Permanent imports play a huge role in the world of ecommerce and international trade. It’s how people are able to run import/export businesses or simply purchase a product that they’d like to keep stateside. In some cases, however, a product only needs to be imported temporarily to fulfill its purpose — and that’s where temporary import bonds come into play.

Key takeaways:

Now that you know the basics, we’ll get into all the import details on TIBs.

Informally known as a temporary import bond (TIB), the proper name is temporary importation under bond. When an importer secures a TIB, they are allowed to temporarily import a product into a country without paying any duty or taxes (including Merchandise Processing Fees, or MPF).

Instead, the importer will post a bond for twice the dutiable amount owed on the product if it was imported permanently. This can be done using a single entry bond or a continuous entry bond, assuming it’s large enough to cover the TIB entry. The importer will then agree to either export or destroy the product within a specified period of time.

If the importer abides by the agreement, they will receive their deposit back once the TIB is completed (however, this can take many months). In a non-compliance scenario, the importer will be required to pay liquidated damages in the form of twice the duty owed on the imported product.

In order to complete the TIB, the importer has two options.

Option 1:

The importer may accompany their product(s) as they are exported. In this situation, the importer will be required to fill out CBP Form 3495 (Application for Exportation of Articles Under Special Bond). Customs and Border Protection (CBP) officials then verify the product to determine that it matches the product that was imported and is being exported within the agreed-upon timeframe.

Option 2:

The second option is to provide proof, either in the form of export documents (such as a bill of lading or cargo manifest) or supervision of the destruction of the product by CBP officials. This proof MUST be provided to the entry branch at the original port of entry. Failure to provide proof to the customs office at the original port of entry can result in having to pay liquidated damages, even if the product was exported.

Unless you complete one of the two options within the allotted time, you will face TIB penalties.

As with any other customs proceedings, it’s important you complete your temporary import under bond correctly. We’ve listed common errors to look out for when using a TIB.

To ensure you follow these procedures correctly, you should hire a customs broker. They can guide you through all the steps you’ll need to follow.

During a consulting session, our customs brokers can guide you through

the steps you'll need to follow to complete a TIB correctly.

A TIB can either be purchased at the time of entry or pre-arranged ahead of time. Entries must be filed within 15 working days of arrival for Customs clearance. However, CBP recommends that it be done within five days to avoid being charged storage fees by the carrier. This will help prevent unnecessary delays.

If the goods are accompanying an importer at the time of entry, an importer will be required to visit the port’s entry branch to fill out CBP Form 7501 (Entry Summary). Additionally, the importer must obtain a customs bond from a licensed surety to cover the temporary import.

Alternatively, you can work with a licensed customs broker to obtain a TIB ahead of time. By doing so, an importer can pre-clear all cargo through Customs and ensure that a bond for twice the amount of import duty on their goods is obtained.

A third option is to obtain an ATA Carnet. While slightly different from a TIB, an ATA Carnet may also be used to temporarily import products. ATA Carnets can be secured in advance and are good to be used for a calendar year.

In most cases, any products that enter the U.S. under the TIB provision will need to be exported or destroyed one year after the date of importation. There are some exceptions, however. Most products may be granted a one-year extension of the TIB, up to three total years.

To obtain an extension, you’ll need to send an application to the port directer where your entry was filed. The extension must be applied for before the current year is up and cannot be requested retroactively.

Other exclusions include:

It’s worth noting that in order to comply with a TIB, a product must be permanently exported from the country. Shipments to U.S. territories and insular possessions do not qualify as permanent exports. If you’d like to import the product back into the country, you must obtain a new TIB after the product is officially exported.

The short answer is no. Once you agree to a TIB, it must be completed by either exporting or destroying the product.

If you decide you’d like to import the product permanently, you will still be required to pay two times the duty amount owed on that product if it is not exported or destroyed within the agreed-upon timeframe. Alternatively, you can complete the TIB and then re-import the product at the normal duty rate.

The same goes for a product that is misplaced while under a TIB. If you can’t provide proof that the product was exported or destroyed, you will be required to pay liquidated damages for that product instead of the duty owed on a permanent import.

It’s also worth noting that this counts for every item listed under a TIB. If you have five products covered under a TIB, but misplace one and are unable to provide proof of its export or destruction, you will be required to pay liquidated damages on the entire TIB.

A TIB is only required if you want to import goods into the U.S. temporarily. This can be especially useful if the products you want to import are coming from a country that isn’t a part of a Free Trade Agreement (FTA). Under any other importing circumstances, the TIB won’t be necessary.

