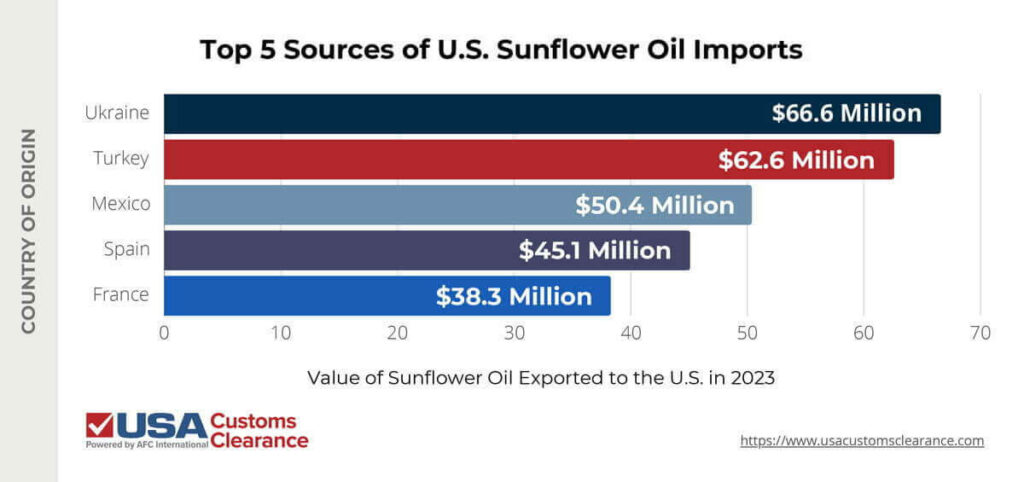

When considering the top sunflower oil-exporting countries, it’s good to have a working knowledge of which countries export the most sunflower oil. As you can see below, the United States gets most of its sunflower oil exports from European and Asian countries.

Source: trade.gov

A small percentage of the world’s global sunflower oil exports come from North and South America, much of it through Mexico.

It’s worth noting that Ukraine produces over half of the world’s supply of sunflower oil annually. As such, importers of this commodity should stay up-to-date with the results of the ongoing Russia-Ukraine conflict.

In the case of sunflower oil, the HTS Code is 1512.19.20 (refined) and 1512.11.00 (crude). According to the USITC, the general duty rate for both refined and crude sunflower oil is 1.7¢/kg + 3.4%. The U.S. also has trade agreements in place with a number of countries, making sunflower oil imports from those nations duty-free.

It is important to note that when pure sunflower oil is changed by introducing other ingredients, the duty rates are subject to change since the resulting product is considered a hybrid oil.

It's time you found out your landed cost.

Accurately estimate import duties and tariffs in minutes, based on origin, value, and product type, so you can foresee your costs and never get surprised after you buy.

Importing any foodstuff into the USA can be tricky due to the regulations involved, and sunflower oil is no exception. To avoid delays, fines, and other impediments to their businesses, many importers choose to work with a customs broker when importing FDA-regulated goods. That’s where we come in.

At USA Customs Clearance, our team of customs brokers has years of experience assisting business owners with every step of the import process. From calculating duties to filing all required documentation, we have the know-how you need to ensure your shipment clears customs without issue.

Our full list of services for importers includes:

Our consultants are ready to provide you with their expertise and get you importing the right way. Call us at (855) 912-0406 or submit a contact form online to start importing sunflower oil today!

Copy URL to Clipboard

Copy URL to Clipboard

Hello, I am looking for details and assistance importing sunflower oil from Ukraine. I have some friends that have a big stock of sunflower oil. I am trying to import it here and sell it.