Importing solar panels has proven to be a lucrative source of income for savvy United States importers. However, the process of importing these goods can be complicated due to trade actions, tariffs, and bans on imports from certain regions.

Key Takeaways:

Join us as we shed some light on the complications surrounding solar panel imports.

When importing solar panels into the United States, importers must follow rules and regulations set by Imported solar panels must follow rules and regulations set by CBP. These regulations ensure that these products comply with U.S. standards for safety, efficiency, and trade. Understanding these rules can streamline the import process, preventing costly delays and fines.

Here’s a closer look at the key CBP regulations governing the import of solar panels:

A somewhat recent regulation in the United States also forbids the import of solar panels and associated components from a certain area in the People’s Republic of China.

In February 2024, CBP sent a questionnaire to certain companies in the USA requesting details about their supply chains. These questionnaires were designed to expose entities violating the Uyghur Forced Labor Prevention Act (UFLPA) of 2021.

The goal of the UFLPA is to prevent the importation of goods made in whole or in part from materials sourced in the Xinjiang Uyghur Autonomous Region of China into the United States. There is strong evidence that the Chinese government is forcing the native Uyghur people in this region into labor camps in order to meet production goals for certain commodities.

Solar panel importers in particular need to be aware of this, mostly because of the “in part” provision of the act. Xinjiang is currently one of the world’s top producers of polysilicon, a primary component of most solar panels. Importers in the U.S. must do their due diligence to be 100% certain their products don’t contain materials sourced from Xinjiang.

While tariff rates have resumed following the two-year exemption, President Biden has more than doubled the energy production threshold of solar panels that can be brought into the country before these tariffs are applicable.

In the past, the overall energy-producing value of solar panels imported into the U.S. could not exceed five gigawatts (GW). This number has been adjusted up to 12.5 GW, and may be reevaluated once more in the future.

In June 2022, the Biden Administration announced a 24-month tariff exemption on the import of Crystalline Silicon Photovoltaic (CSPV) Cells, aka solar panels, from a handful of Southeast Asian countries, including:

Tariffs are likely to be reinstated in June 2024. However, importers will not have to worry about retroactive payments of tariffs on imports during the exemption period.

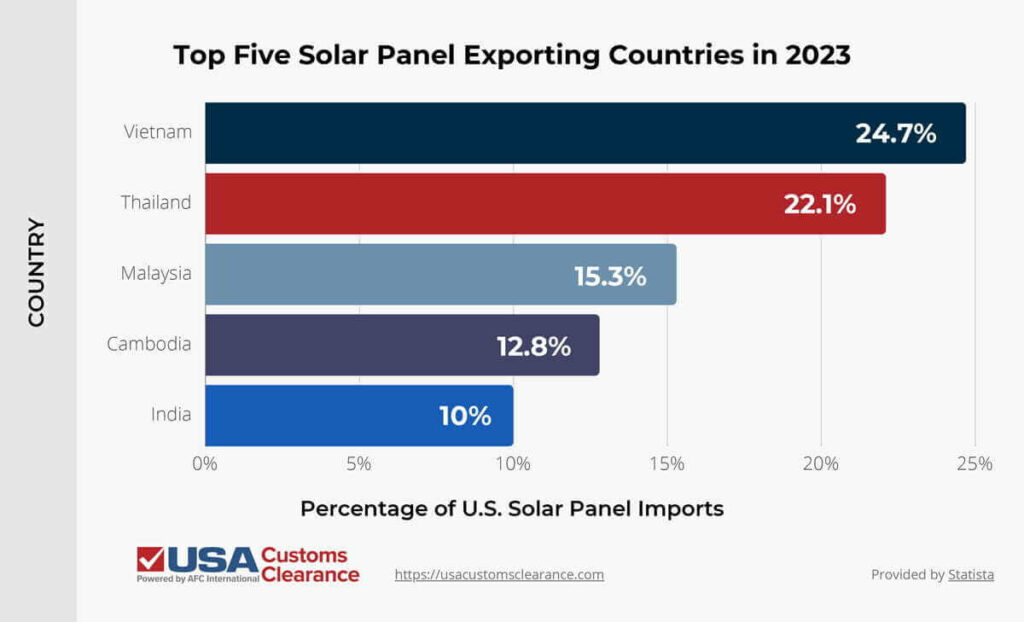

Solar panels are usually classified under the Harmonized Schedule (HS) code 854113. In 2023, the following countries exported the vast majority of this commodity to the United States.

Keep in mind that recent AD/CVD increase have affected solar panels from these countries, so additional duties of up to 14.5% that weren't in effect last year may be applicable to panels from these countries now.

There are two other countries importers in the USA use as a source of solar panels that are worth mentioning: Germany and The People’s Republic of China. While they own a smaller share of overall imports than other nations, they present unique benefits and, in some cases, hurdles for importers.

In 2018, a tariff was placed on all imported Chinese photovoltaic cells (this includes solar panels) into the United States as a result of a claimed unfair competition with China. This is an example of a potential trade barrier, since importers must be aware of AD/CVD when deciding where to make their purchase. The tariff works alongside the previously mentioned UFLPA.

The tariff on Chinese solar panels started out at 25% of the product value, but has increased to 50% in 2024.

Fallout from this tariff and the previously mentioned UFLPA has led importers to search for alternative sources. For those who want to build a reputation for selling the highest-quality products, the most attractive country of origin is likely to be Germany.

No matter what goods you plan to import, proper documentation is key to customs clearance. For more information, check out our article on documents needed for import and export.

Some German businesses have been acknowledged as Tier 1 manufacturers. This means that they assemble their products from start to finish.

In contrast, Tier 2 and 3 companies provide components or raw materials. These lower-tier companies may purchase pre-made components and only perform basic assembly of the final product themselves.

Tier 1 manufacturing is considered favorable since components don’t change hands as often as they would in a lower tier process. This tends to result in a more dependable product.

If you plan to import solar panels from Germany, these are some of the companies to consider:

No matter which country you choose, it’s important to consider several factors when deciding on a supplier.

Some basic questions and details you should ask about when choosing a solar panel supplier are:

Examining a manufacturer’s background can reduce the likelihood of working with a solar business that has the potential for bankruptcy or a history of customs violations.

A company’s average solar panel wattage is also an important aspect to consider when choosing a manufacturer. Solar modules with higher wattage are naturally going to produce more energy per unit. This wattage can be impacted by whether a solar company uses monocrystalline or polycrystalline panels.

Wattage also affects import duties, which is another factor to consider in light of the frequent changes to the U.S. tariff schedule for solar panels.

The biggest difference between these two designs is as follows:

Monocrystalline cells are more efficient, meaning fewer cells will be needed to achieve the same wattage as a comparable polycrystalline unit. Keep this in mind when deciding on a supplier. While polycrystalline is less expensive, it won’t generate as much power per square meter as a monocrystalline panel of the same size.

Related: Importing Electronics to the USA: What You Need to Know

As you can see, importing solar panels can be an extensive and confusing process. Third-party companies are available to alleviate stress on business owners and individuals interested in importing solar energy. This is where USA Customs Clearance can help you.

In addition to assisting you with clearing your goods through customs, our comprehensive 3PL services offer you even more convenience. We can also arrange transportation of your goods from beginning to end. This allows us to act as your one-stop shop when importing goods into the U.S.

We also offer additional import services, including

Give us a call at (855) 912-0406 or contact us online. We’ll be able to answer all of your questions and help you successfully clear and import your shipment of solar panels.

Copy URL to Clipboard

Copy URL to Clipboard

WE want to import solar panels from India for use and resale in USA.

Please contact us and provide us with help and guidance in making this possible