Import duties, also known as customs duties, are taxes imposed on products that travel across international borders. They’re levied by the US to raise money and protect local industry by controlling the flow of goods. CBP is the government agency responsible for collecting duty payments.

Get your landed-cost calculated and learn how to pay your duties correctly when you talk to one of our Licensed Customs Brokers

The US imposes multiple types of customs duties you should know about. This will help when calculating the amount you owe to CBP at the time of payment.

A standard customs duty is imposed on imported goods. To calculate it, you’ll need to classify your goods using the Harmonized Tariff Schedule (HTS). The HTS is a system that sets out the tariff rates and statistical categories of all goods that are imported into the country.

Customs duties are levied as an ad valorem, specific duty, or compound rate.

The way a duty is levied will determine how you perform your calculations.

Related: How Do I Find My HTS Code?

Anti-dumping and countervailing duties (AD/CVD) are trade remedies used to protect domestic industries in the US.

AD/CVD make it more expensive to import goods priced lower than domestic market value or that are subsidized, thereby taking away their unfair advantage. The exact rates will vary based on the country of origin and the type of products being imported. AD/CVD will be paid at the time of entry.

You can find the correct duty rate for your goods by consulting the HTS and locating the correct code for your items. After finding your HTS code, you should do your due diligence to ensure your goods aren’t subject to any trade remedy tariff actions.

The International Trade Administration (ITA) has resources you can access to check if this is the case. Searching through the HTS can be a time-consuming process. Fortunately, we have a tool that can help you find the correct code for your products.

With a bit of typing and a few clicks, you can easily find your HTS code that applies to your goods.

Once you have the duty rate for your products, you’ll need to do some calculations to determine exactly how much you owe to CBP. These will vary based on the type of duty levied on your products.

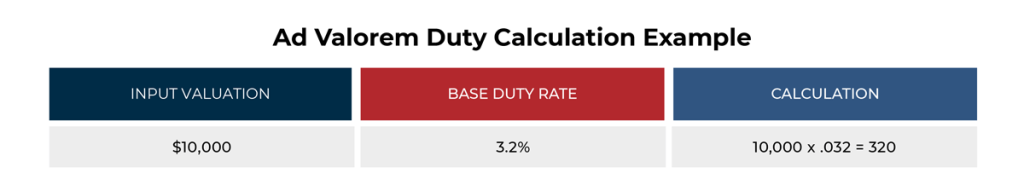

Let’s go over the calculation process for imports subject to a customs duty levied on an ad valorem basis. For products subject to this duty, you’ll multiply the valuation input by the base duty rate. We’ve provided an example calculation in the following graphic.

In this ad valorem example, you would need to pay a $320 duty rate. In the next section, we’ll go over an import duty levied as a specific duty rate. We’ll assume there is a $0.42 per kilogram rate on your goods and your shipment has a weight of 1,250 kilograms.

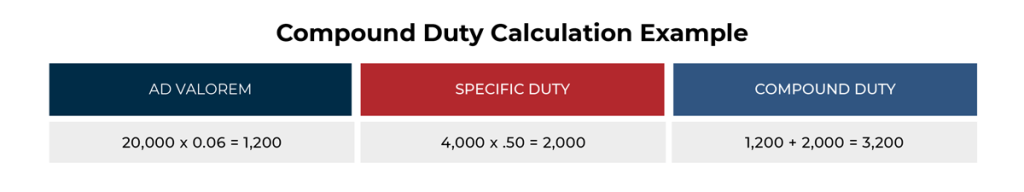

In this specific duty example, you’ll have to pay a $525 duty. We’ll move on to a compound duty calculation next. This will be more involved since it’s a combination of an ad valorem and specific duty.

First, let’s break down the hypothetical rates and value of the goods for the example:

Now that we have the values, here’s our calculation:

Based on this compound duty calculation example, the compound duty will be $3,200. The final example calculations will be for AD/CVD.

