Despite tightening regulations, the tobacco industry in the United States remains lucrative. However, tobacco is also one of the most heavily regulated goods in the U.S. Learn how to navigate different government requirements while making a profit.

Key Takeaways

Read on to learn about the variety of regulations that control tobacco imports and distribution within the United States market.

As it pertains to importing, tobacco may refer to raw leaves, seeds, or plants and tobacco products. The import of raw tobacco leaves or tobacco plants is regulated by the U.S. Department of Agriculture (USDA). The duty rates for these goods vary widely, but can all be found in chapter 24 of the HTS, which exclusively deals with tobacco. For this article, we will focus on the requirements of importing tobacco products only, not unprocessed plants.

Tobacco products are defined as “any product made or derived from tobacco that is intended for human consumption, including any component, part, or accessory of a tobacco product.” I’ve listed some common examples below.

Tobacco Products:

Tobacco Components, Parts, Accessories:

The tobacco industry in the United States has a market profit range of upwards of $50 billion. Despite growing awareness of the harmful effects of tobacco and an overall decrease in the number of adult smokers, market profits continue to steadily increase.

High demand for imported tobacco products can lead to profits for savvy importers, but only after you have successfully navigated regulations, restrictions, and taxes governing the process.

If you are a traveler just looking to import tobacco products for personal use, there are still regulations to follow according to the Federal Food, Drug & Cosmetic (FD&C) Act. Firstly, regardless of the legal purchase age in the country of origin, you must be at least 21 years of age to travel back to the United States with tobacco products. This is per the Tobacco 21 legislation that raised the legal age to purchase tobacco in the U.S. from 18 to 21.

Provided you are of legal age, you are allowed to import up to 200 cigarettes and 100 cigars from outside the country. However, there is a minor loophole. If you are traveling back from an insular possession or beneficiary country of the United States, you are allowed 1,000 cigarettes every 31 days, but only 200 of those cigarettes can be from outside the exemption location. Their value should also be within the allowed $1,600 duty and tax exemption.

These locations include:

Despite being a U.S. territory, Puerto Rico is not included in this list. Travelers returning to the United States from Puerto Rico are still subject to the standard limitation.

Outside standard cigarettes and cigars, you may bring back other tobacco products. However, you might need to pay a Federal Excise Tax depending on the type, quantity, and weight. How much you owe is determined on a case-by-case basis.

If you plan on importing pipe or loose-leaf tobacco for personal use, you also need to check with the individual port of entry, since regulations will vary by state. Flavored cigarettes, commonly known as bidis, are illegal to import.

Our Licensed Expert Customs Consultants will personally guide you.

Requirements are much stricter when you are importing tobacco products for commercial use. All tobacco product imports require a permit. These products are also subject to different taxes beyond the standard duty rates of the Harmonized Tariff Schedule.

Prior to importing, you should also consider how you plan on distributing the products. Regulations on tobacco product advertisement, labeling, and distribution may impact your business negatively if not followed carefully.

When your products arrive in the U.S., their market authorization, labeling, and user fees will all be verified by the FDA. Shipments will also need to pass all inspection requirements of U.S. Customs and Border Protection (CBP).

Import documents are carefully verified by the FDA and CBP and include the:

While Affirmations of Compliance are not required for all tobacco product imports, submitting one voluntarily may fast-track the screening and review of your shipment and product through customs. Accuracy in all documentation, permitting, and labeling may expedite your shipment’s clearance through U.S. customs. Otherwise, your shipment may be held until CBP conducts a more time-consuming manual inspection.

Tobacco product importers need to apply for an import permit through the TTB. Two permits apply specifically to importers.

The other permits issued by the TTB are specific to tobacco products after they’ve arrived. If you are going to manufacture tobacco products with the material you imported, you may need to apply for a Tobacco Products Manufacturer permit or a Manufacturer of Processed Tobacco (MPR) permit.

A permit is not required if you are importing Electronic Nicotine Delivery Systems (ENDs) that contain no tobacco.

Whether you are importing for distribution purposes or for further manufacturing, the FDA requires specific labeling for the product itself or its advertisement material.

Tobacco products need to comply with these requirements even before they can be imported per the FD&C Act and the Family Smoking Prevention and Tobacco Control Act (Tobacco Control Act). Proper labeling is determined by the type of product. The labels themselves have to follow the guidelines of the Cigarette Labeling and Advertisement Act.

To pass inspection by CBP and FDA, general shipment labels must include:

Further labels specified by the FDA depending on the type of tobacco product include:

Because labeling needs to be addressed before tobacco products can enter the United States, you should also be aware of the Federal Trade Commission’s warning label rotation schedule. A series of four warnings are rotated on smokeless tobacco products, such as snuff and chewing tobacco.

Nine rotating labels must be used on cigarettes. If you obtain your products from foreign markets and factories, they must still be in compliance with U.S. laws.

