Mexico has long been one of the U.S.’s top trading partners. The country produces a variety of quality products and shares a free trade agreement (FTA) with the United States. That said, there are certain requirements you’ll need to learn about before importing from Mexico.

Key Takeaways:

I’ll explain the benefits you can reap and the requirements you’ll be responsible for completing when you purchase goods from this important trade partner.

The 25% rate on non-USMCA goods exported from Mexico to the US remains in place. However, sectoral tariffs on aluminum and steel are currently 50% with no exceptions for Mexico, though they do get a lower tariff rate on the USMCA portion of exported vehicles, down 15% from the 25% general rate imposed on most countries.

An agreement between President Trump and Mexican President Sheinbaum has resulted in another month-long tariff break, for a limited number of products. Imports from Mexico that are specifically granted duty-free entry under the USMCA treaty will get a reprieve from the 25% tariff.

As of now, this deal is limited to trade between the U.S. and Mexico.

Additionally, automobiles import have been granted a month-long tariff break after a special request to the White House by major U.S.-based automotive manufacturers.

On February 1, 2025, President Trump imposed tariffs on goods from Mexico, Canada, and China. The tariffs fall in line with his America First Trade Policy and will remain in effect indefinitely, or until removed by the president.

This means all products imported from Mexico to the United States 25% additional ad valorem duty with no exceptions.

No specific HTS code list accompanied the orders, so importers should expect that the import of any product intended for consumption in the U.S. will be subject to the additional tariff.

A last-minute agreement between Mexican President Sheinbaum and U.S. President Trump has paused the imposition of these tariffs for one month as of February, 3, 2025.

In addition to the ad valorem tariffs being applied to imports from each of the three nations, there are other provisions written into each order to provide clarity on specific exceptional situations.

All orders were pushed through as part of a national emergency under the International Emergency Economic Powers Act (IEEPA) and the National Emergencies Act.

A flat 25% tariff was added for all steel and aluminum imports entering the U.S. Previously, Mexico was excluded from these added taxes, but the Trump Administration's announcement includes no exceptions or exemptions for any country.

Mexican President Claudia Sheinbaum stated that her country would be imposing retaliatory tariffs, the details of which will be announced at a public event in Mexico City on March 9.

Importation requirements are enforced by U.S. Customs and Border Protection (CBP). They’re the primary government agency overseeing foreign products that enter the country.

There’s a good chance you’ll also need approval from a Partner Government Agency (PGA). These are federal agencies that have jurisdiction over specific products that work alongside CBP.

Some of them include:

Clearance is given if the goods you are trying to import meet CBP and its PGA’s rules and regulations. While the specific rules you’ll have to follow will vary based on your goods, I’ll explain some basic requirements you’ll need to meet.

Related: An Importer’s Guide To Partner Government Agencies

You’ll have to file your entry documents with CBP and any other agency that has jurisdiction over your products. A licensed customs broker could also do this on your behalf.

Documents required at the time of entry include:

These basic pieces of paperwork are needed for every import you make, regardless of which federal agencies have jurisdiction over your products. However, there are some additional documents that aren’t mandatory, but may be useful.

For example, a certificate of insurance should be included if you want to protect yourself from potential losses. Certificates of origin aren’t typically required, but can help you if you’re trying to apply for preferential tariff treatment under USMCA.

You can apply for preferential tariff treatment for your Mexican products under USMCA with a certificate of origin. USMCA doesn’t require a specific format for this document, but they do want you to include nine data elements on the form.

CBP does offer a certificate of origin template or you can design your own. A customs bond may be required if your Mexican products have a value of $2,500 or more. You can obtain a single entry bond for one import or a continuous bond that will cover all purchases you make for an entire year.

Goods must be classified and evaluated before they reach the point of entry by CBP. Proper classification and labeling are essential to ensure the appropriate duties are paid and the correct rules are followed. CBP then establishes the final duty amount that will have to be paid for your goods.

You should be able to receive preferential tariff treatment under USMCA if you provide the appropriate HTS code and fill out your Certificate of Origin correctly.

Related: What Documents Do I Need To Import and Export

CBP will also examine many imports from Mexico coming into the country for the sake of national security. The inspections will check different aspects of your products.

This includes:

Most exams occur quickly and goods are able to enter without issue. If your freight is suspected to be in violation of any import regulations, CBP will take a more thorough look into the cargo.

Certain partner government agencies will inspect your Mexican products as well. For example, Food Safety Inspection Service (FSIS) personnel working under USDA will review agricultural goods like meat, poultry, and eggs.

For these reasons, it’s essential you follow all import requirements carefully to ensure they’re successfully cleared.

There is a wide range of regulations that apply to different items entering the country. This means you’ll need to be familiar with the requirements of the PGAs that oversee your goods.

