Whether it’s fine art, cars, or commodities, CBP applies strict regulations and assigns tariffs and duties on goods that enter the country. These costs can add up quickly. Here at USA Customs Clearance, we understand that taking extra precautions during the importing process allows for a seamless customs clearance procedure. In this article, we’ll take a look at how to reduce fees for high-value items with invaluable customs brokerage services.

Key Takeaways:

Let’s explore how customs brokerage services work to safeguard your high-value cargo from costly import expenses.

Customs brokers are your shipments' first line of defense from falling out of compliance and keeping supply chain operations running steadily. They can be a private individual or a group of freight experts who work on your behalf to get your cargo into the US safely and smoothly.

While customs brokerage services provide a plethora of benefits to shippers wanting a simple customs process, here are the most popular services a customs broker can assist you with.

1. Keeping Up to Date with CBP Rules and International Trade Regulations

The world of international trade is ever-changing with new regulations and rules. Customs brokers are obligated to keep track of these updates to equip you with the latest information for hassle-free customs clearance.

2. Consulting On Tariffs, Duties, and Other Customs Fees

Because they are keeping tabs on customs news, customs brokers are privy to the newest changes in tariffs and how they can affect your duties and other import expenses. They’ll be able to guide you to make informed decisions on your freight and get the most bang for your buck.

3. Preparing and Submitting Required Declarations and Documentation

From filing forms like Importer Security Filing (ISF) and certificates of origin to obtaining necessary licenses, customs brokers handle all the paperwork CBP requires to declare your goods and expedite the customs clearance process.

4. Solving Customs Disputes and Audits On Your Behalf

When hangups happen during the customs clearance procedure, like CBP placing a hold on your goods for inspection, customs brokers are on your side to clear up any issues that can stall shipments and rack up your import costs.

5. Securing Customs Bonds and Making Government Payments On Your Behalf

Customs bonds aren’t always required for high-value goods, but it’s required for goods worth $2,500 or more. Customs brokers assist you with obtaining the right customs bonds for your products that best protect high-value imported goods.

Keep in mind that customs brokers are not the same as freight forwarders, but certain companies provide both these indispensable services and more.

Related: How to Find a Customs Broker for Your Import/Export Business

CBP has complex regulations to follow, but that doesn’t mean you have to flounder. Partner with our customs brokers to make the customs clearance process easy.

We mentioned how customs bonds may be necessary for certain high-value goods, so let’s break down a few of those goods and how they affect your duty responsibilities.

Luxury Cars

Depending on the country of origin and if the cars are for personal use, the tariffs and duties on luxury goods like foreign automobiles can range sporadically, adding hefty fees to already expensive imports.

Commodities

Commodities like gold, silver, corn, or soybeans can fluctuate in price due to a dynamic market. The value of these goods can also ramp up fees to import them into the US.

Works of Art

CBP requires art pieces that are framed, intended for sale, and worth over $2,500 to submit a formal entry and an Automated Commercial Environment (ACE) manifest. This documentation is standard for high-value goods, but like other examples, it can be paired with duties and tariffs that increase your import fees.

It’s important to understand the total value of your goods for accurate import fees. You can find the value of your goods based on their HTS code.

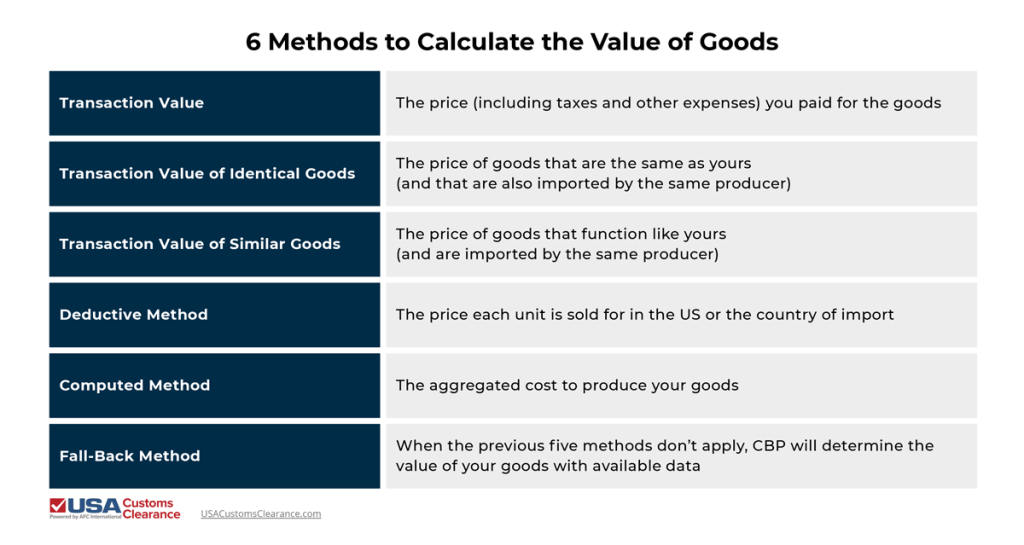

For example, if you’re importing a dozen wooden frames for paintings, the HTS code would be 4414. You can calculate the value of each frame using one of the six approved methods from the World Trade Organization (WTO):

The last two methods are rare but still handy if no other method accurately deduces the value of your goods.

Sticking with the previous example, let’s say you’ve calculated the value of each wooden frame as $200 per frame. This makes your customs value $2,400. Then you can add the specific tariffs and duties derived from the country you’re importing from, as well as the taxes assigned to the HTS code of your goods.

You can use our US Import Duty Calculator to learn what you’ll pay on your imports.

If you aren’t sure which HTS code your product falls under, use our simple HTS Code Lookup Tool.

Importing challenges aren’t always easy to avoid, especially if you’re shipping high-value items from specific countries. Here are three pitfalls that customs brokerage services help you navigate.

Importing has a lot of numbers to keep track of. Overpaying when you add them up can lead to additional costs or delays in your supply chain—or even CBP suspecting valuation fraud if you accidentally underpay.

Many high-value goods are also high-risk items, like agricultural commodities. CBP pays close attention to the labeling of these goods for consumer safety, and mislabeling them with the wrong HTS code may get your goods flagged at customs.

Changes to tariffs, trade agreements, and more affect the rules for certain imported goods. If you aren’t aware of these updates, you risk falling out of compliance and violating new regulations.

While CBP doesn’t require importers to use customs brokerage services, partnering with an expert customs broker spares you from these costly headaches during the customs clearance process and beyond.

When in doubt about how to reduce your tax burden and other import fees for your high-value goods, rely on customs brokers like USA Customs Clearance to see you through the customs clearance process successfully.

You can give us a call at (855) 912-0406 or book a consultation about our customs brokerage services here.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post