The U.S. has been the largest importer of bicycles for many years. Despite the large number that come into the country, the importing process can be confusing for beginners, so it’s best to get familiar with important details before getting started.

Key takeaways:

I’ll guide you through all the basic information you’ll need to successfully import your bicycles.

There are a variety of federal agencies that regulate the importation of bicycles. To get these products into the country, you’ll need to abide by their requirements.

CBP is the primary agency that oversees imports coming into the country. Their guidelines do not require you to have any special documentation regarding bicycles under most circumstances.

CPSC’s job is to protect the U.S. public from the unreasonable risk of injury or death from various consumer products. I’ve outlined the requirements of each agency in the following sections.

CBP will want you to provide them with a variety of import documents for your bicycles.

For one, you’ll need a customs bond for your bikes if they have a value of $2,500 or more. You can obtain two different versions of the document. A single entry bond will be good for one import, while a continuous bond will cover any number of imports for the entire year.

In addition to a customs bond, you’ll need to provide a variety of other import documents that CBP will review. This includes paperwork like a bill of lading, commercial invoice, and CBP forms.

CPSC requirements for bicycles can be found in the Code of Federal Regulations (CFR) in Title 16, Part 1512.

Different parts of a bicycle will undergo testing to ensure they’re safe before being sold to the U.S. public. You’ll also need to make sure that your imports meet CPSC’s general requirements.

This includes:

In addition to these general requirements, CPSC has specific regulations that apply to specific parts, such as:

CPSC requires bicycles to include instruction manuals in the packaging or attached to their frame. Any bicycles that enter the country less than fully assembled must have a list of tools necessary for assembly placed in the packaging as well.

Your bikes should also have a permanent marking or label showing the name of the manufacturer and the month and year it was made.

Related: CPSC Customs Hold

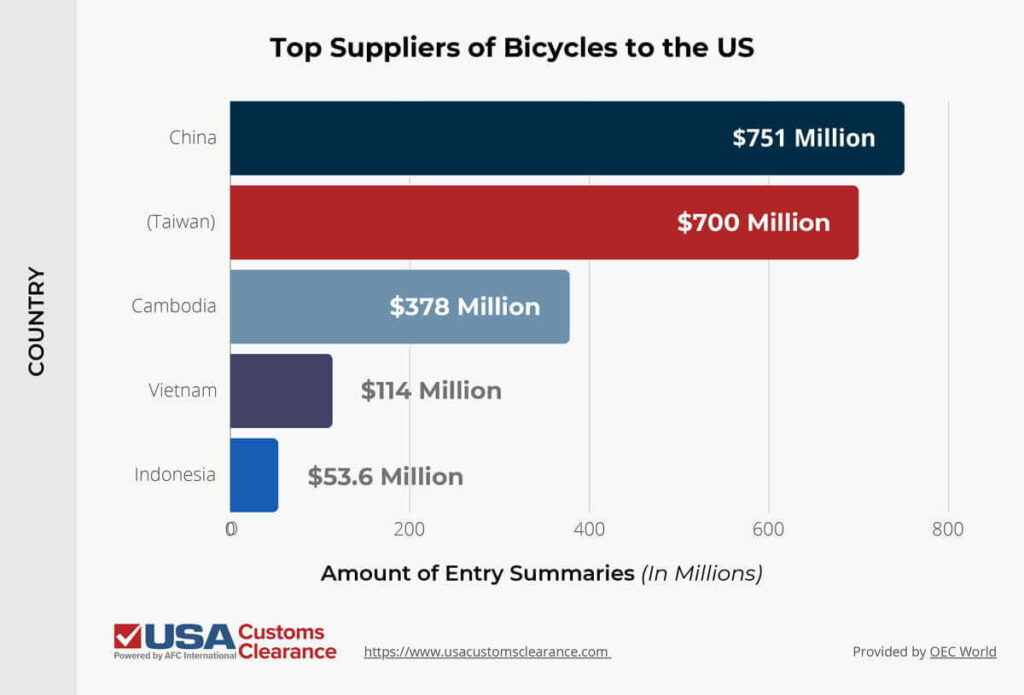

With so many countries exporting bicycles, it can feel a little overwhelming trying to pick one. To narrow your search, consider some data I’ve provided on the top five countries the U.S. imported bikes from in 2022.

