If you run an import export business, you could be managing everything from product design to demographic analysis, gathering customer feedback, and any of the other hundreds of responsibilities business owners face. Combine this with the complexities of importing and you have a recipe for getting overworked.

Thankfully, you don’t have to manage customs clearance alone. In fact, you probably shouldn’t.

Key Takeaways:

Find out who’s responsible for customs clearance and how USA Customs Clearance’s team of licensed customs brokers can bolster your import business.

Navigating customs clearance can be a challenge. Let our experienced professionals take care of it for you. Reach out to us at (855) 912-0406 and start enjoying hassle-free clearance today.

First off, I’ll briefly recap what customs clearance for freight shipments entails.

In freight shipping, customs clearance is the process by which imported shipments are documented and approved for entry into the US once they reach their port of destination. Customs and Border Protection (CBP) is the government organization charged with enforcing the regulations and laws that make up the clearance process. One could say they manage the government’s end of customs clearance.

So, who manages customs clearance for importers? While some try to tackle the job themselves, customs brokers licensed by CBP are frequently responsible for handling customs clearance for international shipments on behalf of importers.

When you hire a customs broker, you provide authorization to them to act on your behalf via signing a power of attorney (POA) document. This allows them to represent you and all details of your shipment for the purposes of US customs clearance. We can break these interactions down into a few general categories.

There are several forms that are filed electronically to CBP to process an import clearance request.

They include:

CBP requires this and other customs-related paperwork to be saved by the importer for five years after completion of the transaction, which is another service brokers often provide.

Related: What Documents Do I Need To Import and Export?

One resource every importing business should have is an import compliance manual. Such manuals are not one-size-fits-all: everything about your product, from its Harmonized Tariff Schedule (HTS) categorization to country of origin and partner government agency involvement can complicate customs clearance.

Brokers who specialize in compliance create customized manuals for import businesses that address all of the requirements for a given commodity to be legally imported into the US. In this way, brokers can even have a hand in establishing in-house rules for the management of importing goods.

Related: What is an Import Compliance Manual? (And How Can it Benefit Your Business?)

Customs brokers don’t usually make shipping arrangements themselves. However, those who work for third party logistics (3PL) providers often serve as a point of contact between shippers, carriers, and CBP.

For instance, a broker handling customs clearance for one of your freight shipments will receive confirmation from CBP once the goods are released. They can then give the go-ahead to their logistics partner to pick up your container(s).

Since the broker receives release notification and has a direct working relationship with carriers in their 3PL network, they’re uniquely positioned to minimize delays and keep the process running smoothly, from clearance to release and domestic shipping.

Many small to medium-size businesses retain the services of a licensed customs broker or customs clearance company, also known as a brokerage firm, to manage their customs clearance process. While this is not always legally required, there are reasons most business owners don’t manage their own clearance. Most of these reasons stem from concerns about correctly filling out paperwork and using the wrong HTS code(s) to calculate duties and tariffs.

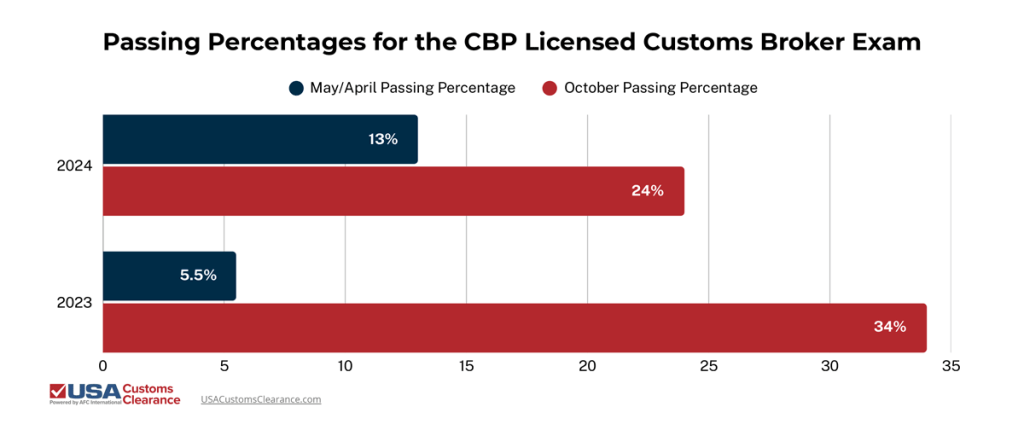

Such concerns are absolutely valid, as illustrated by the CBP broker exam’s pass rate. These are administered twice each year, and the table below shows the passing rate for the last two years.

Provided by CBP

As you can see, about 3 out of 10 individuals pass the test in a good year. One of our own brokers got her license when the passing rate was just 4%. This goes to show how difficult it is to simply understand the processes behind customs clearance, let alone execute them to CBP’s approval.

The fines and damage to your reputation that can arise from inaccurate customs filings can cripple a growing business. To avoid these issues and ensure trouble-free customs clearance, don’t take your chances: partner with a licensed broker.

At USA Customs Clearance, our licensed customs brokers have decades of combined experience with compliance, documentation, and every other aspect of clearing US customs. Give us a call today at (855) 912-0406 or fill out a contact form online to start cutting through the red tape of importing today!

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post