When it comes to importing textiles to the U.S., it takes time and effort to ensure that you have the necessary legal precautions and provisions in place. There are laws and trade barriers that need to be accounted for to avoid heavy fines.

Key Takeaways:

Below, we provide a comprehensive review of what it takes to import textiles into the United States. We cover various regulations and what steps you should take to fully comply with them.

Worried about the Strict Regulations? Ask Our Experts.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

The most basic regulations are enforced by Customs and Border Protection (CBP), the main agency monitoring imports. CBP’s other responsibilities include enforcing the regulations imposed on products from Partner Government Agencies (PGAs).

PGAs most heavily involved in regulations guiding textile imports include the:

To import textiles successfully, whether as a finished product or to be used in domestic manufacturing, you’ll need to carefully review which agencies your imports will be regulated by.

No matter what kind of textiles you plan on importing, the rules set by the FTC are the first ones you should focus on. FTC agents are primarily responsible for verifying product labels and intellectual property (IP) compliance. They currently maintain eight different help guides to ensure importers get labels right.

Proper labels start with correct identification of materials. The most common of which are:

Please note that animal derived leather is not considered a textile, even if it is used to make apparel. The exceptions are synthetic or vegan leathers that are plastic or plant based.

Guides available from the International Trade Administration (ITA) cover everything from sizing to materials and should be followed very closely.

Besides material, importers should also make sure they have the following information:

In cases where the origin must be established for mixed products, such as items manufactured in France from textiles made in China, the distinction needs to be made clear.

As far as IP laws go, violations such as counterfeiting of any kind, will result in product seizure and destruction.

In fact, the Department of Homeland Security (DHS), is now assisting by outlining new programs to detect and punish illegal trade practices of the textile industry.

The DHS will be looking more closely to ensure textiles comply with the following:

Importers can benefit from these by working closely with countries that are participating in Free Trade Agreements (FTAs) with the United States.

Related: U.S. Free Trade Agreements

Several nations with the Western Hemisphere have become prime sources for textiles of all kinds.

Many factories in these countries have been inspected by a Textile Production Verification Team (TPTV) making them trustworthy sources.

For more information on labels specific to clothing and apparel, check out our article, 5 Rules for Successfully Importing Clothes to the US.

Importers of organic textiles will want to get their raw materials cleared by the USDA. While this agency doesn’t perform its own inspections of finished textiles claiming to be organic, it will look into the raw source materials.

As of March 19, 2024, they also require items with such claims be accompanied by a National Organic Program (NOP) Import Certificate.

Such certificates are issued by the USDA’s INTEGRITY database, which foreign and domestic-based based importers must specifically request from an accredited certifier.

Importers should also look into the standards upheld by two common international organic systems:

Having your imports accompanied by certification from either organization will help you comply not only with USDA organic standards, but also with FTC labeling requirements.

Since most textiles are wearables, the CPSC’s focus has mainly to do with meeting certain flammability requirements. This is especially true of children’s clothing products, although all textiles should indicate flammability warnings as appropriate.

Textile products used in the manufacture of personal protective equipment (PPE) are also reviewed for effectiveness.

Certain textile materials are exempt from CPSC testing requirements. Exemptions are determined by fabric surface type, fiber types, and fabric weight. Plain surface fabrics (like jersey cotton or oxford) that weigh 2.6 oz per sq. yard or more are exempt. Certain individual fabrics, regardless of surface finish also count:

Combinations of these materials are also exempt. Also, it’s not that these items aren’t flammable (they are), but that results of testing over the years have been consistent enough to become standardized and accepted.

While the CPSC is more likely to focus on finished textile products when inspecting imports, it’s still important to have the standards in mind. They will come in handy later after domestic production when the needed labels are applied.

Related: CPSC Customs Hold

Finally, there is the EPA, which will check for toxic substances and pesticides that have been used in the dying, printing, or coating of textiles. Aside from the FTC, the EPA is the other agency most likely to interfere with the import process of certain textiles.

Textiles, among other imports, need to comply with the EPA’s Chemical Data Reporting (CDR) rule.