It’s important to know which agency your products are regulated by, whether it’s the FDA, EPA, or USDA. If your goods are regulated by another agency, there will be additional restrictions that you’ll have to follow.

Following PGA requirements is equally essential as following the ones set by CBP. Therefore, it’s vital to research your products before importing them from Mexico. For that reason, you should have a partner that can help you better understand and navigate the various rules and regulations laid out.

Our personalized approach and commitment to customer service will help you understand your unique customs needs.

CBP and USMCA don’t require an import license. However, PGAs may require a license or certificate for the goods you have purchased.

There are a variety of licenses to consider based on the commodities you want to bring into the country. For example, the ATF will require you to obtain a Federal Firearms License when importing guns, ammunition, and accessories.

Regardless of what you’re buying from Mexico, always research the requirements of any PGA’s that have jurisdiction over your goods.

The United States-Mexico-Canada Agreement (USMCA) is a free trade agreement (FTA) you can use to your advantage. It’s a replacement t of the North American Free Trade Agreement (NAFTA).

Thanks to the USMCA, you’ll be able to enjoy duty-free treatment for numerous products you import from Mexico. In addition to preferential treatment, you’ll be able to enjoy a variety of other benefits as well.

I’ll explain the benefits you’ll be able to enjoy when using this important FTA.

The USMCA provides duty-free treatment on a variety of goods. To qualify, you’ll only need to meet the FTA’s proof of origin requirements.

Goods that receive preferential tariff treatment under USMCA includes:

Mexico is one of the U.S.’s top suppliers for all these products. As a result, numerous importers in the U.S. utilize preferential tariff treatment under USMCA to reduce their costs. If you’re in an industry that deals with these products, you’ll be able to enjoy this benefit as well.

Another benefit of USMCA provisions are the allowances it makes for small and medium-sized enterprises (SME). There is a chapter in this FTA that provides information-sharing tools that SMEs can use to better understand the benefits of USMCA.

This chapter also establishes a framework that allows SMEs to communicate their needs and concerns with government officials. If you’re running a SME, these provisions will make it easier to take advantage of this FTA and reduce your expenses.

Not all items that come from Mexico are physical objects. In some cases, products can come in a digital format. Fortunately, USMCA has provisions that will make the trade of digital products between Mexico and the U.S. easier. For one, customs duties on digital products distributed electronically are prohibited.

This includes:

USMCA also protects cross-border data flows and limits localization requirements when it comes to trading these goods. This means you won’t have to require your Mexican seller to store their data on a local server before importing it.

At one time, U.S. importers had to establish a foreign office in Mexico before engaging in cross-border trade. Due to new provisions in USMCA, importers no longer have to fulfill this requirement. This makes it easier for small businesses who couldn’t afford to establish an office to engage in trade with Mexico.

Related: Import Costs from Mexico

Besides the benefits provided by USMCA, there are many other reasons why Mexico is a popular place to import products. In the next few sections, I’ll discuss other benefits you can expect to enjoy when buying goods from this valuable trading partner.

Mexico is significantly closer to the U.S. than many of the other countries importers use as sources for their goods. Because the nation is closer, it doesn’t take as long to receive your goods.

This is especially true when compared to overseas shipments. When you’re working within a tight order fulfillment timeline, the proximity to Mexico is a major boost.

Effective communication with your supplier essential. When you need to make orders or adjustments based on shifting demands, you want to ensure that your partners can respond quickly. It can be a lot easier to communicate with partners in Mexico due to them sharing similar time zones with the United States.

While many U.S. importers use sites like Alibaba to find Chinese suppliers, working with a Mexican manufacturer or supplier can serve as a viable Alibaba alternative. Furthermore, the amount of Spanish/English bilingual individuals in both the U.S. and Mexico is very high, which eliminates most concerns about a language barrier.

The relative proximity of Mexico and the U.S. compared to many other countries reduces the transportation costs associated with importing. Every method of moving freight will vary in price. That said, the less distance your cargo has to travel, the cheaper it will be to transport.

Regardless of which method you decide to use, your expenses will be lower than if you were purchasing goods from a country overseas.

Other importing partners, such as China, currently don’t have the greatest diplomatic relations with the United States. Countries that do not share the positive relationship that Mexico has with the U.S. can be subject to tariffs and restrictions.

Our southern neighbor is a stable trade partner of the U.S., which can make importing from the country more advantageous. With such valuable benefits at play, it’s easy to see why the trade relationship between Mexico and the U.S. continues to grow each year.

