If you import goods for resale, you’ve probably heard the old adage, “Buy low, sell high”. However, goods that are priced far below market value can actually hurt the American economy. To combat this issue, the U.S. government may apply anti dumping duties to those goods.

Key Takeaways

Continue reading to find out more about anti dumping duties and how to avoid them.

Dumping occurs when a foreign entity attempts to sell goods in the U.S. at a price far below their normal market value.

Dumping goods is considered a malicious business tactic. While it may seem unwise to sell products overseas at little to no profit, doing so strategically can cause competing U.S. suppliers to suffer huge sales losses and go out of business.

By taking a temporary loss, the foreign business can dictate the supply, quality, and price of the product going forward. Obviously, this is not ideal for consumers or the U.S. job market.

In order to discourage and frustrate the efforts of dumpers, the U.S. government investigates suspected incidences of the practice and, when found necessary, levies anti-dumping duties.

An anti dumping duty is a tariff imposed by a domestic government in order to enforce fair competition in a free market economy. The duty is assessed by U.S. government agencies against producers of certain commodities when there’s sufficient reason to suspect dumping is occurring. Anti-dumping duties are intended to protect domestic producers from unfair business practices employed by some overseas businesses.

A similar tariff, called a countervailing duty, may be assessed if there’s reason to believe a foreign government is subsidizing production costs for a business. We examine these in detail in our article “How to Calculate Countervailing Duty”.

There are three U.S. government agencies that play key roles in investigating potential cases of dumping, levying ADDs, and enforcing them.

There is a fourth agency involved in anti-dumping duties, but they operate on an international level: The World Trade Organization (WTO). This organization doesn’t determine anti-dumping duty rates or enforce their application. Rather, their role has more to do with investigating whether an ADD order is valid in the first place.

Learn more about how these duties are calculated in our article “Anti Dumping Duty Rates: The Price of Fair Trade”.

The best way to avoid an ADD is fairly simple: don’t import goods under an anti-dumping order. So, how can you find out if the products you want to import are subject to an ADD?

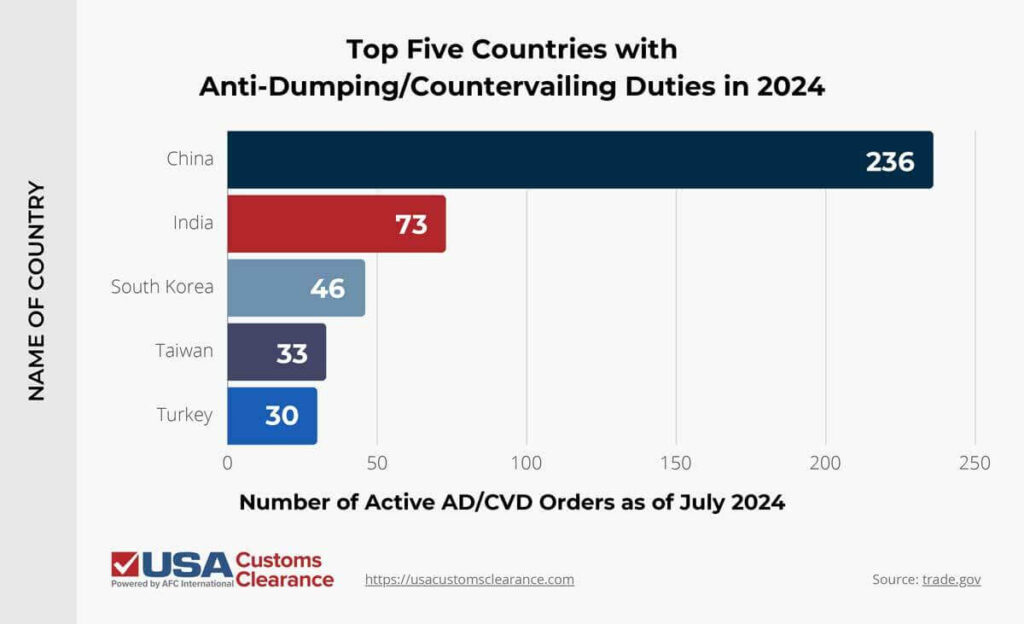

One of the first things you should do is take a look at the International Trade Administration’s (ITA) list of active AD/CVD orders. To help illustrate where most of these orders have been levied, I’ve compiled the five countries with the most AD/CVD orders from the U.S. in the table below.

You probably noticed that China has more active orders than the other four countries combined. This is due to Section 301 tariffs enacted during the Trump administration and expanded upon by President Biden. If you plan to import anything from China, be sure to check the Section 301 trade action lists. There’s an above-average chance your products will incur additional duty rates.

If you plan to re-export or destroy/dispose of the goods in question, you may be able to avoid anti-dumping duties after the fact by filing for a customs duty drawback. This is essentially a refund of duties and taxes paid on qualifying imported shipments.

For those who aren’t familiar with the intricacies of government documentation practices, the most surefire way to identify and avoid anti-dumping duties is by consulting with a licensed U.S. customs broker. Brokers are, by necessity, up-to-date with all the latest anti-dumping duties, and they can put that knowledge to work for you.

Related: Track the Section 301 Tariff Exclusions List

For purposes of clarification, avoiding ADDs using the methods discussed above is perfectly legal. What’s never legal is using deceptive practices to make it seem like a shipment subject to increased duties actually isn’t.

Tactics such as citing the wrong country of origin or using an incorrect HTS code to circumvent anti-dumping duties will almost certainly be discovered by CBP agents when your shipment arrives. This can lead to hefty fines, seizure of your goods, and higher scrutiny on any future shipments you bring into the U.S.

Related: Customs Penalties and Fines: Know Before You Ship

Not sure if your imported goods are subject to additional duties and tariffs?

Our One-on-One Licensed Expert Consultants Will Personally Guide You.

Finding out whether goods will be subject to anti-dumping duties isn’t always easy, and inexperienced importers can easily find themselves owing extra fees at the border that eat into their profits. This is one of many reasons why it makes sense to partner with a U.S. customs expert. That’s where we come in.

USA Customs Clearance has fully licensed customs brokers who can consult with you over the phone via 45-minute sessions so that you can learn the ins and outs of the process and determine if your goods are subject to additional duties. We can even provide full brokerage services, leaving you free to focus on your business while we handle documentation and processing of your shipment.

Our other customs services include:

Give the import experts at USA Customs Clearance a call at (855) 912-0406 or submit a contact form online to find out exactly how we can bring your business to the next level.

Copy URL to Clipboard

Copy URL to Clipboard

We are contemplating either manufacturing TriChlor Chlorine Pool tablets in the USA or manufacturing overseas (probably China). In either case, the raw material is Trichloro-s-triazinetrione. My question is what the duty (possibly anti-dumping duty) is bringing in the finished product in tablet form or alternatively, what the duty is if I brought in the raw material to manufacture in the US. I also heard that you if you have the required EPA certificate for the tablet and a US citizen manufacture overseas they are not subject to anti-dumping duties. Please feel to email me or call me at 415-246-4545 to discuss further.

Thank you for your time.