While a proposed federal ban on the sale of mentholated cigarettes has not yet been enacted by the FDA, a handful of states passed bans of their own. These states are:

It’s important for importers who plan to sell mentholated tobacco products in the United States to keep these bans in mind. Getting even more granular, some bans or restrictions are in place on county and municipal levels.

Given the size and market worth of the tobacco industry in general, there are several government agencies involved in the importation and policing of tobacco products. In many instances, the agencies’ roles overlap one another making it very important to have guidance along the way.

The U.S. Food and Drug Administration (FDA) is the agency largely responsible for tobacco product regulations. At the time of import, it’s the FDA that checks for required licensing and permits, proper labeling, and otherwise enforcing the regulations that are part of the Tobacco Control Act and the FD&C Act.

These regulations include the ban on flavored cigarettes, commonly known as bidis. According to the Tobacco Control Act, if any part of the cigarette (tobacco itself, filter, or paper) contains a flavor, herb, or spice that alters the characteristics of typical tobacco, it cannot be imported. The only allowed flavor is menthol.

If you are looking to import a new type of tobacco product or a modification of an existing product, the FDA requires you to file a pre-market order. The order has to be done before importing for you to be allowed to distribute. A new product is one that didn’t exist or wasn’t available in the U.S. prior to February of 2007.

You must also submit an application to the FDA for approval if you plan on importing and/or manufacturing tobacco products that are advertised as Modified Risk Tobacco Products (MRTPs). The application process, in this case, is specific to individual products, not necessarily to entire shipments.

To learn more about clearing customs with the FDA, check out our article on The Complete Guide to FDA Customs Clearance.

The Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) enforces tobacco product regulation and control in the U.S. When individuals try to get around FDA regulations or import illegally, the ATF is there to catch them.

The bureau works as a law enforcement agency to identify, target, and dismantle criminal trafficking of tobacco. This includes the trafficking of counterfeit cigarettes and tobacco products.

Import permits and tax collection are handled by the Alcohol and Tobacco Tax and Trade Bureau (TTB). The TTB collects the Federal Excise Taxes that are imposed on tobacco products and regulates the Special Occupational Tax (SOT) that may also be imposed. Their website maintains a list of laws and regulations for importing tobacco as well as domestic use and manufacture.

When importing tobacco products, having a licensed customs broker to navigate the requirements of obtaining a Tobacco Importer Permit is highly recommended. Due to the specific requirements and related fees, it isn’t something you want to take on without experienced guidance.

The Center for Drug Evaluation and Research is specific to the import and marketing of any product that will be marketed for therapeutic purposes. In the tobacco industry, this usually means ENDs that are marketed as tools to help a user quit smoking traditional cigarettes.

Speak to one of our experienced and Licensed Customs Brokers to get the help you need no matter what you're importing.

Your cost to import tobacco will largely depend on its type and quantity. Import duty rates are determined through the Harmonized Tariff Schedule. Proper classification of your products will be vital in paying the correct amount through customs duty. Mistakes in HTS codes may cost you in fees and time, even if everything else meets regulations.

