New importers eager to enter the world of international trade often commit fundamental errors that make the already complicated process of importing goods into the USA even more difficult. No matter what products or commodities you plan to import, there are some steps common to the process all importers should follow and expect to encounter when bringing shipments into the country from foreign trade partners.

Key Takeaways

Whether you’re based in the US or a foreign country, this guide will put you on the path to successfully importing goods into the USA.

Worried about the Strict Regulations? Ask Our Experts.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Far too often, new importers start their business endeavors by purchasing goods and expecting the shipment to simply arrive and process like any other transaction. This is how goods end up stuck in port while frustrated importers scramble to find out how to get the items they paid for.

Businesses registered in the United States will need to apply for an Employee Identification Number (EIN) from the Internal Revenue Service (IRS). You’ll need this unique identifier before registering as an importer. If your business isn’t registered in the US, there will be an extra step I’ll explain later on.

Foreign business owners without an SSN or EIN who wish to register as IORs may need to provide copies of their Articles of Incorporation during this process. Afterward, CBP will assign the business a Customs Assigned Importer Number (CAIN) for use on the IOR application.

CBP prescribes a $50,000 minimum for continuous customs bond coverage. The bond should be sufficient to cover 10% of your estimated duties, taxes, and fees over a 12-month period. You can base these estimates on proprietary historical data (if you have any), but new businesses usually base this estimate off projected sales over the course of a year instead.

By following the three steps listed above, you’ll be well prepared to begin the process of purchasing and importing goods from overseas. Before choosing a supplier, however, it’s worthwhile to learn with which countries and trade partners the US does the most business.

Related: How to Start an Import/Export Business

If you’ve decided to become an importer, you probably already have a good idea of what products you want to sell. That brings us to the next question: from which trade partners should you source your goods?

Some countries are better at producing certain types of commodities than others. For instance, China’s abundance of rare earths gives them an advantage in the manufacturing of electronics. To get an idea of where you should start looking, I’ve put together a list of the top US trade partners from October 2025, which is the most recent data available as of this writing.

These five countries alone represent over half of the total value of imported goods in October 48.52025.

No matter which country you choose, you’ll need to make shipping arrangements with your supplier to actually receive the goods. Before doing so, you’d be wise to familiarize yourself with the internationally recognized shipping terms that outline who is responsible for what in a given shipment.

Related: 11 Types of Incoterms

In importing, Incoterms® are used to define the division of responsibilities, risks, and costs between the buyer and seller on an imported shipment. For instance, the Delivery Duty Paid (DDP) Incoterm® places the vast majority of responsibility for shipping and customs clearance on the seller. Under DDP, the buyer’s responsibilities include purchasing and taking delivery of the shipment.

Other terms divide responsibilities more evenly, such as Delivery at Place (DAP), which is similar to DDP but places responsibility for customs clearance in the receiving country on the buyer. When you start shopping for goods or commodities to import, pay careful attention to the proposed Incoterm® of the transaction so you know exactly where your responsibilities and risks lie.

When you or your designated agent make shipping arrangements for your goods, you’ll be provided with a few pieces of important paperwork. Much of the information found on that paperwork will be used to fill out customs forms that will be necessary to clear and release your shipment once it reaches its port of destination in the US.

Let’s start with the documents associated with purchasing and shipping your imported goods.

Other documents, like the pro forma invoice, aren’t as important for informing your customs clearance paperwork. Speaking of which, there are some customs forms you’ll always have to submit regardless of what goods you’re importing.

There are other documents that are unique to certain modes of transportation and goods that are regulated by PGAs. The list below isn’t exhaustive, but contains some of the most commonly imported goods that require additional paperwork or information beyond the standard import documents.

Some of these goods, in addition to extra documentation, also require the importer to get a special license or permission from the relevant PGA prior to importation. This can add to your overall import costs, which I’ll now explain in greater detail.

The actual cost of your goods is just one part of the overall fees associated with an imported shipment. Costs don’t end at freight expenses either: an important part of your total landed costs will include customs fees, which include:

These fees must be paid within ten days of your shipment’s arrival.

It’s also important to remember that you’ll have to pay these fees based on your estimates or those provided by your customs broker: during an audit, CBP may determine that you’ve used the wrong Harmonized Tariff Schedule (HTS) code on one or more shipments, which could result in having to pay more in duties than you anticipated. This is another great reason to partner with a broker rather than trying to handle customs clearance on your own.

