A steady growth of infrastructure and construction development keeps granite and marble in high demand among U.S. businesses. While these stone goods aren’t as heavily regulated as some other construction materials, there are still rules you’ll need to follow.

Key Takeaways

To learn more about importing marble and granite, read through our comprehensive guide below.

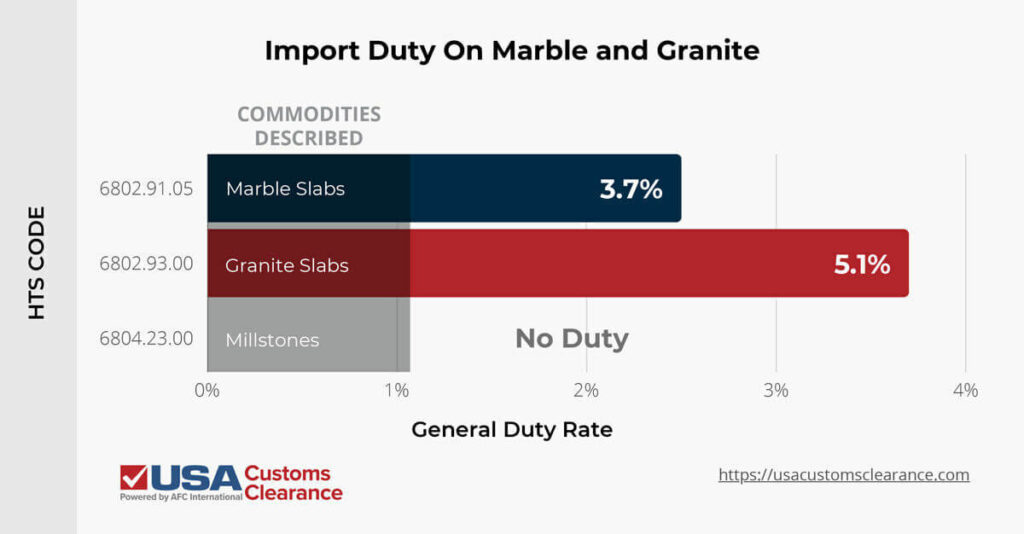

Chapter 68 of the Harmonized Tariff Schedule contains most of the HTS codes that apply to articles of stone, including marble and granite. In the table below, I’ve compiled some data detailing the HTS codes and associated duty rates of popular marble and granite products.

Source: https://hts.usitc.gov/

Marble and granite from China may also be subject to Section 301 tariffs. These additional tariffs can be as high as 25%.

If you’re importing marble and granite from a country with whom the U.S. has a Free Trade Agreement (FTA), you may be able to circumvent duties and tariffs entirely. You’ll pay no import duty in this situation as long as you provide the necessary documents required by the free trade agreement.

Related: U.S. Free Trade Agreements.

India is home to a variety of natural stones, including granite and marble. The subcontinent is also one of the largest raw material producing countries, applying the most advanced technology when it comes to the quarrying and processing of stones.

Let’s take a look at some of the pros and cons of sourcing granite and marble from India.

Pros

Cons

If you want to import stone goods from India, try to plan your shipments well in advance to mitigate these aforementioned difficulties.

Just like India, Brazil has solidified its place as a top global source of granite. The South American country mines hundreds of different types of granite from its quarries, including popular selections like Ubatuba and Santa Cecilia.

While Brazil also produces an array of other natural stones, granite is their bread and butter, accounting for approximately 70% of all the granite countertops globally.

Here are some of the pros and cons of sourcing granite from Brazil.

Pros

Cons

In addition to these specific concerns, there are also some general issues that apply to all shipments of imported stone.

Properly classifying marble or granite with the correct HTS code is one of the biggest challenges importers face. These codes will differ based on the level of processing the stone has gone through. Using the wrong code can lead to CBP holding goods at the border and levying fines in some cases.

Typically, when a product is suspected to be improperly classified, samples of the merchandise are sent to the laboratory to be analyzed. CBP issues an advance notice if they determine that a shipment has been incorrectly classified as granite. Given its similarity to other stones and how often it’s shipped in a raw or minimally processed form, it’s surprisingly commonplace for importers to use the wrong HTS code when importing granite.

Related: Import Challenges: We Explain Trade Barriers and More

In most cases, no. However, shipments of marble and granite are inspected by CBP agriculture specialists. If they find foreign insects or pests, they may recommend fumigation. This will ensure the product is safe for use.

Marble imported from the Mediterranean is particularly susceptible to infestation by certain species of slugs, which may have a destructive impact on U.S. ecosystems.

Brokers can ensure all of your shipment details are correct, including classifying the marble or granite with the correct HTS code. They can also directly handle the clearance of your shipment by acting as an importer of record (IOR), which allows the broker to submit all necessary paperwork to CBP on your behalf.

Related: How a Broker can Boost Your Import Business

If you feel like you’re stuck between a rock and a hard place when it comes to importing stone goods into the United States, we can help.

USA Customs Clearance is your go-to partner for all your importing needs. We have a team of professional licensed customs brokers ready to make the importing and clearing journey as stress-free as possible.

Our full range of customs clearance services includes:

If you have questions about importing marble, granite, or any other stone goods, call our experts at (855) 912-0406 or submit a contact form online. We have the answers you’re looking for.

Copy URL to Clipboard

Copy URL to Clipboard

Like quote to get

Container

Of marbles from Egypt plus shipping cost

Hi,

I am planning to get Quartz and Granite from India to US, I would like to know the process as well as market feasibility and opportunities.