China and Chinese Taipei are popular locations because they make quality bicycles using low cost labor. Many popular bike brands actually manufacture their products in these two countries.

While China and Chinese Taipei are popular manufacturing locations for these popular brands, you’ll also be able to import quality-made bikes in the other Asian countries on this list. The five countries I’ve listed are also great locations to source e-bikes.

Related: Importing from China

There are a few matters you will have to take care of to know your import costs. First consider the cost of the bicycle you want to import. The brand, type, and quality will affect its cost.

The assigned duty rate will depend on the bicycle’s exact dimensions. If you’re not sure which code applies to your bikes, then use our HTS Code Lookup tool to find the right one.

Our HTS Lookup Tool will help you find the code applying to your bicycles with a few simple clicks.

The next area of concern is the duty rate for bicycles. The general duty rate is given by the Harmonized Tariff Schedule of the United States (HTSUS). The Harmonized Tariff Schedule (HTS) code for bicycles can be found under heading 8712.00, while the code for e-bikes is 8711.60.

According to the HTSUS, bicycles will be subject to a duty rate between 5.5% and 11%. This will vary based on the design features of your bike, such as wheel size and the presence of accessories.

Now that you know the duty rate for bikes, we can focus on calculating the total cost of your bicycle import. We can give you an easy formula that you can use to calculate the total cost of your import. For our example, we’ll assume you’re importing a bicycle with an 11% duty rate.

The step-by-step process of the formula is as follows:

In the table below, we give you some examples of how to use this formula with estimated prices for different types of bicycles that you might come across. The graphic I’ve provided will show you how you would apply this formula.

This example shows the total customs duties owed on a $2 million bicycle shipment. In this example, I started with the dutiable value, which will include your share of the shipping and insurance costs.. The actual cost of your bicycles may vary, but you’ll still follow the same procedures.

Over the past few years, there has been a spike in the popularity of electric bicycles, also known as e-bikes. Before importing an e-bike, you’ll need to make sure it doesn’t qualify as a motorcycle.

An e-bike will be considered a motorcycle when:

E-bikes that exceed 20mph and have equipment for on-road use will be considered a motorcycle and regulated by the National Highway Traffic Safety Administration (NHTSA).

If your e-bikes don’t have either of these characteristics, then you can proceed to import them by following the same requirements that apply to regular bicycles.

According to HTSUS, most e-bikes can be imported duty-free. However, e-bikes imported from China will be given a duty rate of 25%.

One difference between e-bikes and regular bicycles that you should know is that e-bikes are much more expensive. That’s because e-bikes have complex parts that are more expensive than regular bike parts. You’ll need to factor in these expenses when budgeting for your import.

Related: How To Import A Motorcycle

USA Customs Clearance has the expertise you need to import bicycles successfully. Our team knows all the regulations that apply to these products, and they can help you follow them correctly. We also offer a variety of other services that will make importing bicycles easier for you.

If you’re ready to bring your bicycles into the country, then contact us at (855) 912-0406. You can also reach us through the site if you have any generalized questions.

Our Licensed Customs Brokers can meet with you to discuss the regulations you'll have to follow when importing bicycles.

Copy URL to Clipboard

Copy URL to Clipboard

Importing a electric assist bicycle from either Spain or Italy. Are the import duties from those two countries as high as from China or Taiwan?

What are the costs for importing a Pole Voima E-bike from Finland? The bike is $8000.00 US.

I’m importing an 8000 watt ebike from China. The seller used Tc freight company that wants me to pay 30% duty. I thought duty is 25%.

Description of shipment: Sur Ron Light Bee Electric Motorcycle

Product Units: 1 Units of eBike

Value: $1707.00 USD

Currency: USD

Exchange Rate: 1.00

Local Rate: 1.00

Value for Duty:$1707

Customs Duty For 1 unit: $430 / 30%

Customs MPF: $85.48

Other Fees:

Entry Fee: $55.00

Bond: $80.00

Bond Underwriting Fee: $10.00

Duty Disbursement Fee: $80.29

ABI Fee: $6.00

Importer Registration Fee: $20.00

Administration Fee: $85.87

Estimated total of all fees: $780

USD

Dear sir/ Mandamiento

I am importing a bike frame with a cost of $330 how can I report and pay the duty

Thanks

I peyd $79.99 to Rareif.com for a bike and I receive a glave.What I have. to do ?