For importers looking to secure Section 301 tariff refunds, there are important details that need to be considered. The good news is that getting a refund on duties you’ve previously paid is possible. However, eligibility is limited and the process is complex. The effort is worth it for importers when it can possibly recover millions of dollars in duties.

Key Takeaways:

To obtain a Section 301 tariff refund, importers need to go through the following process:

Our guide below provides you with an in-depth look at the Section 301 tariff refund process so you can determine your eligibility and see what steps to take next.

The Office of the United States Trade Representatives (USTR) made several announcements recently that affect businesses taking advantage of Section 301 tariff exclusions and refunds.

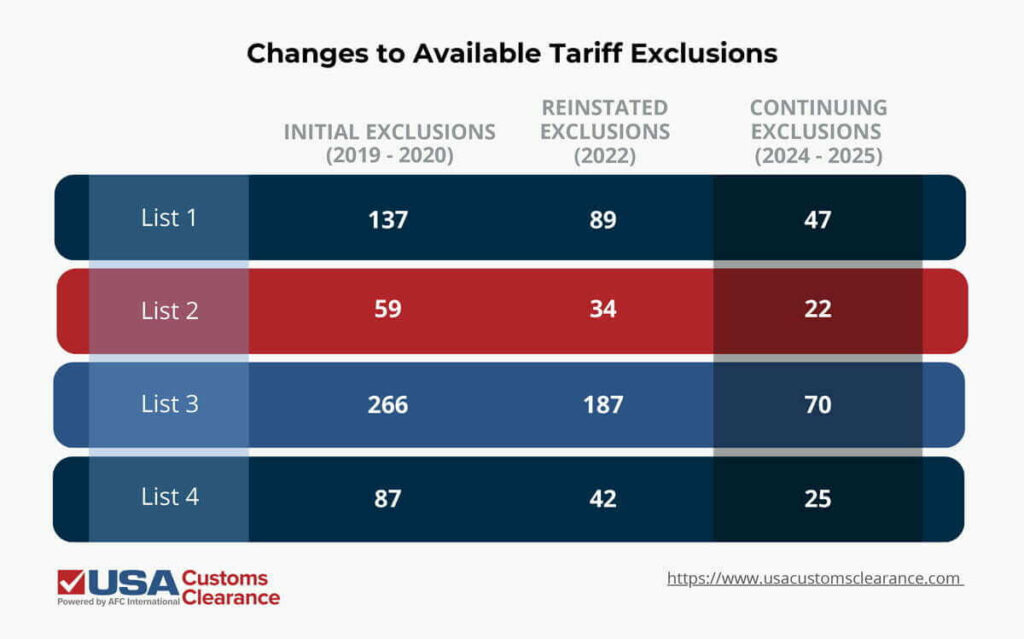

As of June 15, 2024, only 164 tariff exclusions will remain active and there is no longer a separate list being maintained for COVID-related needs. That drops the number of exclusions down considerably from 429 that were available. The renewed exclusions will remain in effect until May 31, 2025.

Recently, a review of all the Section 301 tariffs and trade policies involving China and the United States was also completed. The result promoted the addition and increase of tariffs on about $18 billion worth of products.

The good news is that the USTR is also open to accepting new exclusions requests. They are currently in the process of accepting and reviewing input on 331 new HTS subheadings that could become eligible for tariff refunds if granted.

Most of the products being considered fall under Section 16 of the Harmonized Tariff Schedule (HTS) which describes different types of machinery, electrical equipment, and related parts. There are 19 subheadings which relate specifically to solar manufacturing.

If granted, they would also stay in effect until May 31, 2025. While we wait to see which products may become eligible, it’s best to review the refund process you’ll need to go through.

For more information on all Section 301 extensions, check out our article Track the Section 301 Tariff Exclusions List.

Currently, there are 164 exclusions eligible for a tariff refund. These products can find their classifications in Annex C of the Federal Register, published May 30, 2024.

The exclusions include products from each of the original four lists that made up Section 301 tariffs.

Initially, the USTR allowed exclusions for 549 products. Then in 2022, that dropped to 352. Now that number is even lower.

In order to apply for a Section 301 tariff refund, you have to make sure that you have access to the following:

We highly recommend that you work with a licensed customs broker to ensure all the information you provide is correct. They can also submit the post summary correction and file for the refund on your behalf. Below, I’ve included a step-by-step guide on how to get started applying for your tariff refund.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Each of the 164 exclusions contains products that fall under a specific HTS code. This code provides information on the tariff classification and description of the product. You must match your product’s code to one of the codes listed under the Section 301 exclusions to see if it qualifies.

If you’re having trouble finding your product’s HTS code, use our HTS code lookup tool to get started.

The USTR has stated that exclusions are available for any product that meets the official description, even in cases where the HTS code covers multiple products.

Be aware that in such cases, the available tariff refunds won’t automatically apply to every product listed under the HTS codes being excluded. It’s essential to also match the description of the product to ensure that it qualifies for a tariff refund.

