Section 301 duty drawbacks are refunds associated with tariffs and customs duties applied to China-origin products under the Section 301 act. Duty drawbacks, or refunds, of these duties can only occur under specific circumstances.

Key Takeaways:

I’m going to answer the most common questions most exporters have in regard to 301 duty drawback and tell you how the experts at USA Customs Clearance can help you navigate the final process.

According to the CBP’s information bulletin through the Cargo Systems Messaging Service (CSMS), Section 301 duties applied to products from China can still qualify for drawback.

Even if a product has an HTS code that has been granted a tariff exclusion, the importer can still go through with the duty drawback submission as long as it meets the typical standards.

In addition to products covered under any of the tariff exclusions, general duty drawback rules also apply to section 301 goods.

Your goods are also eligible for duty drawback if:

There are also allowances made for goods that are substituted with valid items. However, companies can only file a drawback for a refund within five years of the original import date.

Duty drawback on products coming from China will continue to be upheld for the benefit of U.S. exporters who bring in components and raw materials for manufacturing before selling to foreign markets.

Related: Customs Duty Drawback

If you’re unsure whether goods that you’ve previously imported are eligible for a tariff refund, our team of Licensed Customs Brokers can. We’ll let you know exactly how much of a refund you’re eligible for and help you prepare to file.

Worried about the Strict Regulations? Ask Our Experts.

Our Licensed Expert Consultants Will Personally Guide You.

As of January 2021, CBP requires businesses filing for Section 301 duty refunds to include an HTS Chapter 99 identifying code.

That chapter of the U.S. tariff schedule is for temporary modifications to trade laws and policies. We’re all hoping that the high tariffs on so many products eventually ease. In the meantime, the Ch. 99 identifying code lets CBP know that the requested drawback is specifically for Section 301 imports.

The announcement, CSMS #45963175, also states that the quantity and value of each import needs to be included. It also has to be in the same order as when it’s submitted through ACE by your customs broker.

What I’m really getting to here, is that there are significant amounts of fine print in getting these drawbacks filed correctly. The wrong order or missing HTS code could result in the claim being significantly delayed or rejected.

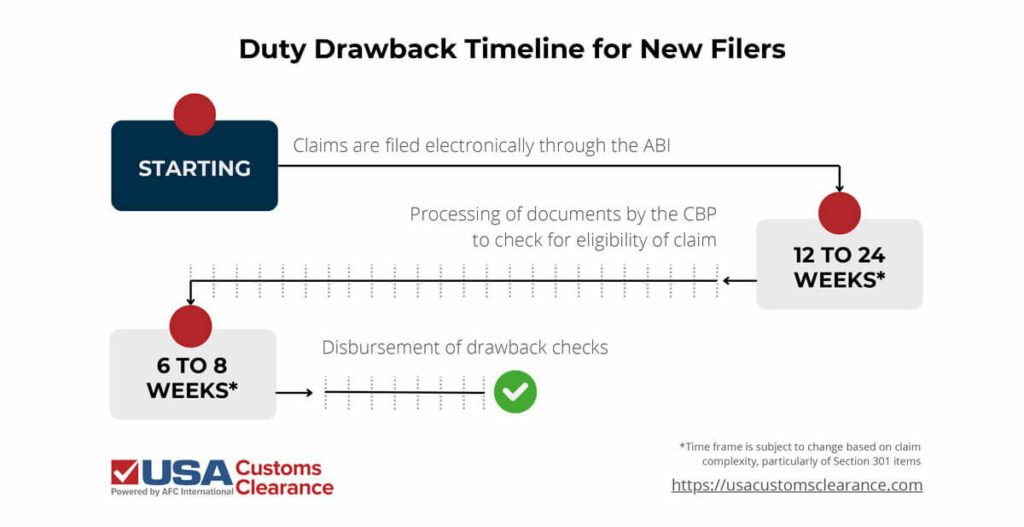

The amount of time it takes to receive a refund depends on whether your business has ever filed a duty drawback before. New filers of Section 301 drawbacks are likely to wait a year after a claim has been filed before receiving funds.

If the claim is simple, you might get lucky and receive your refund within six months, but I wouldn’t bank on that possibility.

All drawback claims are now done electronically through the Automated Commercial Environment System (ACE), which does speed things up a little. Before, claims could to take up to three years to fully go through.

Once all forms are completed and sent to the CBP via the Automated Broker Interface (ABI), it should take between 3 and 6 months for authorization. If a form is sent to a drawback center for manufacturing products rather than to customs headquarters, it might only take 3 months for approval.

None of these timeframes are guaranteed, however. If you happen to be submitting a particularly complicated claim, the approval process can take over a year.

After all requests have been submitted and approved, drawback checks should be disbursed in 6 to 8 weeks.

Once your company is in the system, refunds are processed a little faster and you get some additional benefits.

The AP privilege allows for a quick refund that only takes about 4 weeks after the drawback is filed. However, businesses initiating a claim a year after the exemption has been announced, forfeit the privilege. Essentially, the quicker you act, the faster you’ll receive your refund.

When you work with our team, we’ll let you know when to expect your tariff refund, providing you with updates along the way as we receive them from CBP.

If you’re looking for a refund of duties that don't need to comply with drawback rules, you may still be in luck. Check out our article on Section 301 tariff refund eligibility for more information.

Up to 99% of paid duties can be refunded, though a portion of the refund goes back to customs and the duty drawback office as a fee for their services.

Considering the range of additional duty tacked onto Section 301 products is now anywhere from 10-50% (not including the NTR rates) the refund can be quite substantial.

Related: A Guide on China’s Section 301 Tariffs

No, because some goods that are included in the Section 301 lists applying to China are also subject to anti-dumping and countervailing duties (AD/CVD).

The most common imports facing this limit are items made from steel and aluminum. These imports are on List 1 of the Section 301 tariffs, but also fall under Section 232 provisions.

Presidential Proclamations 9739 and 9740 made in 2018 make both steel and aluminum imports from China ineligible for duty drawback.

Related: Importing Steel

With as complex as importing products from China can be under Section 301, getting a refund for those same tariffs is even more so. One error in any document, especially the HTSUS code, could force you to start the entire process over, or even worse receive a denial letter.

Our skilled and friendly consultants can guide you through the duty drawback process, helping you file as well.

We also offer other services to keep you on track:

Call (855) 912-0406 today to get customs consulting services that will answer all of your questions. For more direct inquiries, complete our contact form and one of our customs experts will call you back with a response.

Copy URL to Clipboard

Copy URL to Clipboard

We purchase from a USA company items that they import in from China. We have one customer that we sell to in Canada. Would we qualify for Duty Drawback?

Hi Gayle,

It's possible that you could qualify, but it will depend on a number of factors. These include providing adequate proof of export out of the U.S., who the official Importer of Record is, and more.

We've replied privately with additional information to assist you.