Importing scrap metal into the U.S. can be a lucrative business, especially with stricter tariffs in place for steel and aluminum. However, materials must still meet U.S. standards and rules, which can change with little notice. With a little experience and know-how on your side, you can realize the benefits of this venture.

Key Takeaways:

We'll walk you through the whole scrap metal importing process, from understanding the standards to ensuring your scrap clears customs without any issues.

Like any other import business, understanding your product is vital for success. Whether you're importing scrap metal for resale or as a manufacturing component, you'll need to be familiar with certain terms unique to the business.

Let's break down some of these key terms and their significance in the scrap metal importing process.

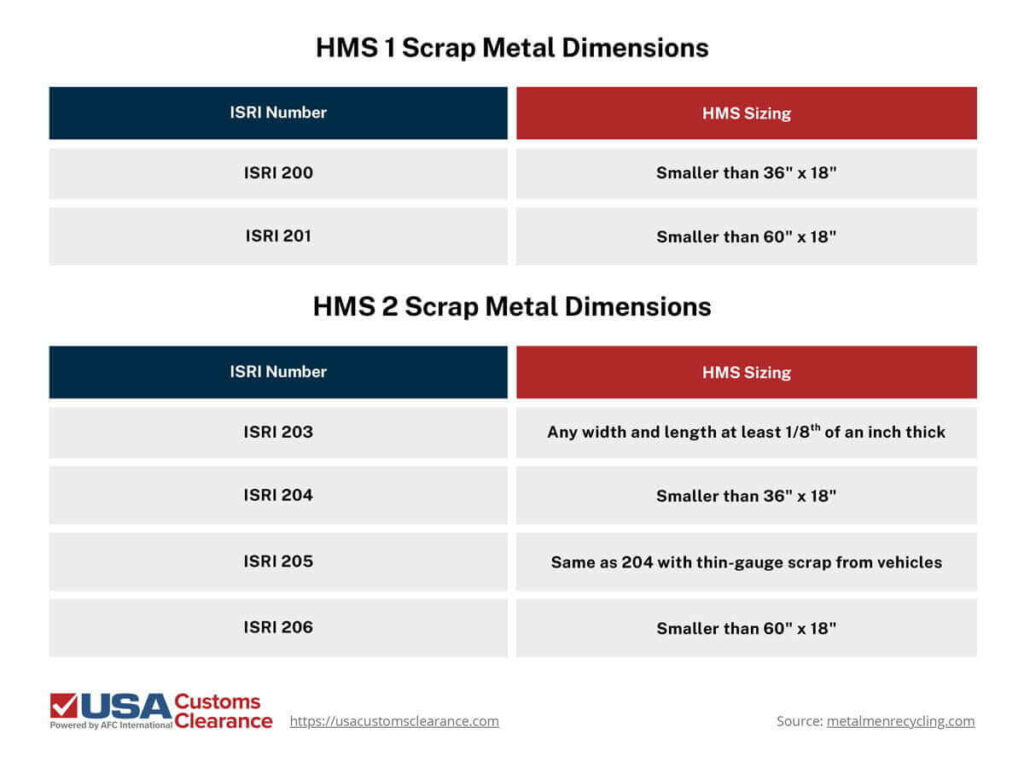

HMS is further categorized according to overall dimensions using an ISRI (Institute of Scrap Recycling Industries) number.

Understanding these terms and dimensions is essential for anyone in the business of reselling or processing imported scrap metals.

For that, you’ll need to know the various types of scrap metal eligible for import.

Depending on your purposes, you may need to import several kinds of scrap metal. At their most basic, they can be separated into ferrous and non-ferrous categories.

Ferrous metals contain iron, are usually structural, and include:

Non-ferrous metals do not contain iron and have more specialized applications:

Differentiating between these types is important for several reasons; not only for recycling and processing purposes, but also for complying with regulations and paying the correct duty assigned.

Several government agencies and systems play a key role in the process of importing scrap metal. Understanding their function and authority can help you handle the import process more effectively. As with all imports, Customs and Border Protection (CBP) is the main agency you need to deal with.

Here’s a rundown of other major agencies involved and their roles.

Each agency develops and enforces its own regulations, which can sometimes overlap. It’s important to be thorough in your compliance efforts if you decide to import scrap.