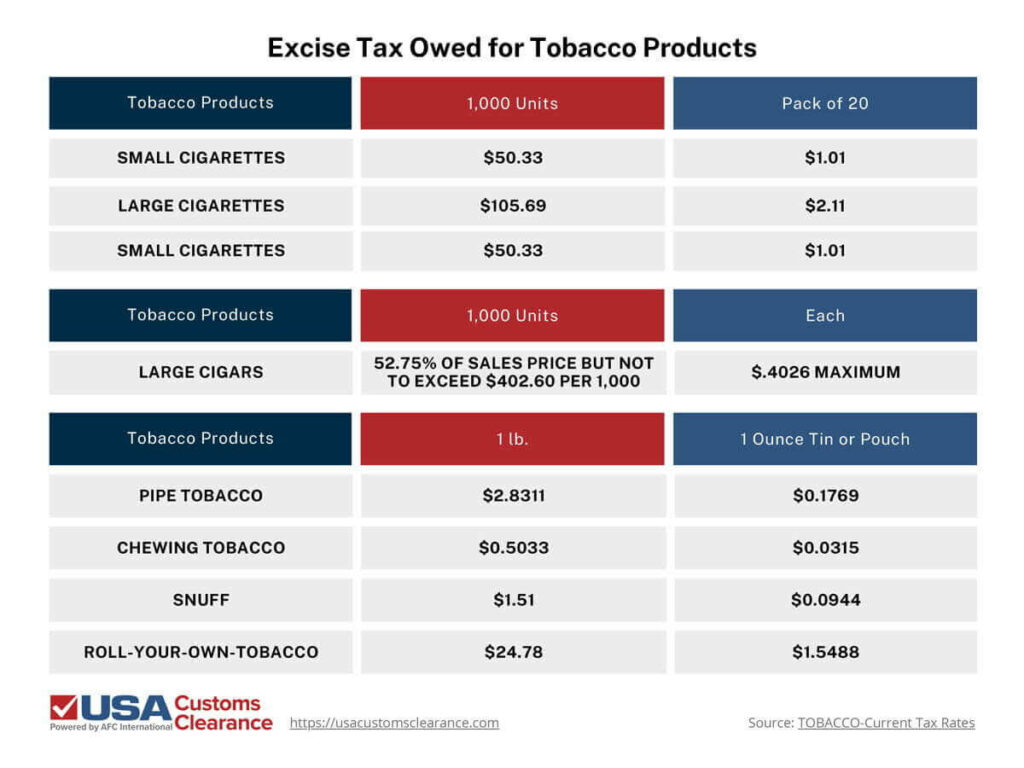

Aside from customs duties, there is a Federal Excise Tax on tobacco products paid through the TTB. When importing cigarettes or cigars, shipment taxes are calculated in terms of units or cartons. There is also a breakdown between large and small sizes. Pipe, chewing, snuff, and roll-your-own tobacco are taxed by the pound, tin, or pouch.

The following tables are a basic breakdown of possible excise taxes (meant only as guidance) paid to the TTB. Expert consultation is recommended for the true calculation of complete taxes to be paid.

Vaporizers are classified as Electronic Nicotine Delivery Systems (ENDs) along with e-cigarettes, vape pens, e-pipes, e-hookahs, and e-cigars. Because the majority of ENDs do not contain actual tobacco, they may be imported without a permit from the TTB.

However, they are still under the jurisdiction of the FDA as of 2016, when it was ruled that ENDs fall under the category of tobacco products. This means the FDA still regulates the manufacture, import, labeling, packaging, advertisement, and distribution of all ENDs and their main components.

Sorry cigar fans, but Cuban cigars are banned from commercial or personal import into the United States. This ban also covers any other tobacco product manufactured in Cuba. Although you used to be able to bring cigars back for personal use following the established limit (200 cigarettes/100 cigars), as of September 24, 2020 regulations banned personal import as well.

The process of importing tobacco is extremely regulated. Between the different agencies involved in the regulation and federal excise taxes imposed, there is a veritable mountain of paperwork to be gathered. Partnering with a licensed customs broker through a clearance agency with experience in tobacco imports may mean the difference between turning a profit and being in the red.

A customs clearance service can review applications for import permits for accuracy before submission to the TTB and guide you through the required documentation of CBP and FDA. They may also ensure the accuracy of HTS codes, which are product-specific.

Should any of these things be mislabeled or missing, you risk having your shipments stuck at their port of entry, potentially costing you thousands of dollars in fees. In other scenarios, CBP may seize your shipment entirely or mark it to be destroyed.

The tobacco industry might be a very profitable market, but without the assistance of an expert, you could come to regret taking on the challenge.

Given the ongoing federal and state-level efforts to limit what tobacco products can be sold legally, importers often find it challenging to ensure their products are permitted for sale in the U.S. This is why many businesses partner with customs experts such as ourselves.

At USA Customs Clearance, our licensed and experienced customs brokers are able to walk you through the entire import process. No matter what goods you plan to import, scheduling a one-on-one consulting session with one of our experts can help ensure all of your imports are performed correctly.

We also offer other importing services, such as:

Invest in our consultation services and make the best decision for your import business. Call us at (855) 912-0406 or fill out a contact form online for a no-obligation price quote and keep your profits from going up in smoke.

Copy URL to Clipboard

Copy URL to Clipboard

I would like to import cigars into the USA from Nicaragua. I plan to open a company and cigar lounge in the USA. Can you please inform me, what permission & License do I need. Not sure how and where to start from?

How can I have my cigarettes imported for personal use

good evening, i'm interrested on importing tabacco lefs (WRAPS ) from the dominican republic to usa and would like to know what is the procedure and licences that i would need to start i already have my LLC and EIN . THANK YOU IN ADVANCE

Hi

I would like to import tobacco leaf into usa from domenican republic. i have plan open company in usa .So which document you need from me?

Thanks

Hi

I would like to import e cigarettes and device into usa from china. I did not have company or anything yet, it mean I just want to start from beginning. So which document you need from me?

Thanks

Hello Sir/Madam!

I would like to start own company to import Shisha Tobacco from Europe and Middle East countries to USA. can you please inform me. what permission & Licens do you need. how and where to start from?

Hi.

I am looking, with a friens, to start importing cigarretts from Brazil. I am here at Brazil and he is looking to opening a trading/import co..

Note that there is no company in his name so far, we would star from the beginning.

I would like to receive a previous quotation for consultancy to open the business, requires licenses with FDA, TTB, as any others required.