Importing candy into the United States isn’t just a sweet idea, it’s big business. Global sales for candy and sweets add up to nearly $140 billion each year, with many of the top candy brands coming from international sources. Having worked with some big candy brands, our team of experts can help you unwrap the secrets to the sweet taste of successful importing!

Key Takeaways:

Find out what regulations and agencies you’ll need to work with as a candy importer, and how to best manage the various steps of the import process.

The first step is finding a supplier. You can choose to purchase from a wholesaler that can provide a wide variety, or you can try to purchase directly from a manufacturer.

However, candy and related confectionary items such as chocolates are considered food. When buying from a wholesaler, you need to make sure they are sourcing from facilities that meet Food and Drug Administration (FDA) requirements. The same holds true when working with a manufacturer directly.

Foreign candy manufactures and wholesalers must register with the FDA before their products can be admitted to the U.S. domestic market. This includes the following businesses:

Confirming that a company’s registration status with the FDA is in place and up-to-date saves time and hassle. Be aware that businesses need to renew their registration every other year to remain compliant.

Related: Importing Vanilla Beans to the U.S.: Everything You Need to Know

The current drive to ensure high quality food imports stems from the Public Health Security and Bioterrorism Preparedness and Response Act of 2002. Its sections relating directly to imports focus on:

For candy importers, it means that their goods are more likely to be flagged for inspection when entering the country. To help minimize potential disruptions, the FDA requires importers to file Prior Notice before consumable goods enter the country.

This is done in one of two ways:

CBP will not release shipments of candy or chocolate without proof of Prior Notice. The filing number must be submitted to the CBP along with other entry documents, including:

The ingredients used in your imported products will determine if additional documentation and inspection is required. Most often, these are connected to ingredients overseen by the U.S. Department of Agriculture (USDA). They might require health certificates, permits, and other special certifications from the county of origin.

Working with a licensed customs broker can help ensure you have all the proper documentation.

Of course, the number one factor most importers want to know is cost. What will your products cost to bring in and is it worth it?

For starters, yes, there is an import duty on most sugar confectionary and chocolate products. The exact calculation depends on the following factors:

On the bright side, candy is not on the list of items that the Internal Revenue Service (IRS) charges excise taxes on. Although, it does impose one on sugary drinks based on total grams of sugar per 12 ounces.

Trying to interpret the HTSUS without professional assistance is particularly challenging when importing candy. See, products aren’t coded by name. There’s no code specific to Ritter Sport chocolates from Germany or Turkish Delight from Great Britain. Instead, it’s determined based on an individual candy’s ingredient make up.

The average HTS search for sugar confectionary codes is going to turn up many things that fall in the ‘other’ category (of which there are more than one, of course). For now, I’m just going to review the basics with you.

The four digit base HS code for sugar confectionaries is 1704, but specific tariff rates are only given once codes reach the 8 to 10 digit phase.

Some classifications don’t carry any tariff rate, which means they won’t cost you anything to import as far as duties are concerned.