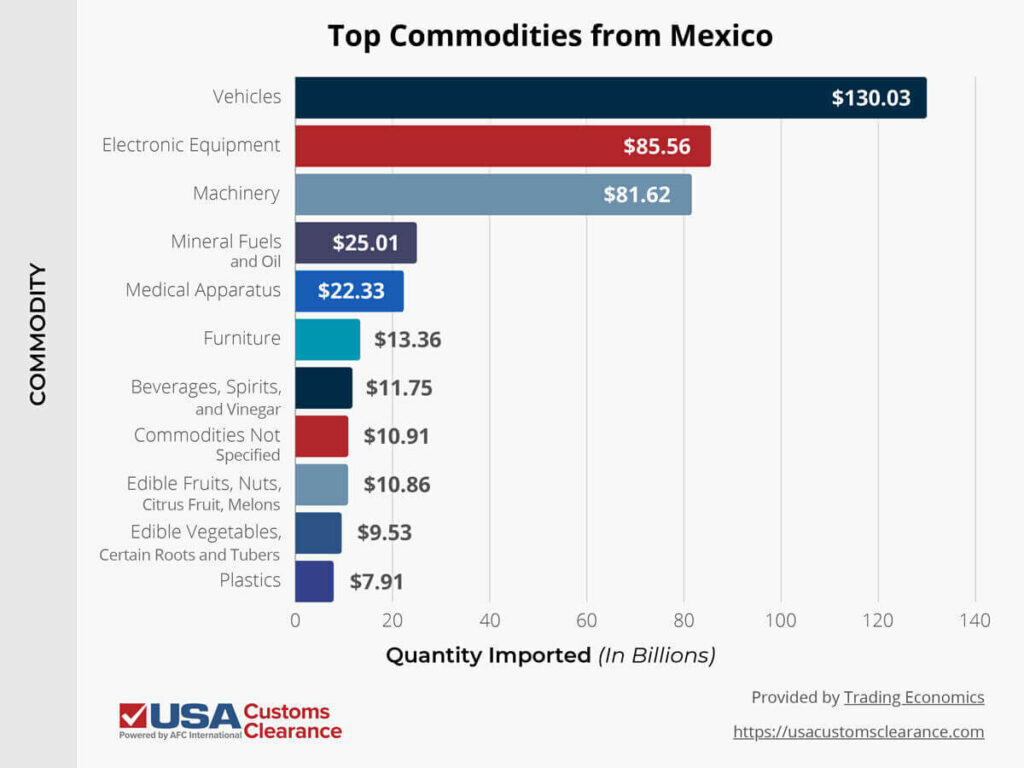

In 2023, the U.S. imported from Mexico more than any other country. This means there’s a tremendous amount of goods coming from the southern border. I’ve provided data on the top commodities the U.S. imports from Mexico.

Cars and car parts are frequently imported from Mexico to the United States due to the numerous car companies that manufacture their vehicles in this nation.

This includes:

If you want to import cars or auto parts made by one of these companies, you’ll be able to receive preferential tariff treatment thanks to the provisions in USMCA. Other products that are frequently imported from Mexico are given special treatment under USMCA as well, such as fruits, vegetables, and industrial machinery.

When you’re importing goods from Mexico, you’ll need to use a mode of transportation that will work best for your unique situation. Each method has different pros and cons that you’ll have to consider.

The three most popular transport methods are:

Thanks to Mexico’s geographic closeness, truck transport is actually a great way to move your freight into the United States. In 2022 alone, 590,906 truckloads of produce in 40,000-pound loads were carried from Mexico to the U.S., with 55% entering through land ports in Texas.

According to the Bureau of Transportation Statistics, 71% of all freight traveling from Mexico to the U.S. is carried by truck. Make sure you obtain a Pre-Arrival Processing System (PAPS) number if you choose to use a truck to transport your cargo. Another method of transferring your cargo into the country is rail.

Large volumes of goods can also be moved along railroads running from Mexico into the United States. This mode of moving cargo is among the safest ways to move freight by land. It’s also a cost-effective strategy for moving freight over long distances.

Despite sharing a border with the U.S., vessel transport is a great way of transporting your goods from Mexico. Ships can also carry large volumes of freight in their cargo hold. Out of all the ways you can move freight internationally, vessel transport is the cheapest. Make sure you complete an Importer Security Filing (ISF) if you decide to use this method.

Air transport is a good option if you need a quick turnaround, but you’ll be paying more for this method than the others.

Related: Importer Security Filing (ISF)

Importing from Mexico can be much easier when you have the knowledge of import specialists at your disposal. USA Customs Clearance has a team of licensed customs brokers and professionals that have helped numerous importers get their goods into the country. With their assistance, your importing operations will be a success.

You can also take advantage of our others services, such as:

Don’t get bogged down in regulations. USA Customs Clearance will help you through the process every step of the way. Use one of our services or contact our team through the site. You can also contact our team at (855) 912-0406.

