When Christmas comes around, items like decorations, toys, and artificial trees see high seasonal demand. This demand is largely met by importing goods from overseas. To successfully import these goods, you’ll need to be familiar with U.S. customs clearance procedures and regulations from Partner Government Agencies (PGAs) of Customs and Border Protection (CBP).

Key Takeaways

This comprehensive guide provides you with all the information you need to know to successfully import ornaments, toys, and other in-demand Christmastime goods into the U.S.

The Chinese city of Yiwu specializes in the production of all sorts of Christmas merchandise, including ornaments, toys, and decorations. To put China’s market dominance into perspective, Christmas decorations are classified under the four-digit HS code 9505. In 2023, the United States imported approximately $4.8 billion worth of goods under this classification, with $4.3 billion worth of those goods coming from China.

Wholesalers such as Alibaba can point you toward manufacturers in Yiwu, but finding a supplier is just part of the import process. Understanding the rules and regulations that govern the importing of Christmas decorations is equally important.

Related: 18 Alibaba Alternatives

To simplify things, we’re going to separate imported Christmas-themed goods into three basic categories, which are:

These three categories all have one thing in common: they’re primarily sourced from China and purchased by importers and end users in the United States.

Let’s take a more in-depth look at each category.

The U.S. Consumer Product Safety Commission (CPSC) regulates all Christmas decorations that are set to be imported into the United States. This includes the ever-popular category of Christmas lights, which the CPSC classifies as a seasonal and decorative lighting product.

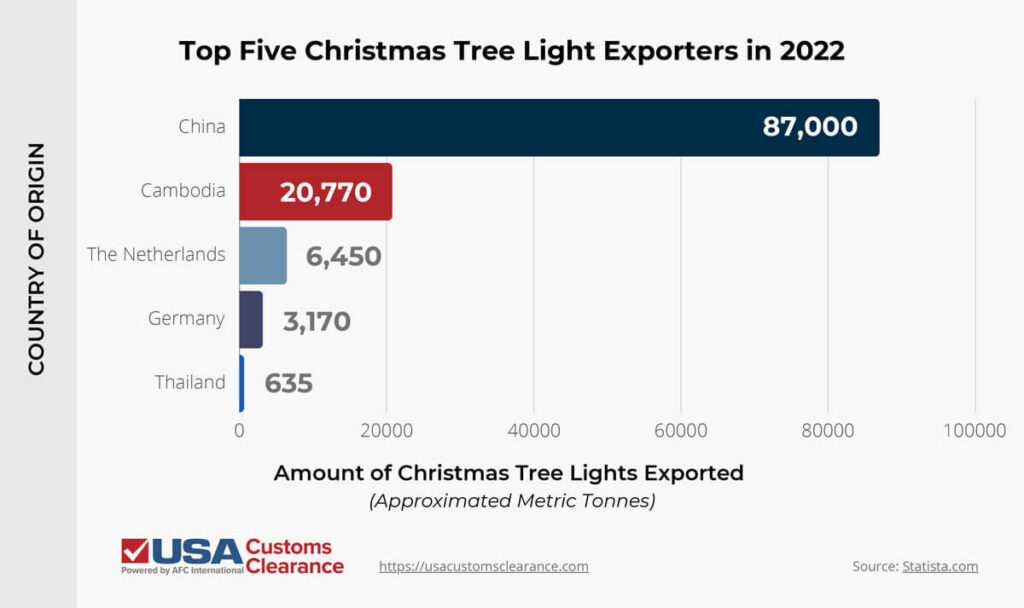

China’s dominance in this category is illustrated in the table below, which displays export volumes in metric tons from the world’s biggest Christmas light exporters in 2022.

In other words, China accounts for approximately 74% of exported Christmas tree lights from the world’s top five suppliers.

What does this have to do with regulation? It could mean you get to work with manufacturers familiar with U.S. standards. However, it also means that importers must ensure that their goods are not sourced in whole or in part from the Uyghur Autonomous Region in China.

Items from this area violate the Uyghur Forced Labor Prevention Act (UFLPA).

Assuming your imported lights meet this standard, you’ll also want to ensure they meet safety criteria determined by Underwriters Laboratories (UL).

Related: Importing LED Lights From China

Poorly-engineered Christmas lights can be dangerous due to the possibility of shocking users and even generating electrical fires. Underwriters Laboratories provides three characteristics of safely constructed holiday lights, which I’ve summarized below.

While UL does not necessarily set policy on behalf of the CPSC, UL certification carries benefits for re-sellers, especially those selling to businesses. Savvy buyers are more likely to purchase certified lights to avoid potential electrical and safety issues.

Many American consumers choose artificial trees over live varieties. Reusable and easily stored, these fabricated trees are (surprise) primarily manufactured in China.

If you plan to import artificial Christmas trees for resale, you’ll want to make sure they meet flame-resistance standards enforced by the CPSC.

We cover the rules and regulations for importing Christmas trees extensively in this article specifically focused on that subject.

From simple stuffed plushies to battery-operated, remote control cars, toys are big business during the holiday season. Given the wide range of toy designs available on the market, regulations can include:

Given how diverse and complex imported toy regulations tend to be, we have an article focused specifically on how to import toys from China, which covers this subject in detail.

In order to protect domestic manufacturing of certain goods, the U.S. government began levying Section 301 tariffs against some Chinese imports in 2018. These include many of the goods I’ve mentioned in this article, including

These tariffs are usually in the 25% range, but may very well increase between now and 2026.

Before you finalize any transactions on imported Chinese goods, you would be wise to ensure that these tariffs won’t eat into your profits too much. Otherwise, another country of origin might make a better choice overall, even if the initial cost is higher.

Related: Section 301 Tariffs: A Comprehensive Guide

There are some documents that need to be filled out and submitted to CBP for any import transaction, regardless of the commodities being purchased. These include:

Proper documentation is essential to a trouble-free customs clearance process. This is where many importers will partner with a customs broker to avoid mistakes that can cost valuable money and time.

Related: Documents Needed for Export and Import

In most cases, the answer is yes. Any imported shipment valued at $2,500 or more must be backed by a customs bond to ensure CBP receives all necessary duties, taxes, and fees. Assuming you’re importing large quantities of goods for resale, you’ll easily exceed this value.

Related: How to Get a Customs Bond: A Guide for New Importers

The seasonal but reliable demand for toys, decorations, and other Christmas goods can present profitable opportunities for importers. However, the wide variety of regulations applying to these goods can trip up even the most seasoned business owner. That’s where we come in.

The customs experts at USA Customs Clearance have years of experience assisting importers with every aspect of bringing goods and commodities into the United States. We can fill out and submit all necessary paperwork on your behalf, preventing potential fines and delays from CBP when your shipment arrives.

USA Customs Clearance also offers:

Give us a call at (855) 912-0406 or fill out an online contact form today. We’ll keep you off CBP’s naughty list.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post