Incense sticks have been widely used since ancient times and remain popular throughout the world. For importers, the intended use of incense will play the largest role in determining what regulations may apply when entering the country.

Key Takeaways:

We’ll narrow down potential regulations and provide you with an overview of everything you’ll need to successfully import incense sticks to the U.S.

Work With Experts. Get the Process Right From the Start.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Incense sticks are commonly made up of different aromatic materials that give off a fragrance when burned. Incense can come in different forms, including as powder, rolled into coils, or molded into cones.

Most types are made with plant-based materials and combined with wood or another combustible material to ensure they can ignite. Common ingredients include:

Incense is meant to be fragrant, and many people use it for just that purpose. As an import, incense has more in common with perfumes in that sense. Its four-digit HTS classification code, 3307, places it among products like personal deodorants and other perfumery.

Aside from their form, incense can also be classified by how it’s ignited.

Because of the potential for combustion, incense sticks that are direct-burning meet the specifications of a class 4 fire hazard as defined by the UN Recommendations on the Transport of Dangerous Goods.

Granted, the odds of your incense imports spontaneously combusting are low. However, you should pay attention to how it’s packed for shipping and what other items it may be shipped with.

Related: Importing Perfume to USA

There are no specific regulations or agencies you need to report to when importing most incense. As far as products go, it’s fairly harmless. Provided that you follow proper entry procedures and have all the documents required by Customs and Border Protection (CBP), you should be good to go.

This includes having the following:

Since incense sticks are not overtly regulated by a Partner Government Agency (PGA), you’ll only need to secure a customs bond if the total value of the import is greater than $2,500. On the flip side, if the shipment is less than $800, the goods qualify for duty-free entry under the current Section 321 de minimis laws.

Related: Section 321 Shipments

The only potential exceptions would be if you are importing incense products that fall under the following intended uses:

In such cases, the product may end up classified as a drug or medical device. If that becomes the case, your incense may become subject to Food and Drug Administration (FDA) regulations. Even in such cases, it’s more likely to affect your domestic market distribution plans rather than the import process.

Related: The Guide to FDA Customs Clearance

When planning distribution, the other agency to consider is the Consumer Product Safety Commission (CPSC). Should your incense be found to release certain toxic emissions or have ingredients that have been banned from entry, there will likely be an investigation into your import process and suppliers.

Don't Hold Off Your Questions. Ask Our Experts.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Incense, whether in the form of a stick or molded into another shape, falls under the HTS code 3307.41.00.

Products in this category are measured in terms of weight rather than quantity and carry a dutiable rate of about 2.4%. For an accurate accounting, make sure that gets calculated by kilograms, not pounds.

Of course, if your incense comes from a country with a Free Trade Agreement (FTA) or one claiming some kind of preferential duty status, that rate may go down.

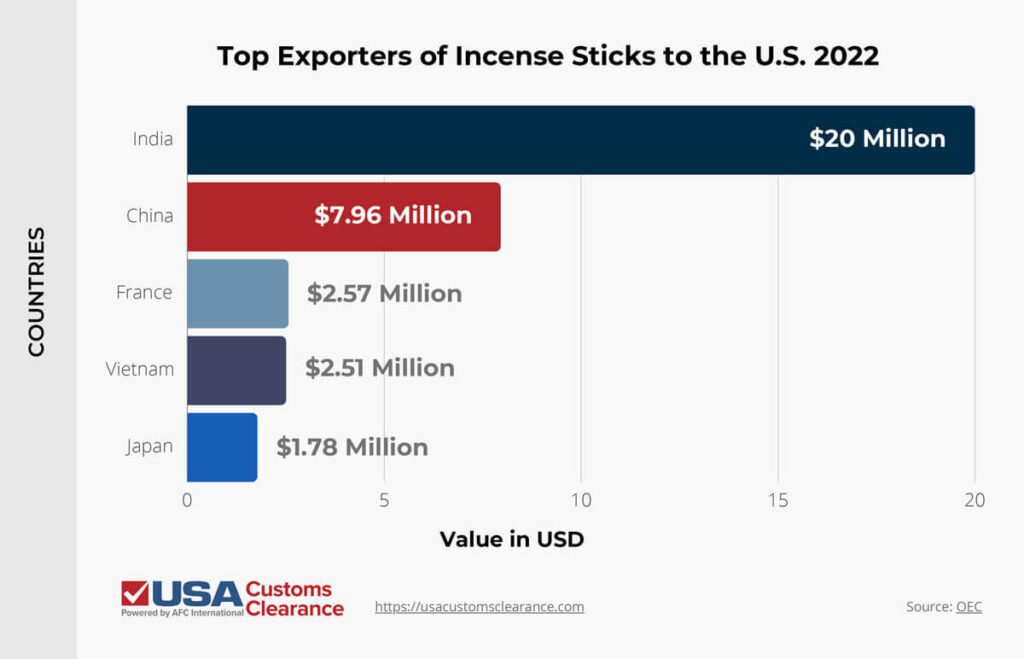

Incense in varying forms is most popular in Asia and the Middle East. In modern times, China and India dominate the global incense export market.

The U.S. primarily imports from India. In fact, the HTS classification for incense sticks defines them as agarbatti specifically, which is Hindi for ‘incense stick’. This is followed by its official description as ‘odorifers operated by burning’.

India produces millions of dollars worth of incense annually, and in 2022, exported $20 million worth to the U.S., making up over 50% of the incoming supply.

To find potential suppliers within these nations, consider checking online supplier databases like Alibaba and others. Some databases are regional, so be sure to consider that in your search.

If you are looking to source from less common suppliers or have a nose for rare ingredients, it’s a good idea to become familiar with the various ways incense is referred to. We’ve already covered the Hindi term, agarbatti, but there are a few others.

If you do source from Japan, expect to see significantly higher prices than average. The country takes great pride in various premium incense producers, some of which have been around for centuries. France is another nation known for its premium quality incense, which commands a higher price.

These are things to consider when planning your marketing strategy down the road. You can still profit greatly from premium imports provided you are targeting the right audience.

As more consumers explore the benefits of incense and incorporate their use into their everyday lives, the global market works to keep pace. Religious ceremonies make up a large sector of the market for incense sticks, as do cultural celebrations and the marking of significant life events.

Other popular uses for incense sticks in the U.S. include:

The intended use may dictate what incense types you select. As mentioned earlier, it will also play a factor in determining what regulations you may need to adhere to.

Deciding to work with a customs broker means you gain an expert to get your imports into the country. Despite the relative ease surrounding incense imports, keeping up with even standard rules and regulations is challenging if you’ve never been through the process before.

The benefits of choosing a licensed customs broker include:

Their goal is to make importing goods to the U.S. a seamless process from point of origin to port of entry.

When it comes to importing incense sticks, we’ll work to keep the process simple and uncomplicated. The team at USA Customs Clearance is ready to put their expertise to work and find the right import solution for you.

We offer a full range of brokerage services, including:

Contact us today for one-on-one assistance from our team of experts to answer pertinent importing questions. Call us at (855) 912-0406 to speak with someone, or complete a direct contact form online.

Copy URL to Clipboard

Copy URL to Clipboard

Google is changing how it surfaces content. Prioritize our high-quality guides and industry-leading coverage in search results by setting usacustomsclearance.com as a preferred source.

i am from

hidaya expo

i am manufacture wooden incense stand

hidaya expo

5-62 misran street saharanpur (up)

india

my watsp 0091 9897645648