While Christmas comes every year on December 25, the industry for Christmas trees — mainly of the artificial variety — kicks into gear months before. Many of those trees come from foreign suppliers, so it’s important to know how to import them into the U.S.

Key Takeaways

In this article, we’ll show you how to import Christmas trees into the United States without ending up on the government’s naughty list.

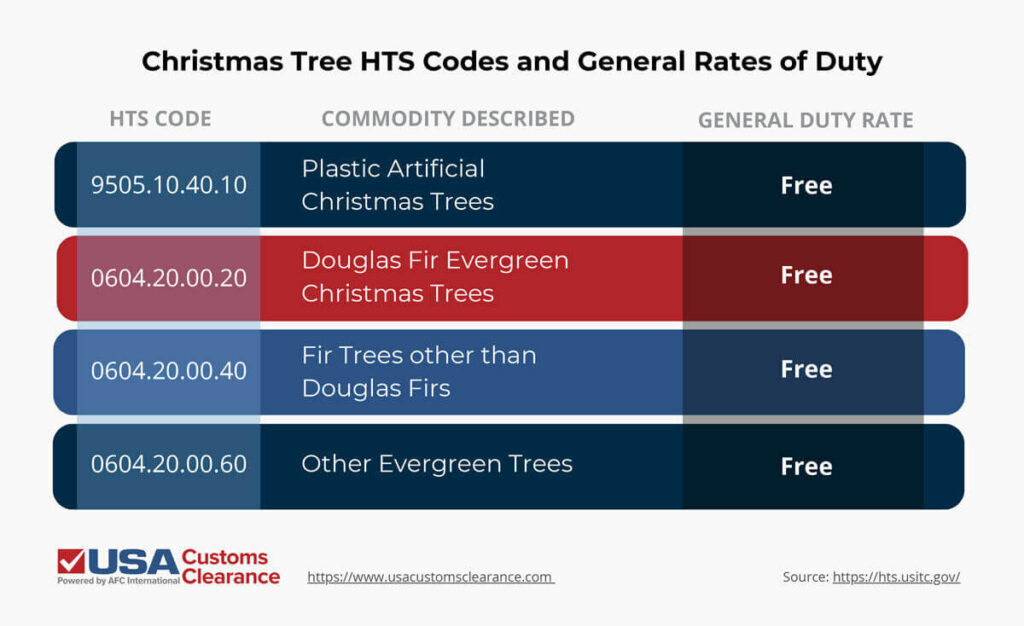

For the purposes of this article, there are basically two types of Christmas trees — live and artificial. These trees are classified under chapters 6 and 95 of the Harmonized Tariff Schedule (HTS), with the most common HTS codes and their rates of duty listed in the table below.

You read that correctly: Christmas trees usually don’t incur duties, which simplifies things for importers. Exceptions can occur based on your product’s country of origin, which I’ll address later in the article.

While rarely subject to duties, live trees are heavily regulated by the United States Department of Agriculture’s (USDA) Animal and Plan Health Inspection Service (APHIS).

If you plan to import Christmas trees, you’ll probably use Canadian sources. The United States can meet much of the demand for live trees, but it’s still it’s common to see Scots pine and White Spruce specimens imported from our neighbor to the north during the holidays. For instance, in 2022, the U.S. imported nearly three million Christmas trees with an estimated value of $68 million dollars.

Like most plants and plant products, Christmas trees are regulated by APHIS. The service is tasked with ensuring that imported plants don’t carry pests that could do significant harm to U.S. ecosystems. For Christmas trees, the primary concern is with the invasive spongy moth. Import regulations are centered around containing the threat posed by this European species.

Aside from the standard paperwork associated with importing goods, APHIS sets the following regulations for importing live Christmas trees from Canada.

Importing From an Area Infested With Spongy Moth

If the trees are destined for or traveling through an uninfested area of the U.S., the shipment requires a Canadian phytosanitary certificate stating that the trees were either inspected and found free of spongy moth or treated for infestation.

Importing From an Uninfested Area

If the trees are destined for an infested area of the U.S., no additional paperwork is required. Shipments to uninfested areas requite a certificate of origin certifying that the trees came from an uninfested part of Canada.

Keep in mind that these regulations apply to Christmas trees that are not intended for propagation. Otherwise, you’ll need to submit form PPQ 546 for post-entry quarantine.

Related: Importing Plants to the United States: What You Need to Know

Unlike their live equivalents, artificial Christmas trees are rarely produced in the United States. The vast majority of artificial trees are imported come from China. Importers usually bring their shipments into the country months in advance of the Christmas season to be ready for consumer demand.

The most common material used to make artificial trees is PVC plastic. This gets them off the hook with USDA and APHIS. However, artificial Christmas trees do need to meet mandates from the U.S. Consumer Products Safety Commission (CPSC).

Among other things, artificial trees must meet the following general qualifications.

Basically, as long as you’re importing artificial Christmas trees that have already been found to meet CPSC standards, you won’t need any extra licenses or have to put the product through any verification processes.

However, these products are subject to Section 301 tariffs when imported from China. This can make the prospect of importing artificial Christmas trees from China less appealing in the long run.

While wood is rarely used in the construction of modern artificial trees, some stands use wooden legs. If your imported products contain wood, you’ll want to familiarize yourself with the rules of importing wood into the USA.

Related: Importing Christmas Decorations to the U.S.

You will need a customs bond to import live Christmas trees into the United States. Ordinarily, bonds are only required on shipments valued at $2,500 or more. However, goods regulated by Partner Government Agencies (PGAs) require a bond even if they don’t meet that threshold.

Since artificial Christmas trees are not subject to any special regulations at this time, you’ll only need to bond the shipment if its value meets or exceeds the previously mentioned $2,500 limit.

Related: How to Get a Customs Bond: A Guide for New Importers

Christmas trees are a core element of the holiday season, and importing them for resale can be a profitable proposition. However, given the complexities of importing plants and plant-based goods into the U.S., it’s wise to partner with a customs expert to simplify the process.

The team of customs brokers at USA Customs Clearance has years of experience helping importers in the United States with every aspect of clearing customs. With our help, you can rest easy knowing that all the necessary paperwork has been filled out properly, avoiding potential issues with the United States Customs and Border Protection when your shipment arrives.

Trust us for all your importing needs, including:

Call our customs experts at (855) 912-0406 or contact us online today. We’ll help you make sure your Christmas tree imports are a cut above the rest.

Copy URL to Clipboard

Copy URL to Clipboard

can i import a cut live tree from mexico?