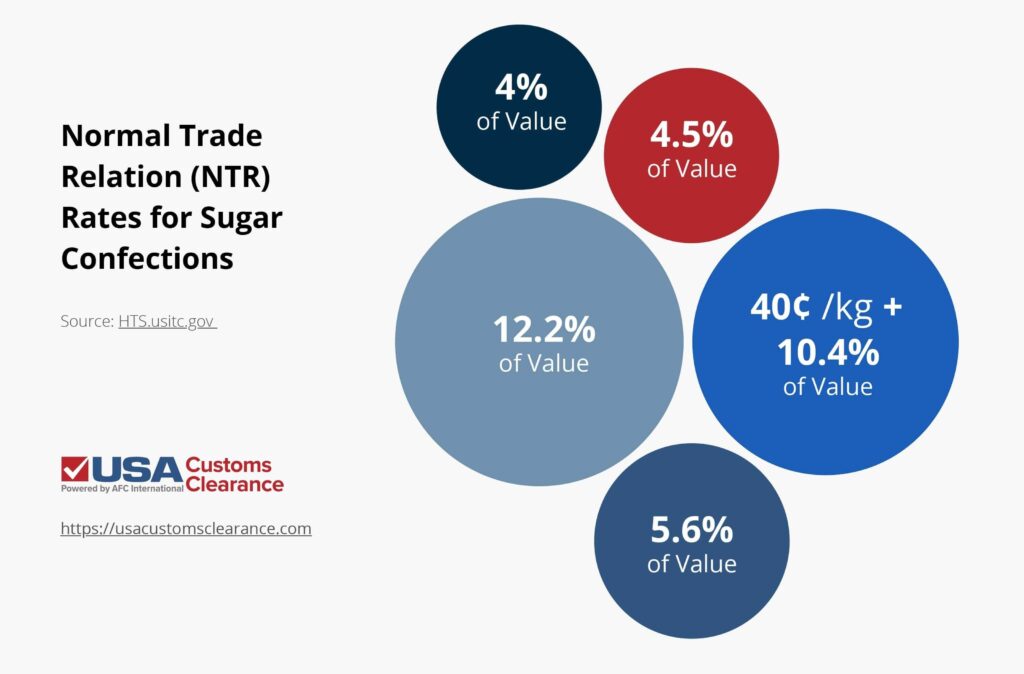

Of the classifications that do have duties, the amount varies.

If you are importing from a country that has a Free Trade Agreement (FTA) or enjoys a Preferential Trade Arrangement (PTA), those duty rates go down.

FTA or PTA are currently in place with following countries or organizations:

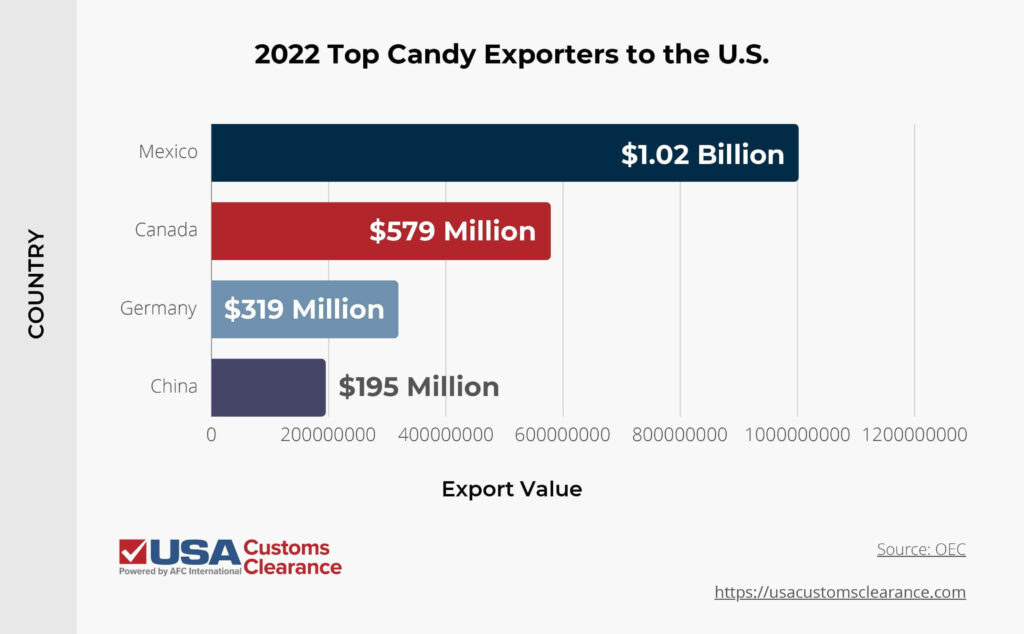

For importers looking to find an easy entry into the market, Mexico and Canada are currently the top exporters to the U.S. for this classification. Even better, they are part of the USMCA, so most products enter duty-free.

Whether you are able to get duty-free status or not, a customs bond is the final step to calculating your import costs.

CBP requires that you use a customs bond when importing goods subject to regulations from any federal agency (in this case the FDA) or when the shipment is valued at more than $2,500. Because candy imports fall under FDA regulations, this means candy importers will need one.

There are two general kinds of customs bonds: Continuous bonds and single entry bonds. The one you select likely depends on how often you plan to import candy or food products into the U.S.