The rule came about as part of the Toxic Substances Control Act (TSCA). It requires importers to provide a list of all the chemicals that may have been used in the production of incoming products.

When importing textiles that could be used in the manufacture of PPE or similar final products, such as certain non-woven textiles, such a list is critical. Other fabrics and textiles may also need to provide information for the CDR.

The easiest way to determine the necessity of EPA documents, or that of any other agency, is to consult with a licensed customs broker. They can guide you through the process and even complete certain tasks on your behalf.

Worried about the Strict Regulations? Ask Our Experts.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Import duties are taxes that are claimed on any of the imports making their way into the country. In the case of the U.S., the CBP collects the import duty. Also known as a customs duty or import tariff, this is a cost that anyone importing textiles into the U.S. needs to be aware of and account for.

Import duty is typically calculated based on a percentage of the value of the product, rather than a flat fee. You’ll only know for sure once your product is correctly classified according to the Harmonized Tariff Schedule of the United States (HTSUS or HTS).

The assigned HTS code will take into account specific details of the product, such as:

Most textiles, across multiple industry applications, are assigned duties ranging from 0 to 25% of value. Those rates apply when importing from a nation that does not have an FTA with the U.S.

However, if you are importing textile products from China, it’s critically important to check whether their HTS codes fall under the Section 301 tariff hikes. Several consumer products, including various types of clothing, were included in Lists 3 and 4A of applied tariffs.

If they are, expect to pay an additional 25% tariff on top of the normal trade relation rate I already mentioned. Just in tariffs, you could be paying up to 50% of the value of the product just to get it into the country.

Related: A Guide to China’s Section 301 Tariffs

Being surprised with additional import duties isn’t a pleasant experience. Thankfully, working with a Licensed Customs Broker can alleviate this issue.

Before importing, our brokers can help you classify your textiles with the proper HTS code. We can even obtain a tariff classification ruling for the CBP if necessary. Doing this will give you a clear answer as to what your import duties will be.

Looking for a quick estimate while browsing products? Check out our Import Duty Calculator to see what duties you might need to pay.

As a result of the tariffs announced on April 2nd, 2025, over 180 nations will either be subject to a 10% tariff or a higher country specific tariff. Many of the nations the U.S. imports textiles from would have been subject to the country specific tariffs.

Fortunately, the U.S. decided to put a 90-day pause on reciprocal tariffs. All countries, except for China, will now be subject to a flat 10% tariff. This means you’ll be able to import textiles from a variety of countries like Vietnam, India, and Bangladesh without incurring the extremely high tariffs that were supposed to take effect.

If your textiles meet the United States-Mexico-Canada Agreement (USMCA) rules of origin, you’ll be able to import them from Mexico or Canada at a preferential duty rate. Sourcing your textiles from either of these countries is a good way to circumvent tariffs altogether.

At USA Customs Clearance, we strive to keep you updated about changes in the international trade environment. That said, changes often occur quickly. If you want the most recent information, schedule a consulting session with one of our Licensed Customs Brokers or call our team at (855) 912-0406.

For several years, textile and clothing manufacturers in Asia, particularly China, were the dominant suppliers to the U.S. However, due to the heavy tariffs being imposed on many of their products, importers have looked for new markets.

That being said, Asian markets still accounted for $1.39 trillion worth of textile imports to the U.S. in 2022. The top countries were:

That same year, emerging markets in North and Central America, mainly Mexico and Canada, nearly matched that of the Eastern Hemisphere. Total textile imports from the region were valued at $901 billion.

No matter where you ultimately choose to import from, there are a wide range of factors to consider.

The recent changes in top trade partners makes it worthwhile to review where growth is and isn’t happening. I’ll go over current fast-rising markets that are worth looking into.

