As an importer in the United States, costs like duties, tariffs, and other customs fees are simply a fact of life. However, there are plenty of legal methods to mitigate, reduce, and even eliminate duties depending on factors like the goods you’re importing and their country of origin. Educating yourself on the options available and partnering with an experienced customs broker can help you keep more money in your pocket when it’s time to pay Customs and Border Protection (CBP).

Key Takeaways

Our import cost reduction playbook will show you many of the most effective tools and strategies available to reduce import costs.

Looking for Ways to Lower Your Import Costs? Ask Our Experts.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

If you imported a shipment of goods and had to either destroy or re-export them, you may qualify for a drawback of duties from CBP. This is essentially a refund of up to 99% of certain customs fees (including duties) on qualifying merchandise. It can also apply to goods used in the manufacture of the items in question.

At one point, it was believed that up to 78% of available drawback money owed to importers goes unclaimed. That’s millions of dollars left on the table, largely because importers are unfamiliar with drawback or they lack the advanced knowledge of US customs necessary to file it. Though the drawback process can be lengthy, it’s worth looking into if you have shipments that qualify for the program. Consider making your request through a duty drawback broker for the most accurate and timely results.

Depending on where you source your goods, they might also qualify for reduction or elimination of duties via a free trade agreement (FTA). For instance, merchandise imported from Canada or Mexico can receive preferential duty treatment under the United States-Canada-Mexico Agreement (USMCA). Goods that are produced within the three countries can be traded between them with duty-free treatment.

There are limitations to this, based on factors such as:

Claiming preferential treatment on such imports will require you to submit a USMCA certificate of origin. This document will need to include several data points, including:

This is a self certification process, and if CBP determines that the goods in question were not eligible for preferential treatment, you might end up paying more than you would have in the first place due to fines. Experts in the customs clearance process are an invaluable resource in properly determining country of origin and, by extension, whether your goods could be imported free of duties under a trade act.

When you import goods into the US, one of the most important pieces of information you’ll need is the HTS code for those goods. The HTS contains an exhaustive list of almost every conceivable commodity, but that very level of detail opens possibilities for importers to sometimes find creative ways to pay lower duty rates through tariff engineering.

Tariff engineering involves manufacturing goods in such a way that they take advantage of lower duty rates than they would have otherwise. A classic example comes from the case United States v Citroen, and serves to provide a clear illustration of how the process can work.

The relevant facts in the case were:

Ultimately, the supreme court sided with the importer since the descriptive language didn’t include pearls that could be strong or set, only those that already were upon importation.

Similar practices have been enacted by more modern manufacturers, and a savvy importer may still find ways to legally classify goods at a lower rate and modify them once they arrive in the US. However, razor-sharp knowledge of the HTS is key to using this tactic correctly. Just ask the Ford Motor Company what happens if CBP decides your attempts at tariff engineering amounted to deliberate misclassification.

There is another side to this coin: if you try to classify goods on your own, you could end up choosing a code with a higher duty rate than you actually have to pay. This is especially true when multiple tariffs can apply to a single good, such as those imposed by IEEPA and Section 301 or 232 tariffs. Discerning which rates apply and whether they stack on top of each other isn’t easy, but it’s crucial to import compliance and ensuring you pay the correct duties.

If you find a mistake on documents submitted to CBP, even after you’ve received your shipment, you have options to correct them before they spiral into expensive and time-consuming problems.

Get a one-on-one, 45 minute consultation with a Licensed Customs Broker.

Customs and Border Protection offers importers the following options for correcting their own mistakes and calling out potential errors from CBP itself:

If you have filed an entry summary (also called CBP Form 7501) and later discover that some of the information filled out was inaccurate, you may be able to correct it by submitting a PSC. This option is available for unliquidated entries up to 300 days after the shipment’s entry or no fewer than 15 days before CBP liquidation.

After an entry is liquidated, importers can file a protest with CBP if they believe a decision made about their entry by the agency was in error. Protests can be filed within 180 days of a liquidation, giving importers the opportunity to recoup losses due to overpaid tariffs and to have decisions reversed in their favor.

Now let’s say that you have determined on your own after an auditing process that you underpaid duties, but CBP has not yet made that determination itself. It’s considered a best practice to volunteer this information once discovered via prior disclosure. During this process, you’ll also have to pay the balance of underpaid duties due to CBP, but you’ll avoid fines and a hit to your credibility with the agency.

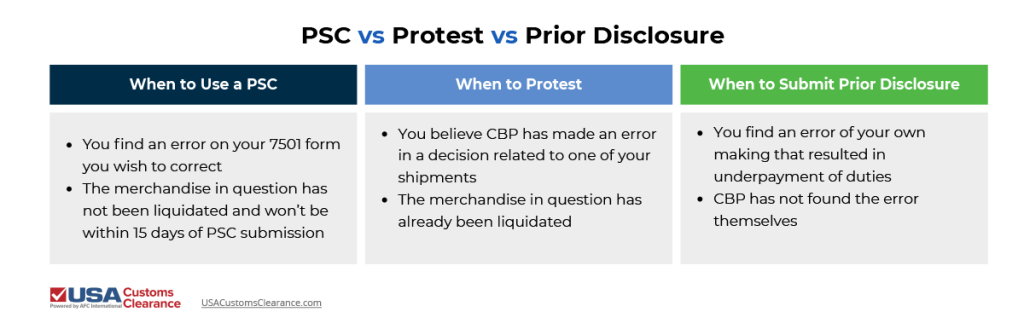

To simplify deciding which of these options could be useful for one or more of your imported shipments, refer to this decision-making table.

