Thailand is a popular country of origin for a wide variety of electronic components, tires, and other everyday commodities in high demand from American consumers. Knowing how to calculate duties and tariffs on goods from Thailand is an important skill for importers looking to ship Thai commodities into the United States.

Key Takeaways

Find out how to estimate import taxes on your shipments from Thailand in this article.

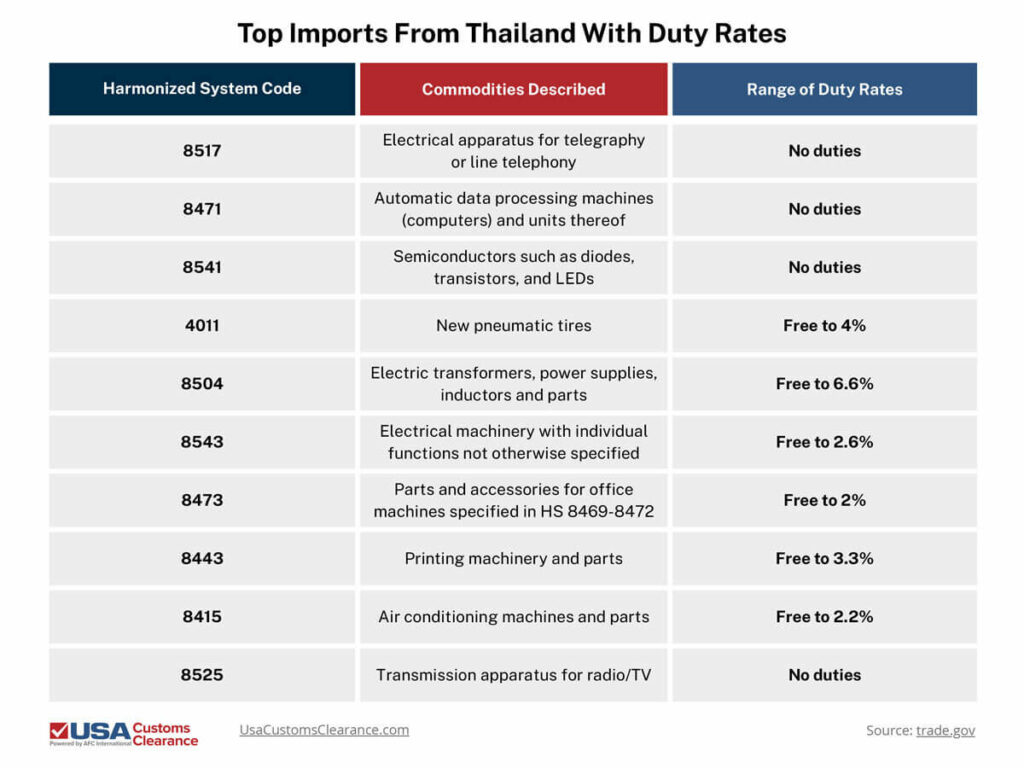

Thailand’s entire list of exports and associated duty rates would take up far too much space for a blog entry. However, we can look at the top 10 most commonly imported Thai commodities to get an idea of what duties you can expect to pay.

In 2025, calculating duties will only get you about half the information you need about your import taxes: you’ll also need to account for tariffs that apply to most shipments entering the United States.

In April 2025, the Trump administration unveiled a series of what were called “reciprocal tariffs”, which were calculated based on factors such as trade deficits between the United States and its trading partners.

Goods from Thailand were set to incur tariffs of 36% across the board before reciprocal tariffs were paused for 90 days in favor of a flat 10% import tax on most goods imported from other countries.

Thailand is also subject to Section 232 tariffs on certain goods, including:

As you can see, factors such as the type of commodity in question will cause duty and tariff rates to vary. So what’s the most effective and accurate way to estimate your import taxes on goods from Thailand?

If you look back at the table I used to show duty rates on common Thai imports, you’ll see that some tires incur a duty rate of 4% of the shipment’s total value according to the US Harmonized Tariff Schedule. This is referred to as an ad valorem duty, which basically means added value.

If you were to import of these 1,000 tires from Thailand for resale in the United States at a cost of $50.00 per unit, the duty calculation would look like this:

This duty stacks with the 10% flat rate tariff enacted by the US government. Since this is an ad valorem tariff, the calculation is similar to that of the duties.

By adding the duties and tariffs together, we end up with a figure of $7,000 before costs like shipping, port fees, and brokerage charges come up.

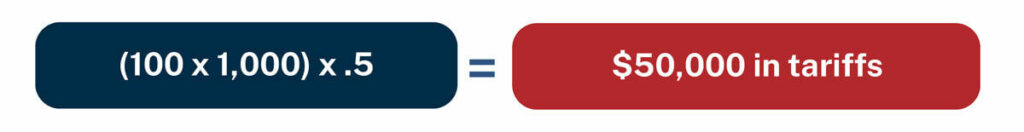

Now, let’s say you want to source raw aluminum ingots from Thailand. The good news is that there are no duties on aluminum ingots. However, the goods are subject to a 50% Section 232 tariff.

Assuming an order of 1,000 ingots valued at $100.00 a piece, the tariff calculation would look like this.

As you can see, the 10% flat rate tariff is ignored in favor of the higher Section 232 rate.

When you import goods from Thailand, you’ll need to factor these rates and possible anti-dumping or countervailing duties on a commodity-by-commodity basis.

While I’ve used some simple examples to illustrate how to calculate duties and tariffs on imports from Thailand, the process is often tricker in practice. Making sure you use the correct Harmonized Tariff System (HTS) codes to classify your goods is key to ensuring you calculate your duties correctly. Many importers rely on a customs broker to get this information right and avoid provoking the ire of Customs and Border Protection CBP.

If you plan to import goods from Thailand or any other country, the licensed customs brokers at USA Customs Clearance can assist you with as much or as little of this complex process as you need. From one-on-one consultations to complete brokerage services, we help importers like you succeed every day.

We also offer the following:

Import your goods with confidence and clarity. Give us a call at (855) 912-0406 or submit a contact form online today!

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post