Importing from Canada to the U.S. might seem like a straightforward task, given our close ties and extensive trade relationship. However, it's not always a walk in the park. The maze of U.S. customs regulations can trip up even seasoned importers. Before you attempt to import goods from Canada into the U.S., it’s important to know what hurdles to expect and where to look for guidance.

Key takeaways:

Join us as we review the basics of importing from Canada, choosing commodities, and what fees you can expect.

Trade between Canada and the U.S. has been fruitful for decades, marking a relationship built on trust, quality, and mutual benefit.

There are numerous advantages to importing goods from our northern trading partner, such as:

With that being said, the rewards of successful importing hinge on your ability to navigate the often-complex process. This means clear, compliant importing practices are essential. Let's explore further.

Don't let customs clearance hold you back. Our team of experts is ready to guide you through the process of clearing your Canadian imports.

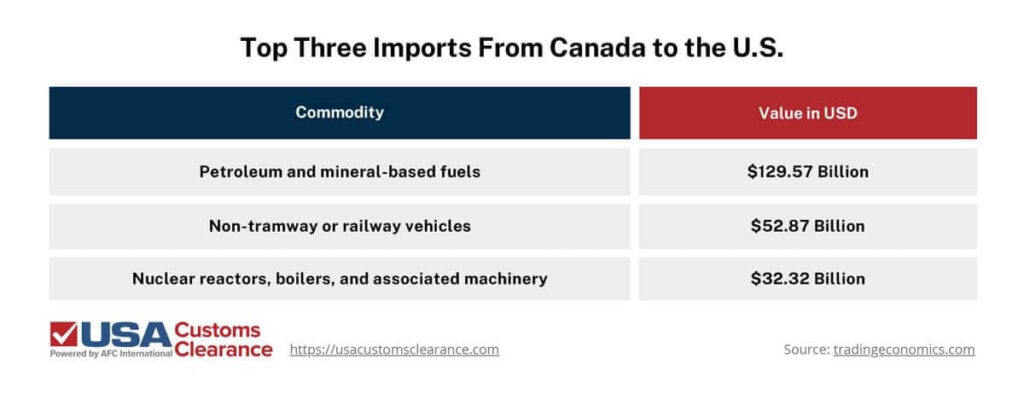

Canada offers a smorgasbord of products that appeal to the American market. So many that in 2024, Canada exported over $434 billion worth of commodities into the United States. The lion’s share of that price tag belongs to the following goods.

In addition to these highly sought-after goods, Canada also supplies the U.S. with almost any other commodity you can think of, including:

Basically, Canada’s available exports are vast and varied. If you’re an aspiring business owner in the U.S. importing from Canada, choosing what you want to bring into the states is a matter of researching customer demands and choosing merchandise with which you have experience.

Related: Importing Potash to the United States

Importing goods from Canada into the U.S. might seem daunting initially, but with a well-laid-out roadmap, you can navigate through the process confidently.

To help ensure a smooth import journey, start by following the import requirements listed below.

If you’re concerned about errors in the aforementioned process, working with a customs broker can save you a world of stress. Their expertise ensures you're always in compliance with changing regulations.

U.S. customs and regulations can be complex, even when your goods come from a relatively close supplier like Canada. Understanding these rules is crucial to ensure your imports get across the Canadian border without any problems, especially if your goods could qualify for USMCA preferential duty rates.

The following list contains the standard regulations from CBP governing the import process.

A clear understanding of these regulations and close adherence to CBP guidelines will ensure your importing process remains hassle-free.

There is no flat percentage that can be used to easily calculate all import duties from Canada to the U.S. Instead, you should focus on the HTS codes used to determine individual product duties and taxes.

These can be expressed as a percentage of the product’s value (ad valorem) or a set cost per weight/measure.

There are some imports from Canada that are subject to increased rates, such as softwood lumber. Certain varieties of this product are subject to anti-dumping and countervailing duties (AD/CVDs) which currently sit at about 14% ad valorem in addition to the duty assigned by the HTS code.

Related: Antidumping and Countervailing Duties: Balancing World Trade

A flat rate for non-USMCA items was recently put into effect, which we will get into in the next sections.

On August 1st, the U.S. raised the tariff on Canadian goods from 25% to 35%. Imports of Canadian energy products and potash are still at 10%.

Fortunately, the United States-Mexico-Canada Agreement (USMCA) free trade agreement is still in effect. This means if your Canadian imports meet the USMCA’s rules of origin, you’ll be able to avoid these tariffs.

However, some commodities with Section 232 tariffs levied against them are ineligible for duty-free treatment, even if they meet USMCA’s rules of origin. For example, aluminum, steel, and copper receive a 50% tariff that were invoked by Section 232.

The term ‘duty limits’ can show up as you research the import process. For those new to importing and unfamiliar with the term, it may seem to imply a maximum duty amount per transaction. This is not the case.

Duty limits on imports from Canada to the U.S. are only applicable to items intended for personal use, such as alcohol purchased at duty-free shops. Generally, the limit is $800, at which point even personal use items will incur duties. Duty limits do not apply to importers intending to re-sell merchandise from Canada.

Strictly speaking, you don’t have to hire a customs broker to import shipments from Canada into the United States. You don’t have to hire a Sherpa to scale Mount Everest, either. However, expert guidance will give you a greater chance of success in either venture.

Customs brokers facilitate a smooth and problem-free import process by:

There are several other benefits of working with a customs broker. No matter what commodities you mean to bring into the country, a broker can be the difference between a seamless transaction and delays from CBP detention and inspection.

The possibilities of profit when importing from Canada are enticing, and with the right broker by your side, you can take advantage of these opportunities.

At USA Customs Clearance, we have years of experience with CBP as well as the Canada Border Services Agency (CBSA). Our team of experts can ensure that your merchandise crosses the border without incurring fines and penalties resulting from inaccurate paperwork and filing.

Look to us for:

Call our knowledgeable team of customs brokers at (855) 912-0406 or contact us through the site today. We’re here to take the guesswork out of getting your shipment from Canada to the United States.

Copy URL to Clipboard

Copy URL to Clipboard

i would be interested in hiring a broker to import some equipment i purchased at ritchie bros auction