The U.S.’s chocolate industry is heavily dependent on cocoa bean imports from other countries. However, getting these important agricultural products into the U.S. isn’t a walk in the park. You’ll need to find out where to source your cocoa bean products and identify all applicable regulations.

Key takeaways:

Our complete guide will provide you with everything you need to know to safely import cocoa beans into the U.S.

There are three federal agencies that regulate the entry of cocoa beans into the country.

CBP is primarily concerned with receiving all the essential customs documentation required for your goods to make entry. The FDA and USDA are Partner Government Agencies (PGA) that also oversee the importation of your products.

FDA will want you to follow their food importing guidelines when bringing cocoa beans into the country. As an agricultural product, your goods will also have to pass USDA’s inspection when they arrive at the port of entry.

You’ll need to provide CBP with a variety of documents for your cocoa bean imports.

CBP uses these documents to verify the details of your cargo. Additional paperwork may be required depending on your document. For example, an Importer Security Filing (ISF) is necessary for cocoa beans arriving in the country by vessel. Be sure to research your cargo and the details of your shipment very carefully to ensure you have the right paperwork.

Related: ISF: 7 Things To Know

Cocoa beans will need to adhere to the FDA’s human food regulations. As a result, you’ll need to complete four key requirements.

Any facility that manufactures, processes, packs, receives, or holds food must be registered with the FDA. This means registering the facility of your supplier and your own if you have one. To do this, you’ll need to create an account in the FDA Industry System (FIS) and follow the registration steps.

Due to the requirements in the Food Safety Modernization Act (FSMA), you’ll need to complete the FSVP. The purpose of this program is to ensure your supplier has adequate measures to keep their food is safe.

There are four elements of the FSVP you’ll need to complete:

Most prepared food imports must adhere to FDA food labeling requirements. However, nutritional labeling for raw cocoa beans is optional, as most are processed further rather than going directly to the consumer. Finally, you’ll have to provide a Prior Notice before your cocoa beans can be imported into the country. These are used by the FDA to prepare inspections for imported food arriving at U.S. ports of entry.

You can submit the Prior Notice through CBP’s Automated Broker Interface of the Automated Commercial Environment (ABI/ACE) or FDA’s Prior Notice System Interface (PNSI).

Related: The Complete Guide To FDA Customs Clearance

USDA’s Animal and Plant Health Inspection Service (APHIS) is responsible for overseeing the importation of agricultural products. Since cocoa beans are technically considered seeds, you’ll be subject to APHIS’s import regulations for Plants and Plant Products Not for Propagation.

You can find the specific requirements for your cocoa beans by using the Agricultural Commodity Import Requirements (ACIR) database. Simply enter the country you’re importing your products from and type the common name or synonym for your goods.

After hitting the search button, numerous results will pop up for different types of cocoa beans. Simply view the specific requirements for the one that applies to your products. Most cocoa bean imports should have a permit, which can be obtained on APHIS eFile.

Your goods will also be inspected by APHIS authorities at the port of entry. Many plants and plant products need phytosanitary treatment to prevent the spread of pests.

You might be able to circumvent this requirement since cocoa beans typically receive steam sterilization to eliminate bacteria. That said, you should still check to determine if phytosanitary treatment is still needed for your products. Our Licensed Customs Brokers can provide you with the assistance you’ll require.

Our personalized approach and commitment to customer service will help you understand your unique customs needs.