As mentioned, the HS classification for many candies is ‘sugar confectionary’ although at times the word order changes. Here’s the issue: it can’t be used with any candy containing cocoa solids.

Cocoa, of course, is the main ingredient in making chocolate, candy or otherwise. The only exception is white chocolate. Confused? Well, it’s because white chocolate doesn’t actually contain any cocoa solids, it’s made from cocoa butter. A technicality, but one that importers need to be aware of.

How does that affect candy importers? It means that any products containing cocoa fall under a different HTS classification code. The four digit base HS code for chocolate and other items containing cocoa is 1806.

Like with other candies, chocolate imports are regulated by the FDA and occasionally the USDA. This means they follow the same import rules we’ve already outlined, including the need to file Prior Notice. The FDA identifies chocolate and chocolate products in several categories or types, including:

Recall, despite white chocolate being on that list, it does not qualify for the 1806 HTS code classification.

When you go to classify your chocolate candy imports, you’ll run into similar issues with the HS code descriptions. Aside from value and quantity, classifications also depend on the following factors:

Each type of chocolate has FDA requirements regarding its formulation. These rules include guidelines on sugar and milk content and other ingredients added to the chocolate. Again, despite the named chocolate categories used by the FDA and CFR, only the ingredient makeup is relevant to import classification.

It should also be noted that 1806 HTS code does not include chocolate drink items, only solids.

As an alternative to importing finished chocolate products, many companies import cocoa beans and then process them into chocolate once they arrive.

Related: How to Import Cocoa Beans

Talk to a Licensed Customs Broker at USA Customs Clearance.

We'll answer your questions and walk you through the entire process.

Chocolate liquor is a food ingredient containing cocoa solids and cocoa butter, but without additional sugar or flavors. This shouldn’t be confused with the popular spirit, chocolate liqueur.

The import rules here can get pretty convoluted, so for the sake of simplicity, I’m going to focus on non beverage candy and chocolate products that contain alcohol/ethanol.

Related: How to Import Alcohol

As far as non-chocolate candy is concerned, the vast majority of ‘cocktail’ candies available, such as the ever popular ‘wine gums’ from various producers in Europe, are non-alcoholic. It may taste like port or sherry — but there is no alcohol, and thus they are safe for kids and adults.

The same goes for various jelly bean and taffy products that come in flavors like ‘Pina Colada’ or are said to be infused with various champagnes. There is still no alcohol content, so special considerations during import aren’t needed (although you may turn a few heads during inspection).

Chocolate candy containing alcohol, on the other hand, is quite popular and does call for additional documentation. Aside from the previously mentioned agencies, you’ll be dealing with the Alcohol and Tobacco Tax and Trade Bureau (TTB).

To qualify as a non beverage food product, candies or chocolates with an alcoholic filling must meet these standards:

Provided it meets those standards, importers will fill out a TTB Form 5154.1 to accompany their other import documents. Here you’ll have to provide information on details such as:

It is important to note that the IRS charges excise tax on imported alcohol, but by completing this form you can qualify for duty drawback. However, realize that a legal import is not the same as domestic distribution permission. Make sure you check local and state laws regarding the sale and distribution of alcoholic candies.

No advice on importing would be complete if we didn’t talk about the items that you just can’t bring in. There are the obvious culprits, such as candies from embargoed countries, but others have been banned due to various safety concerns. Others are not banned, but pressure from domestic companies has made imports of foreign competitors extremely difficult.

Here are some of the most common:

These are the two more famous cases of banned candies, mostly because of their popularity in other parts of the world.

However, importers should also be aware of countries that have been flagged in recent years for producing candies found to have unsafe levels of lead and other toxins.