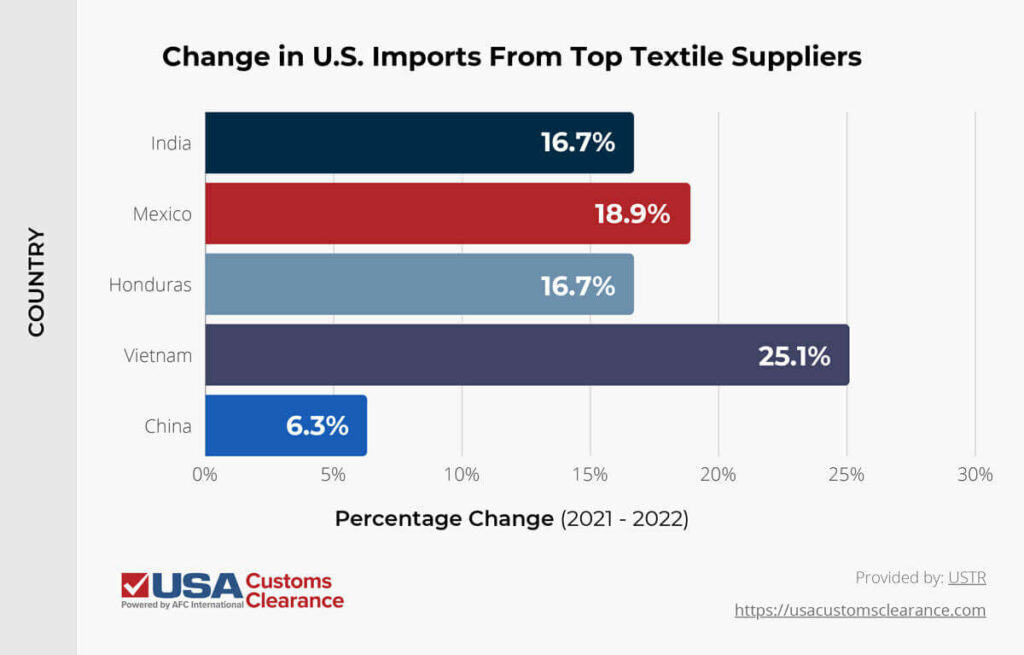

Positive trade relations have led to increased benefits when it comes to imports from several nations, even without the presence of an FTA. The Office of the United States Trade Representative (USTR) reports on each country’s trade history helps us see where growth is taking place.

While China is technically still growing, it’s at a significantly slower pace than the other nations on this list.

Aside from the current trade disagreements between China and the U.S., the economy of the former has grown steadily. In turn, this has made labor more expensive and driven up pricing.

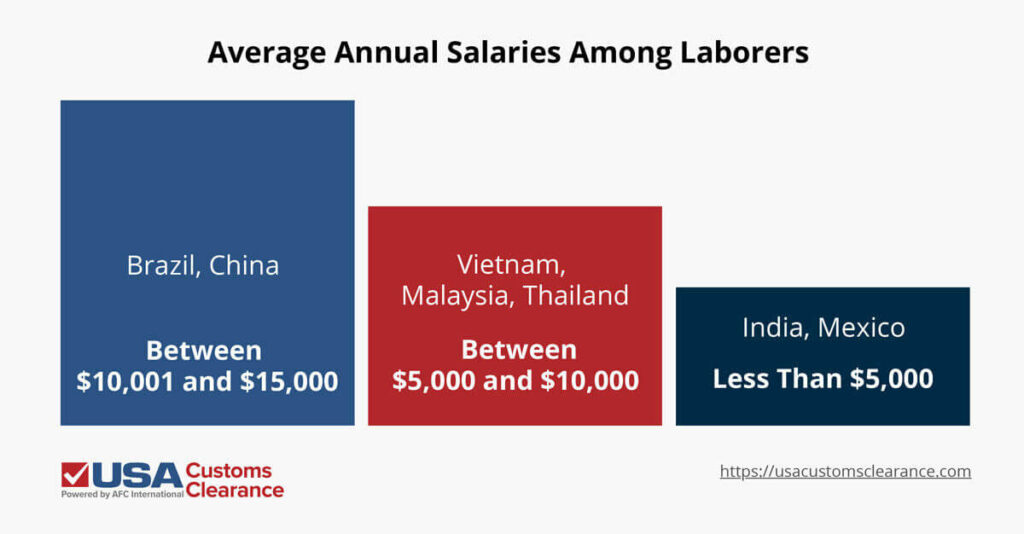

A recent study by the Reshoring Institute looked at countries with low and high average salaries of production workers and machine operators from 2022. Not surprisingly, the countries on the lower end of the scale include a few that are rapidly growing as textile suppliers.