The United States HTS is based on the internationally recognized Harmonized System (HS) of commodity classification. It is an exhaustive list with codes for every conceivable good you could import, as well as codes that modify tariff and duty rates based on factors like country of origin.

Since HTS codes are used to determine the duties due to CBP for imported goods, getting the right code is crucial to avoid audits, fines, and other punitive actions. The complexity of the HTS and the rules used to interpret a product’s proper classification make it very difficult for those without customs brokerage experience to reliably get the right code on a consistent basis.

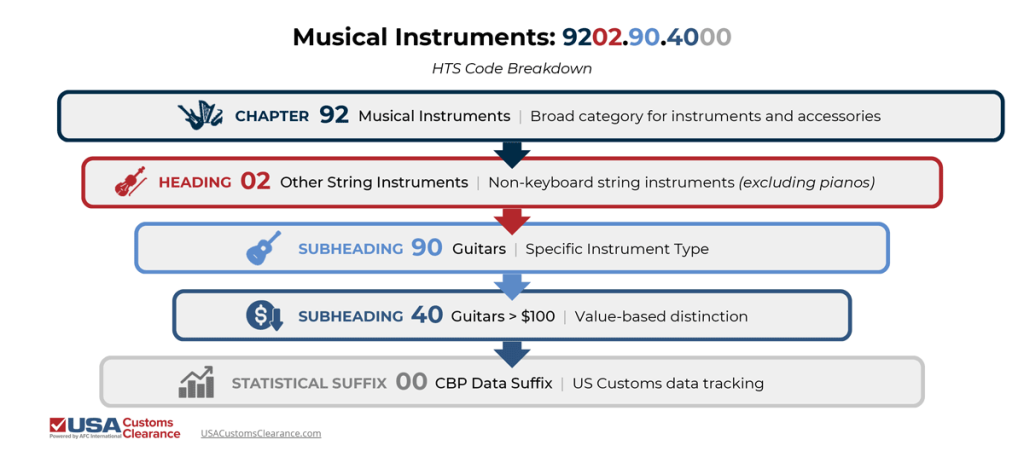

Knowing the anatomy of an HTS code can help you find the right ones for your imported goods. They can be broken down as follows: I’ll use the code for an electric guitar valued at over $100 as an example: 9202.90.4000.

Our USA Customs Clearance HTS lookup tool can also help you narrow down your selection, but working with a customs broker is the best way to ensure you use the right code, pay the correct amount of duties, and avoid delays due to inaccurate documentation.

Related: How Do I Find My HTS Code?

Assuming the information on your entry summary is correct and there are no delays from factors like CBP inspections or port congestion, your shipment could be cleared within about 48 to 72 hours of arrival. However, it’s not uncommon for goods to be released prior to clearance.

Once again, assuming nothing goes awry, successful submission of form 3461 will release your goods for delivery. Keep in mind there is a chance that, if you receive your goods prior to clearance, CBP may request that they be returned to port or brought to a specified site for inspection purposes. This occurrence is difficult to anticipate, and is less likely when working through a customs brokerage that already has an established relationship with CBP.

The time frames mentioned above reflect shipments received via ocean freight. Air cargo tends to clear even faster, and goods moving by truck will have their shipments cleared at border crossing.

Related: What Happens After Customs Clearance?

So, you’ve followed all the steps necessary, paid your customs fees, and your shipment is in your hands. Even with all that done, there’s a chance you’re not quite finished yet.

Since many customs fees are based on estimates which are themselves based on interpreting the HTS, smart import/export business owners conduct routine audits after the clearance and release processes. During this process, you may find that a simple error caused you to overpay or underpay duties. You might also decide to challenge a decision made by CBP regarding your shipment.

Depending on the mistakes made, the date of your shipment’s entry, and the time that has transpired since will give you some options:

Correcting paperwork is a time-consuming process that can tie up excess funds prior to correction, refunding, and liquidation. The best way to avoid the issues fixed by these processes is to avoid them in the first place by working with an experienced customs broker.

Shipping goods into the US from foreign trade partners requires attention to detail, compliance with CBP regulations, and knowledge of both customs clearance and freight shipping processes. By partnering with the Licensed Customs Brokers at USA Customs Clearance, you’ll be able to import with confidence knowing your goods will come into the country safely, legally, and without unnecessary delays.

Call us today at (855) 912-0406 or fill out a contact form online. We’re ready to help you easily import goods into the USA.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post