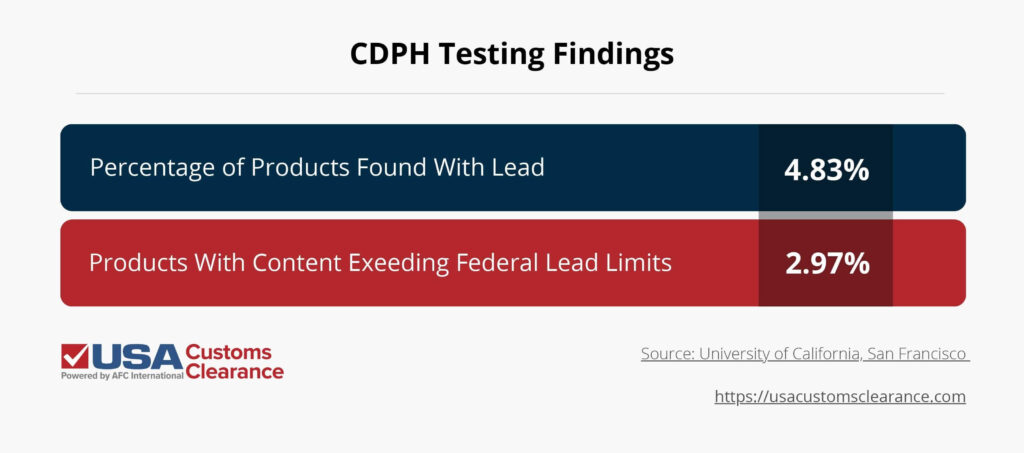

If you’re planning on importing and distributing within the state of California, it gets even more specific. Since 2006, the California Department of Public Health (CDPH) has mandated state testing on all imported candies.

Some of their findings have been scary. Between 2001 and 2014, 32% of all food contamination reports issued by the CDPH were for lead in imported candy. An additional study looked at data specifically from 2011 to 2012.

The biggest culprits when you break down the imports by country are:

Exposure to lead is known to cause developmental delays, learning difficulties, neurological problems, seizures, and more. To make sure your imported candy is safe, only purchase candy from reputable distributors and wholesalers. Follow all state regulations regarding candy imports, including testing when necessary.

If you have traveled abroad and fallen in love with a foreign sweet treat, you might want to bring some back with you. Individuals seeking to enter candy into the U.S. for their own use have different rules to follow than those seeking to import candy for resale.

According to CBP, failure to declare candy and other food products when bringing them into the U.S. can result in fines of up to $10,000.

Customs brokers work in the best interest of their clients to ensure the import process goes smoothly. In the long run, this is likely to save you both time and money.

They can provide many services, including:

AT USA Customs Clearance, the broker is there to work for you and make sure the import process is smooth and hassle-free.

Talk to a Licensed Customs Broker at USA Customs Clearance.

We'll answer your questions and walk you through the entire process.

Working with USA Customs Clearance can make importing candy simple and easy. With a team of licensed customs brokers available, you’ll get help navigating the candy import process and customs clearance needs.

Benefit from a range of available services:

Are you ready to get started or need more information? Call us today at (855) 912-0406 or contact us online with a direct question. We’ll get you the right help to make life just a little bit sweeter.

Copy URL to Clipboard

Copy URL to Clipboard

I’M very small importer. I’m planning to import Chocolates from Turkey to USA. I would like to use air cargo.

Do I need customs broker service? Please help.

Hi, I want to bring Choclate from Lebanon around 200 kilo do I need a custom agent .

HI, my name is Raymond, I was looking into starting an Ecommerce business In Florida USA. I wanted to import American made candy that follows The EU regulations (no red dye 40 etc.) I was also thinking about importing American cereal n any other American products that's made under EU regulations. Is this something that you can help me with? I found this company that ships to the USA, Candy Hero Ltd. There're many others also, I just need to know laws n regulations. I'm register as a wholesale/retail company.

Dear Sir/Madam,

We are a new CN manufacture for candy with toy product. We noted the FDA and customs notice are required. I have a question. What about the label, outer carton requirement during import from China to USA. Thanks in advance.

I'M very small importer. I'm planning to import Chocolate bars from India to USA. I would like to use air cargo.

Do I need customs broker service? Please help.

Dear Madame: We are opening a Chocokate shoppe, and small snack bar. We are French and A.erican a dcwould like yo import Chocokate Belg, French, Irish chocolates, as we have wholesalers. can we obtain customs permits plus chocolate liguers

Deborah

Thank you for reaching out. One of our import sepcialists will be in touch to answer your questions.