It’s no secret that Americans love their pets like family. In fact, we spent approximately $83.7 billion in 2023 on pet supplies and services, and that’s not counting food. Over the years, people have become willing to spend a little extra on quality pet toys, medications and other products to provide their pets with a better quality of life. With that willingness comes opportunities for savvy importers.

Key Takeaways

Join us as we take a close look at the steps involved in importing pet-focused goods.

There are some aspects of importing that apply to any international transaction. These include:

Let’s start with a brief overview of these requirements.

Making sure all of your import documents are properly filled out is an essential part of this process. Even a single typo in one of the shipping documents can create serious hurdles in customs clearance.

In order to prevent costly delays, make sure you familiarize yourself with all the documents involved in the import process, so you don’t have to fix any errors after your product arrives at the U.S. port of entry.

There are two main reasons your import transaction would require a customs bond.

If you’re importing these supplies for resale, you’ll almost certainly need a bond one way or the other. Our team of brokers can help you choose which type of bond works best for your business needs.

Related: How to Get a Customs Bond

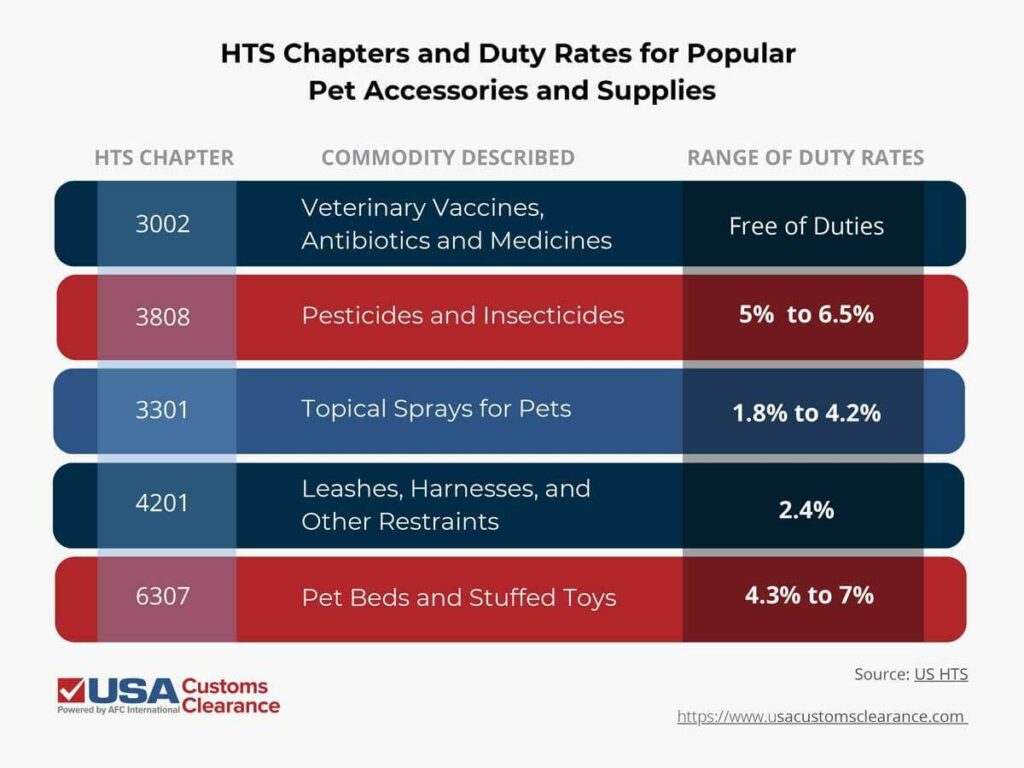

Every type of product entering the country has a specific HTS code identifying it for tax purposes. This is a 10-digit number assigned to goods that are traded to the U.S.

The first four to six numbers are globally applicable because they describe the actual product per an internationally accepted system. The last four numbers make it unique to the U.S. tariff system and vary depending on product details and applicable duty rates.

In the graphic below, I’ve listed some of the HTS chapters and duty rates for popular commodities in this category.

It is very important to get your product classified correctly. If the HTS code on your shipment does not match the commodities it contains, it could face significant delays. You may even incur extra fees for improperly labeling your shipment.

You may find that duty rates will play a part in deciding what supplies you want to import. While making this decision, it’s also important to consider multiple sources for your goods.

Sites such as Alibaba.com have simplified the process of sourcing imported goods in general. Unsurprisingly, many of these are manufactured by Chinese businesses.

Some of the most popular pet supply manufacturers you might consider are:

Since these items tend to be small and relatively inexpensive, expect correspondingly high minimum order quantities (MOQs). Depending on how many units you’re willing to purchase, manufacturers may be willing to offer small percentage discounts during the negotiation process.

For products supplied from China, you should also be checking on their Section 301 status. If your import’s HTS classes are among those of any current 301 list, it can add an extra tariff rate anywhere from 7.5% to 25% of the purchase value on top of the standard duty.

Related: Section 301 Tariffs

Once you decide what you want to import, you should determine which government agencies regulate them. In the sections below, I’ll list some popular supplies and their relevant U.S. regulatory bodies.