If you submitted your entries through a customs brokerage, your broker will most likely be able to handle these submissions as well, and will ensure timely and accurate filing.

Importers should always take the time to vet their supply chains, and this is truer than ever as the US government cracks down on the importation of goods believed to have been sourced from areas where forced labor is being used. Many of these efforts are focused on keeping goods from the Xinjiang Uyghur Autonomous Region of China out of the country due to suspicion that the Uyghur people are victims of forced labor violations by the government of China.

If you try to import goods that CBP determines to be made wholly or in part from goods sourced in this region, they will be prohibited from entry into the US market. In the 2025 fiscal year, CBP held 22,398 shipments suspected of UFLPA violations. Approximately half of those entries were denied entry into the US, resulting in millions of lost dollars from affected importers.

As mentioned before, loss of saleable merchandise is just one of the consequences at play here. Affected importers can also reasonably expect that their shipments will be flagged for inspection more often, increasing customs fees and delaying receipt of goods, all of which add up to even greater financial losses over time.

Importers whose shipments are detained under UFLPA can submit an applicability review request to CBP. There are several records and key pieces of information you’ll need in order to successfully request this review:

This is more of a preventative measure than a reactionary one. If you’re an importer bringing in goods that could potentially be flagged as violating forced labor laws, have all of this information ready to go prior to ordering. This will prepare you to avoid punitive CBP actions.

CBP is less likely to flag shipments for inspection when they’re brought into the country by trusted importers. A great way to stand head and shoulders above other import businesses is certification via the Customs Trade Partnership Against Terrorism (CTPAT).

Certification in this program confers many benefits, some of which are:

If you’re interested in CTPAT certification for your business, the most important first step will be creating a supply chain risk profile. We recommend consulting with a customs expert during this process for the purposes of accuracy.

Complying with US customs laws while also looking out for your bottom line isn’t always easy, but foreign trade zones offer a unique opportunity for importers to lower their duties by manufacturing goods within an FTZ using raw materials sourced from other countries. Here’s a hypothetical example of how this process works.

Your company manufactures heavy equipment using imported raw materials. The heavy equipment, if imported from another country, has a duty rate of 10%. The raw materials used in its construction have a duty rate of 20%.

If you were to manufacture your equipment outside an FTZ, you would have to pay the 20% rate for the raw materials. However, if you manufacture the equipment inside an FTZ with the imported raw materials, you can elect to pay the duties on the finished product rather than the raw materials. Since we go from 20% to 10%, this effectively cuts your duties in half.

We’ve gone over several options for fixing mistakes, mitigating duty rates, and legal methods to lower those duties or even avoid them. However, getting the fundamentals of importing correctly on every transaction is also a key aspect of reducing excess tariff costs brought about by simple human error. So, don’t forget to always:

Even getting these basics right on a consistent basis will ultimately reduce excessive import costs and keep more money in your bank account, improving your cashflow and allowing you to build your business.

When you work with the Licensed Customs Brokers at USA Customs Clearance, you’ll have professionals with decades of experience in customs and international shipping on your side in the increasingly complex world of satisfying CBP regulations. Get started today by scheduling a consultation, or give us a call at (855) 912-0406 with any of your import-related questions to find out how we can help.

FAQ

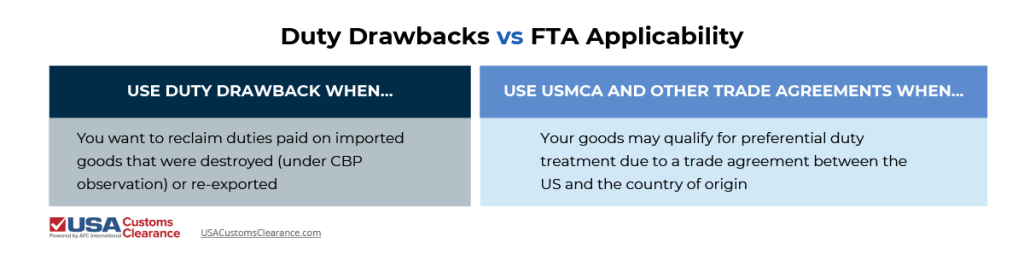

When should I use duty drawback vs USMCA to cut costs?

You should use duty drawback when you plan to re-export or destroy the goods you’ve imported at a later date. Use USMCA when the goods you’re importing meet the rules of origin.

What is tariff engineering and how do I do it without penalties?

Tariff engineering is when goods are manufactured in a way that allows importers to take advantage of a lower duty rate. You’ll need accurate knowledge of HTS codes to ensure you pay the right amount for your goods.

What’s the difference between PSC, protests, and prior disclosures?

PSCs are used to correct information on Entry Summaries that you’ve already filed. Protests are filed if an importer believes a decision CBP made regarding their entry was incorrect. Prior disclosures are used by importers to let CBP know they’ve underpaid on duties before CBP realizes the mistake.

How do I prepare for UFLPA scrutiny to avoid detention?

You can provide transactional documentation of the goods’ supply chain, country of origin, names of the parties associated with the manufacturing and manipulation of your imports, and documentation of how payment for the goods was submitted.

How can CTPAT and FTZ reduce costs?

CTPAT helps you speed up the clearance of your goods, which can help reduce delays that lead to fines. Manufactured goods in an FTZ can enter the US at a lower duty rate than the raw materials used to make them.

Legal disclaimer: All information provided is not to be taken as legal advice

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post