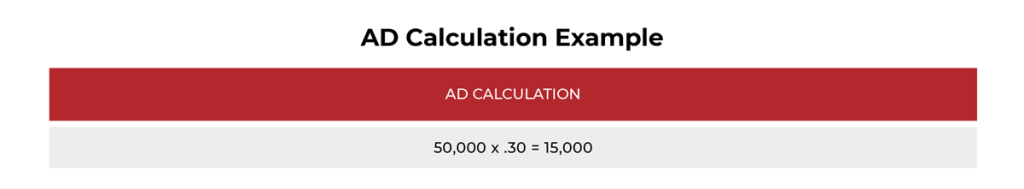

We’ll start with an AD calculation example. Let’s say the products you’re importing have a value of $50,000, but they’re subject to an AD margin of 30%.

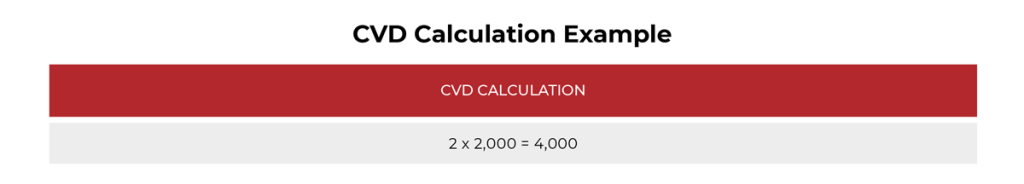

In this scenario, you would need to pay an additional $15,000 on top of the applicable customs duty on your goods. For our next example, let’s assume there is a CVD of $2 per unit on your import of 2,000 units.

Based on this example, you would need to pay $4,000 CVD on top of the regular duty rate.

Most duties are paid to CBP in one of two ways:

The ACH is an electronic payment option that importers use to pay customs duties and fees. If you choose the ACH as an option, you can take advantage of the Periodic Monthly Statement (PMS). The PMS is a program that allows you to consolidate multiple imports into one payment on the 15th of each month.

You can submit your check or payment through the ACH yourself or with the help of a customs broker.

Most imports have some type of duty levied on them. Fortunately, there are certain exemptions that you can use to mitigate import duties. We’ll explain each one in the following sections.

Section 321 is a statute that outlines the rules for de minimis importation. It allows importers to bring in goods up to $800 in commercial value each day free of duty. This provision is used primarily by small e-commerce businesses and direct-to-consumer brands.

Unfortunately, de minimis was suspended on August 29th, 2025, which means all low-value shipments will be subject to applicable import duties and fees.

FTAs are comprehensive trade programs the US shares with other countries. They aim to reduce or eliminate trade barriers like tariffs and duties. This expands market access for the participating countries and promotes economic growth.

You’ll need to apply for preferential tariff treatment for the FTA you’re importing under if you want to reduce your import duties.

To do this, you’ll need to follow these two steps:

The US shares 14 FTAs with 20 countries. That means you’ll have to go over the specific rules of origin in each agreement to ensure you apply for preferential treatment correctly.

Related: US Free Trade Agreements

You can also minimize import duties by importing products into the US temporarily. To be eligible, any products you bring to the US need to be exported or destroyed within one year of the date of importation. Extensions might be provided up to three years.

You’ll also need a temporary importation under bond (TIB) if you want to take advantage of this provision. A TIB is a bond that allows you to import goods duty-free for a limited time. Goods imported under a TIB must be destroyed or reexported within the specified timeframe.

A carnet is an international customs document that allows businesses to temporarily import for commercial purposes without having to pay duties or value-added taxes on the goods.

Here at USA Customs Clearance, our highly-experienced staff has been helping importers pay their duties for decades. They’ll use their experience to calculate your import duties and even submit payment on your behalf. Our team can also provide services like consulting to help you through other parts of the importing process.

You can learn more about the wonderful members on our team by navigating to our about page. If you’re ready to get help with your import duties, then call our team at (866) 738-2121 or reach out to us on our contact page.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post