Additionally, you may only have the 8-digit HTS code for your product, rather than the full 10-digit code. In this case, you must match the description of the product to make sure that it matches the description of a full 10-digit HTS code that is eligible for exclusion.

Once you have your product’s information, it’s time to get in touch with a licensed customs broker.

A broker can ensure that all product and tariff classification information is accurate and can help ensure that each of the remaining steps are performed correctly.

If you don’t already have a broker, we offer customs brokerage service and can assist you in quickly securing your tariff refund.

In order for a customs broker, or a customs clearance service to perform business on your behalf, you must grant them power of attorney.

Granting power of attorney to your broker gives them the ability to assist you in every step of the customs clearance process, including tariff refunds. They can submit documentation on your behalf, receive goods at the port of entry, and generally work as an extension of yourself in Customs-related matters.

Giving your customs broker power of attorney is necessary in order to complete the remaining steps to obtain your refund.

The purpose of the tariff refund process is to help those who may have paid the import duties on imports they weren’t aware had an exclusion.

If this applies to you, it’s necessary to obtain a list of previous entry reports that you’ve made through the Automated Commercial Environment (ACE). Be aware that entries are liquidated after 300 days, at which point, they are no longer eligible for a Post Summary Correction (PSC).

A protest can be filed with CBP, but there are no guarantees that eligibility will be granted again.

Your broker can complete the PSC by submitting the specific exclusion request for your products. A specific exclusion request code must be submitted for each individual entry.

This must be submitted electronically.

CBP will review the submitted PSC and give one of three potential answers:

If approved, congratulations! You have no further steps other than to await your refund. If denied, then that means that CBP found reasons that your product does not qualify for a tariff refund.

CBP may also request more information before determining if your product qualifies for a refund. If that happens, be sure to carefully review which information they require to ensure you get it right before submitting.

Refunds are processed weekly on Fridays and delivered via your Automated Clearinghouse (ACH) account. If you do not already have an ACH account setup, the refund will be sent out by mail in the form of a check.

At USA Customs Clearance, we can help you get started and set up your ACH for free so you can get your money faster.

For more information on Section 301 and duty drawbacks, check out our article Section 301 Duty Drawbacks: Qualifying for Refunds

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Importers can submit a PSC to request a refund up to 15 days prior to the day the entry is scheduled to be liquidated. Liquidation typically occurs within 300 days from the date of entry filing.

If the entry is within the 15-day window prior to liquidation, or if it has already been liquidated, a PSC can no longer be filed. At that point, you have two options

This request can either be submitted on paper or electronically to the appropriate Center of Excellence and Expertise.

If the request is approved, the liquidation date will be moved back one year from the scheduled liquidation date. You can do this up to three times (no more than three total years).

Once an extension is granted, an importer may file for a product exclusion as normal. If approved, the importer may then file a PSC. If the exclusion is not approved, the liquidation extension will still stand and the entry will be liquidated one year after the originally scheduled date.

If your request for a Section 301 tariff refund is denied, you can do one of two things:

Obviously, by accepting the rejection made by CBP, the process will end and you will not be granted a refund.

However, CBP allows importers who disagree with the decisions it makes to file a protest. If you choose this option, you will have the chance to make your case to CBP as to why its decision is incorrect and why you should get a refund. That being said, there is no guarantee (or likelihood) that you will receive your refund by going this route.

It’s worth noting that an importer may also have to file a protest to begin the refund process if their entry has already been liquidated. While the process to file a protest remains the same, this is not the same situation as filing a protest after an application has been rejected.

Getting a refund approved is not a simple process. Between the detailed evidence and ensuring that all information included is accurate, there’s plenty that can go wrong. Any incorrect information can result in your application being denied or delayed.

CBP has been very aggressive in monitoring the exclusion/refund process. If it feels that the information listed is incorrect or that you have been untruthful, it can conduct a formal investigation. The larger the refund being requested, the more CBP will scrutinize and investigate the refund request.

Additionally, once the PSC is submitted, customs brokers can monitor the status of the request and contact CBP on your behalf. If you don’t already have an ACH setup to receive the refund, they can help you get started so that you can receive your money faster.

You can think of your customs broker as your partner. We understand your imports and the Customs Clearance process. It’s also worth noting that even if your request is denied, we can still identify other opportunities to save on tariffs and import duties.

Our team at USA Customs Clearance is committed to helping you obtain the maximum Section 301 tariff refund. We’re experienced in the refund process directly, helping importers recover millions of dollars in previously paid Section 301 duties.

When you work with us to handle your tariff refund, we keep you updated throughout the entire process. You won’t have to worry about checking in or reaching out to CBP. We’ll even help you set up an ACH duty account with Customs if you don’t already have one. This ensures your refund gets to you as quickly as possible.

Schedule a consulting session with our team today, or call us directly at (855) 912-0406 to get your Section 301 tariff refund before it’s too late.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Copy URL to Clipboard

Copy URL to Clipboard

Hi,

We are an ebike company selling ebikes in the US. We need to apply for Section 301 Tarrif refund for the products imported from China to the US. Could you reply back how to work with you for the application? Thank you.