If the products covered by a TIB are lost or stolen, or if the TIB is not completed correctly, you could end up owing twice the amount of money you would have without the TIB.

Like a TIB, an ATA carnet allows an importer to temporarily import goods into a country. So how does a temporary import bond differ from an ATA carnet?

Unlike a TIB, an ATA Carnet can be used more than once. A carnet can be used to import and re-export goods in and out of multiple countries as many times as necessary during a 12-month period. No other documents are required for your goods other than the carnet.

An ATA Carnet can also only be used to cover specific items, like goods that are used commercially. Some of the most common products imported under an ATA Carnet are:

Essentially, an ATA Carnet is best when you’re frequently importing multiple goods within a one-year period.

Not all products are eligible to be imported using a temporary import bond. Only goods listed in subheadings 9813.00.05 through 9813.00.75 of the Harmonized Tariff Schedule of the U.S. (HTSUS) qualify to be imported under a TIB. This encompasses 14 subheadings:

It’s important to note that goods covered by subheading 14 (9813.00.75) may only be imported for six months (as opposed to one year) and cannot be granted extensions.

Similarly, if goods covered in subheading 10 (9813.00.50) are seized for any reason other than personal lawsuit, the requirement to export the product will be suspended during the time that the goods are seized.

Goods imported into the U.S. for the purpose of resale will not be granted coverage by a TIB under any circumstance, even if the goods in question fall under one of the above subheadings.

You will be required to pay liquidated damages twice the dutiable amount owed on the imported product if your goods aren’t exported or destroyed in the agreed time-frame.

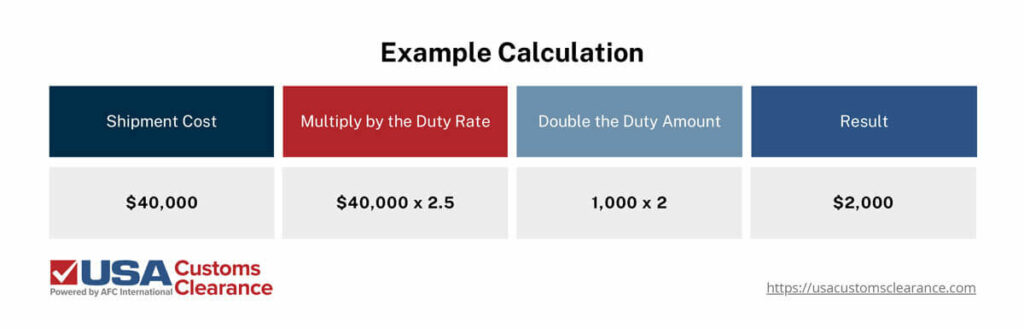

For example, let’s say you’re importing an automobile for show or exhibition, which falls under subheading 9813.00.75. The value of the automobile is $40,000 and the applicable duty rate is 2.5%.

After multiplying the value of the automobile by the duty rate, you’ll need to double the amount. We’ve provided a graphic showing what this calculation will look like.

Once the exhibition is over the automobile exported, the $2,000 would be returned. However, if you failed to complete the TIB correctly, you would owe that $2,000 in liquidated damages and potentially have to destroy a $40,000 car.

If it’s found that a TIB was broken intentionally, the importer may be subject to additional penalties, depending on the importer’s level of culpability.

If you need a continuous customs bond, then USA Customs Clearance has you covered. We offer this document and many others. Our team of Licensed Customs Brokers can also assist you through the importing process.

Our services include:

Get started with a consulting session or obtain the document you require. You can also contact us at (855) 912-0406 if you have any questions.

During a 45-minute consulting session, one of our customs brokers can

help you with filling out your TIB.

Copy URL to Clipboard

Copy URL to Clipboard

I have a jewelry piece that I need to send to Boucheron, Paris, France so they can authenticate the piece as an actual 'Boucheron antique'. Therefore the piece would leave the USA, Atlanta Georgia to Paris and back again. What form/s do I need for shipping the to Paris and back

Dear Sirs,

I have an item temporarily imported under TIB for evaluation purposes recently.

I am non-resident, so there is Importer on Record, the US resident.

As I would like to re-export the item outside of the US in order to close the TIB, what would be the procedure, given that I will carry the item with myself while departing from LAX?

Does this procedure require custom broker on LAX?

Many thanks

Dave