The first pet supply you might think of would be food and snacks, and that’s sensible.

Pet food accounted for over 40% of all pet goods imports in the USA in 2023, and it makes up the biggest share of this particular market.

It’s for that reason we have a dedicated article addressing the ins and outs of importing pet food. In it, we cover everything from FDA regulations to labeling requirements. Meanwhile, this guide will focus more on accessories, toys, and other supplies for pet owners.

Importing anything medically related, even for animals, raises a whole set of regulatory flags. Start including goods that can be labeled as pesticides on top of that — you’re going to want help navigating the rules. Some chemicals and medications are tightly regulated, while others are exempt. Let’s start by looking at the regulated variety.

Most of us hear the term pesticides and likely think about the sprays and granules used to keep bugs out of the garden. The term can also refer to products marketed for pet owners to get rid of pests like ticks, fleas, and mites.

We can think of these in two categories. The first would be parasite preventatives given to or applied directly to a pet. These would be the products that can also be classified as medications. Depending on the type and strength, some can only be distributed to the consumer market with approval of licensed veterinarians, so keep that in mind when planning your eventual sales.

These goods need to have a factual claim on the label in order to be considered pesticides. This claim could be that it effectively repels or kills some sort of pest.

Without this claim, you can expect trouble at port if Customs and Border Protection (CBP) inspects your shipment.

The second category would include products meant to eliminate or prevent various pests in and around the home or elsewhere that animals are kept. It may also include applications to items that you want pets to stay away from (that new sofa you don’t want the cat getting near).

These items are the ones more in line with a ‘traditional’ pesticide, but are often made specifically to be safe for use around the animals they are meant to protect.

Given the potentially harmful nature of pesticides, it’s important to understand government regulations regarding this commodity.

Not all pesticides are regulated by the same government agency. Depending on which type you want to import, it may fall under the EPA, FDA, FTC, or some combination of the three. .

External pesticides like flea collars, shampoos, and sprays need to be registered with the Environmental Protection Agency (EPA). In order to be registered, the products must pass EPA inspections.

These product must NOT:

However, ingestible and injectable goods like pills and vaccines fall under the jurisdiction of the FDA, and have a different set of regulations. Most of the safety regulations are the same as for the EPA, however, the FDA also requires that all pesticides be labeled using the FTC labeling regulations.

In order to comply, the product must:

Although pesticides are heavily regulated, these rules are important to ensure the health and safety of your consumer’s beloved pets, and the successful import of your shipments.

Some pesticides that pose little threat to people, pets, or the environment are considered “minimum risk.” They are exempt from inspection and registration if they meet the right criteria.

As long as those conditions are met, the products can be safely imported and distributed without being registered or regulated by the EPA and FDA.

There aren’t any specific regulations in place for the import of plastic toys, food bowls, and similar items. However, some manufacturers and larger companies have started using internal quality testing procedures to ensure they aren’t falling behind their competition.

These testing procedures typically imitate those used to test children’s toys, but sometimes inspectors use more aggressive methods to simulate usage by a large dog. These are more to showcase certain durability expectations, although choking hazards are also a concern of many pet parents.

Even toys for smaller animals like rodents and birds can undergo these tests. This way, the toys can be guaranteed to not chip or splinter, breaking into small pieces that a pet could potentially swallow or choke on.

In addition, all plastic products should be free of toxins such as lead, chlorine, mercury, and arsenic. These can be damaging to pets and their owners.

If you want to import these commodities, you’re going to need to follow some additional regulations for textile labeling. If you’ve ever seen a tag on a mattress or pillow that says “Do Not Remove”, then you’ve already seen what these should look like. Even dog beds need to come with those tags.

According to the FTC, all textile labels must contain the following information.

The label must be firmly attached, and must not be removed for any reason until it reaches the final customer. Placement is also important. It must be positioned where it can be easily seen and accessed.

If you want to import pet care supplies, you know now that there are many regulations, agencies, and documents you need to keep track of to clear customs. This can be overwhelming, which is why importers frequently choose to work with experienced customs brokers.

The team at USA Customs Clearance has decades of experience helping businesses like yours import all types of commodities, including goods that set tails to wagging. Our services simplify the complicated clearance process, allowing you to focus on your business.

Come to us for:

Give us a call at (855) 912-0406 or contact us online today. Leave the hard part to us while you go fetch new customers or schedule a meeting with one of our import consultants.

Copy URL to Clipboard

Copy URL to Clipboard

Hello,

Im in need to import dog leashes from china

The package value is under 2500$. What are the requirments and certficates needed to

import and sell those goods?

Hello my name is Jonathan Heiland, I am one of the Customs Specialists with USA Customs Clearance. We will gladly assist you with your import but we will need more information about your shipment. For immediate attention please reach out to consulting@afcinternationalllc.com. We look forward to working with you!

To whom it may concern,

We would like to import quality pinewood Cat litter to US market, but we have difficulty in finding information regarding rules and regulations for cat litter,

Can you help us ASAP?

Thank you.