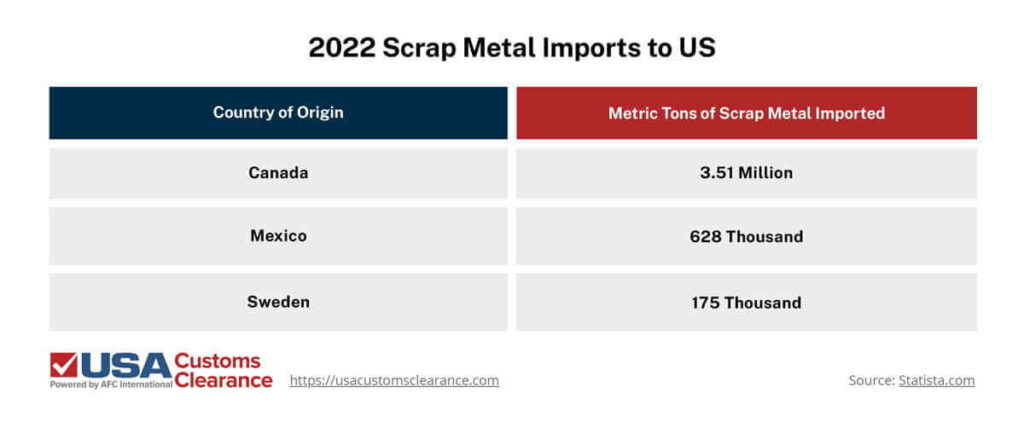

The United States is one of the world’s largest scrap metal importing countries. In 2022 alone, over 4.72 million metric tons of scrap steel, copper, and more made its way to American shores.

The following three countries accounted for the lion’s share of scrap metal imported to the USA in 2022.

Canada and Mexico continue to be the most popular sources of scrap due to the variety of metals available and the reduced shipping time.

Scrap metal importers should consult CBP guidelines for the specific type or types of metal they plan to import. However, the basic steps are more or less universal.

Let’s review seven steps you’ll need to focus on.

Accurate documentation is critical to avoid holds that are often attached to costly fees. The best way to accomplish that is with the right support services, usually in the form of full service customs brokerage that can manage details from origin to destination.

Related: What Documents Do I Need To Import and Export?

Given the wide variety of materials covered by the term ‘scrap metal’, duties and tariffs will differ. To determine your exact costs, first find the exact Harmonized Tariff Schedule (HTS) code(s) that describes your import(s).

HTS code assigned duty rates will vary by metal. Typically, your fee will be based on value per kilogram.

Depending on where you import from, there may be additional fees involved. As of April 2025, for example, there is a 10% baseline reciprocal tariff in place for nearly all trading partners.

Mexico and Canada are the only current exceptions to this rule. However, scrap from there may still be subject to an executive order tariff that was put in place in March 2025, which can add a 25% ad valorem flat rate to your import.

If your shipment exceeds $2,500 in value, which scrap metal typically does, you will also need to secure a Customs Bond sufficient to cover any applicable duties and fees. The same applies if the scrap metal requires further documentation with another agency, such as the EPA.

Currently, steel and aluminum imports to the U.S., and various downstream products, are subject to a 25% additional ad valorem tariff imposed by Section 232.

At this time, no HTS codes describing steel or aluminum scrap metal are included in the orders, so these are exempt from the 25% tariff.

However, be aware this is specific to scrap. Finished metal products that have been made with scrap or recycled metal may still be listed among the downstream products that are subject to the additional ad valorem tariff imposed by Section 232.

Importing scrap metal has many benefits, not just for businesses, but for the environment as well. However, bringing scrap into the USA can be a challenge without the right help. That’s where we come in.

USA Customs Clearance brokers have over a century of combined experience assisting businesses who need to bring imported goods to the United States. No matter what questions or complications you face in your import journey, we have the know-how you need to excel.

Trust our team for assistance with:

Don’t be deterred by the complexity of U.S. customs. Give us a call at (855) 912-0406 or complete a contact form with a direct inquiry online today. We’re standing by to help you with every aspect of the import process.

Copy URL to Clipboard

Copy URL to Clipboard

Hi, I would like to ask regarding the importation of Scrap Aluminum UBC Beverage Cans in China. Can I buy thru Alibaba Delivery Duty Paid . That item from China can deliver to my address in Oceanside CA.