Need to import goods with a value of $2,500 or more?

Get a customs bond to cover all your shipments for an entire year!

Copy URL to Clipboard

Copy URL to Clipboard

Hi there I'm trying to start a small hobby of bringing new wood burning stove's to sell on my spare time and bring them on My vehicle and a trailer probably less then 2500 dollars what do I need to bring them across the border thanks Javier.

We are ready to import Mezcal into the USA through San Diego. We have USA residents and Mexican nationals as owners.

I'd like to import smoke glass pipes from Mexico. What would the requirements be?

Hi. I would like to speak to a licensed customs broker for information on products for my grocery store. Thank you.

I sell inexpensive costume jewelry online. Recently one of my neighbors suggested I would see a higher profit margin if I sold jewelry made in Mexico. He travels there frequently and could bring me some samples, but I don't even know how to get started, or know anything about border taxes, tariffs, etc. Can you give me some direction on how to find out or who to talk to.

Hello, I am interested in importing planters and garden equipment to the USA, they vary sizes from small to super large, weight from a few pounds to tons probably, what’s the best way possible?

Hello - I am looking to connect with a company that manufactures custom 3-ring binders for import into the USA. Can someone help connect me with possible vendors?

I am interested in importing all types of horse tack, Leather bridles, saddles and other leather goods. I also want to import metal spurs and bridle bits and other metal attachments, used in the horse tack business. I have imported for years from India and China, but never from Mexico. I did live in Mexico for two years in the 80s. I am having a problem finding suppliers of Mexican saddlery and horse tack to contact. Any help would be vastly appreciated. I have a continuous bond and am ready to start now. I do not have a Mexican broker and will need one. Thanks Dannie

If I buy 20 metal sheets from Mexico will I be charged to bring them back to the US if I use a regular truck and travel trailer?

Can I import fabric or clothing for resale?

When importing exercise equipment, treadmills, Bikes, Rowers, Ellipticals, etc. from Mexico to the US what is the taxes / Fees that would apply for the imports

The main HTS Code we use is 9506.91.00

Hi I am looking to import singles roof from México. Can you help me get the information I need.

If you paid an import fee in Mexico coming from another country, will there also be a importing fee coming from Mexico to the USA?

Hello,

I am looking at importing polyurethane for spray foam from Mexico. Are there regulations about importing certain chemicals from Mexico to the USA. The polyurethane company said they have documentation but it is in Spanish and will probably need to be translated to English.

Good morning, I have a question. I just bought some Chinese products from Mexico, do I still have to pay taxes (25% taxes) as if I brought them from China directly?

Hi!

My family is manufacturing kids clothing for me to wholesale in the USA. What requirements do I need to import the clothing.

Thanks

Anel

I`m looking to import floor covering from Mexico do you have factory list ?

Hi I am wanting to bring candles from Mexico to the U S to sell. What do I have to do to keep them from being sieved at the border?

Can I import fabric or clothing for resale?

Hi Alixon,

You can absolutely import fabric and clothing for resale! We can assist you with making sure that your imports are compliant and meet textile import regulations. One of our import experts will reach out to you shortly to further assist you. We look forward to working with you!

Hi, i want to import,orgánic raw honey, coffe, mezcal,and other eatable products from México into the US.

Hi Daniel,

We'd be happy to help you with this! One of our customs experts will reach out shortly to assist you. We look forward to helping you!

I am interested in importing Solar Panels from Mexico to the U.S.

I do know that the origination of subject solar panels is not from Mexico, but instead from Asia. I would like to know if it is possible to import such a product from Mexico to the U.S. (particularly through Tijuana). This would be continuous import by the container load.

Hi Milo,

These solar panels can absolutely be imported from Mexico. However, given that their country of origin is not actually from Mexico, you'll have some additional complications to deal with in importing them. We highly recommend consulting with a Licensed Customs Broker in this situation. If the process is not handled properly, you could incur significant penalties and fees or have your solar panels seized at the border. You can sign up for a consulting session with our Licensed Customs Brokers at the link below. They'll obtain information from you and provide you with a detailed guide of what you'll need to safely import your solar panels.

Licensed Customs Broker Consulting

Hi- I am working with a plastics injection company that will be producing parts for my company. What do I need to know to import my products back to the United States. My company is in San Diego and the manufacturing will be completed in Baja Mx. Thanks

Hi Chris,

We'd be happy to go over the import process with you! One of our import experts will reach out to you shortly to schedule a 1-on-1 consultation with our Licensed Customs Brokers.

Do you guys have some custom broker who speaks Spanish!?

Hi Victor,

We do have members of our customs team that speak Spanish and are able to help you! One of our Spanish-speaking customs experts will reach out to you shortly to provide further assistance. We look forward to helping you!