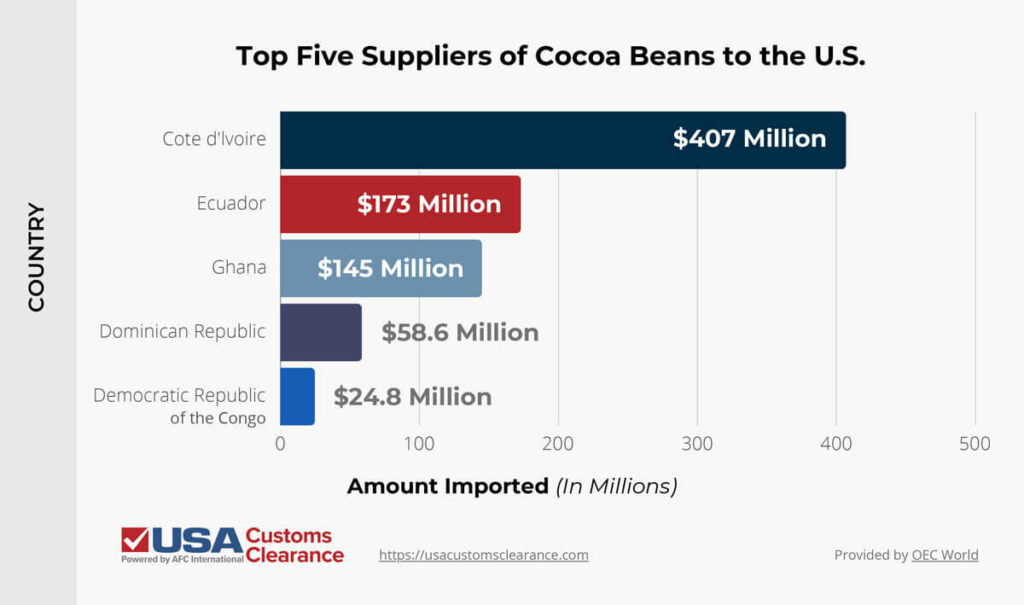

It’s essential to learn where you can source your cocoa beans. While many countries grow these products, there are five the U.S. imports from more than others. I’ve provided the data on how much is purchased from each one.

Each of these countries are known for their extremely high cocoa bean production, which makes them popular sourcing locations amongst U.S. buyers.

There are numerous duty rates that apply to different cocoa bean imports. For certain products, the duty rate will be completely free, while a rate between 2% and 10% per kilogram will be applied to others. In some cases, the duty rate will be charged a few cents per kilogram.

Your job is to find the correct HTS code for your shipment, include it in your import documentation, and pay the assigned rate. You can find the HTS codes for cocoa beans under Heading 1801 of the Harmonized Tariff Schedule of the United States (HTSUS).

From there, you’ll have to scroll through the different subheadings to find the one that matches your shipment. If you want to make the process easier, use our HTS Lookup Tool. All you need to do is type in a simple description of your cocoa bean import and hit the search button.

Our HTS Lookup Tool will find the HTS code for your products!

When importing cocoa beans from countries abroad, you can either use vessel or air transportation. Vessel transport is a much cheaper way of moving your cargo, but it can take a long time for it to arrive. While less common due to cost, air transport is a quicker way of bringing your cocoa beans into the country.

Cocoa beans are put into burlap sacks made out of jute, which is a long, strong fiber made from a plant of the same name.

Your products will be loaded and secured to a pallet to keep the shipment together. The containers holding your cocoa beans need to have natural ventilation, with little to no moisture able to reach the beans.

If natural ventilation can’t be achieved without excessive moisture, a liner can be placed inside the container to provide a seal of sorts. This can keep oxygen, moisture, and sunlight from altering the properties of the cocoa beans. This also prevents mold growth that can be caused by humidity in the air.

Your cocoa bean supplier should be familiar with these practices, but check with them to ensure they can make the appropriate accommodations.

A customs bond is only necessary if your import of cocoa beans have a value of $2,500 or more. The bond acts as an insurance policy the importer pays for, allowing CBP to collect duties on the import.

There are two customs bonds:

A single-entry bond is only good for one shipment, while a continuous bond can be used over a 12-month period from the date of purchase.

Related: Types of Customs Bonds

Start importing cocoa beans with USA Customs Clearance. We have a team of import specialists and Licensed Customs Brokers that are ready to offer their assistance. You can access their expertise by using one of our services.

With USA Customs Clearance by your side, you’ll be able to get your cocoa beans into the country without issue. Click one of our service links to get started or contact us team through the site. You can also give us a call at (855) 912-0406 if you’d prefer to speak with over the phone.

We work with you every step of the way to ensure a smooth and stress-free customs experience.

Copy URL to Clipboard

Copy URL to Clipboard

Google is changing how it surfaces content. Prioritize our high-quality guides and industry-leading coverage in search results by setting usacustomsclearance.com as a preferred source.

I would like to know what documents from the origin port should be submitted to US Customs to clear the cacao beans shipment. We will have a sample shipment of about 159 kgs. only of fermented cacao beans ex Philippines.

I would like to Knowles what paperas work documents from Colombia origin port should be submitted to US Customs to crear cacao beans shipment. We Will have a sample shipment of 150kgs. Only cacao beans.