Of course, you’ll still need to keep quality in mind. With more equipment becoming standardized, you’ll want to focus more on the raw materials being used and ensure they come from trusted sources.

While Mexico may not yet have a textile market output equal to that of China, they are close. In other areas of production, they have already surpassed China, so this shouldn’t come as too much of a surprise.

Thanks to their proximity and the financial benefits that come from USMCA trade policies, Mexico has become a more popular partner for importing textiles.

In 2022, over $7 billion worth of textiles entered the U.S. from Mexico, representing 13.5% of all textile and apparel imports. That places them third behind Canada (14%) and China (17.7%).

However, to take advantage of the tax breaks that make textile imports from Mexico so profitable, there are a set of rules to follow.

Related: NAFTA vs USMCA

The USMCA trade agreement governing large portions of trade between the U.S. and Mexico lays out a range of specific rules for textile and apparel products. This is to ensure that any textile products said to originate in North America actually do.

The rules of origin dictate that the material which is used to form the fabric implemented in textiles must come from a USMCA country.

The exact percentage of material that must be from a USMCA country can vary.

Products in short supply are given some leniency in terms of the rules of origin requirements, but these fluctuate with the market.

The USMCA rules on Textile and Apparel Products go into much more detail, so it’s worth taking a closer look, preferably with a customs broker, to ensure you’re following all rules and regulations.

Many of the challenges I’ve mentioned can be addressed with the help of the right partner. Customs brokers are often relied upon by companies that are looking to import textiles to the U.S. because of the myriad demands, rules, and regulations that are applicable.

Working with a Licensed Customs Broker to import textiles can make the entire importing process simpler in the following ways:

A customs broker’s help will depend largely on your needs. Many companies depend on them to ease the legal and regulatory side of importing textiles to the U.S., but they can also help establish the importation infrastructure, such as storage and transport, as needed.

When it comes to importing textiles to the U.S., we have the experience and knowledge to help you. Our experts are intimately familiar with all requirements in play when importing textiles, no matter where you source from.

Furthermore, we offer our experience in a wide range of importing resources that can help companies learn everything they need to know about getting the products they need in the country.

Get in touch with us today at (855) 912-0406 to take the next steps in importing your products. You can also reach out to us with a direct query through our online contact form. Our experts are ready to help you get your imports clear and your business thriving.

Copy URL to Clipboard

Copy URL to Clipboard

I'm about to do a temporary import to the US from Germany, for an art print on polyester and carpet to be on display for 3 months and then return to Germany.

Since it is not a sale or clothing, what would I have to provide for fast customs clearance?

If I am a reselling company. What do I need to ask the suppliers to provide. I don’t buy in bulk.

Hi: if I have to import in USA from China garments with duck down, do I need to provide also sanitary certificate?

Hi For coming year, any cotton traceability documents are needed for custom clearance ?

I have a small e-commerce resell company and want to expand. I am dealing with Amazon now and planning on heading to Mexico and Egypt to explore some family business buying and selling along the Atlantic and Gulf coast of the USA

There were lots of times when I bought clothing made in other countries. On many occasions I found insects (probably microscopic) biting me from the garment. Aren't there any regulations regarding that?

if there is duty in the USA on import of 100% Linen fabric, product and how much.

Do I understand your article correct, if I importat textiles I have to document the origin of the fibre?

Does organic textiles from India get fumigated or treated with chemicals of any kind before entering the US (either at the port of origin or at the port of reception)?

Hi Mokihana,

There are no rules regarding fumigation of textiles. However, textiles have many other requirements that they have to meet including flammability guidelines in place through the CPSC.