If a business runs into issues while shipping in regard to tariffs, cargo insurance, or even international laws, an expert in importing and exporting can provide effective solutions. Whether you’re an importer, exporter, or both, professional guidance can help you solve problems and identify issues you might never have noticed on your own.

Key Takeaways

In this article, we’ll discuss what responsibilities import and export consultants take on, and how partnering with them can help your business succeed.

CBP and other government agencies have several regulations, designations, and rule sets that dictate how importing and exporting is conducted in the United States. Consultants study these to gain extensive knowledge of customs procedures.

Some of the fundamental materials with which they familiarize themselves include:

It’s common for consultants to apply for and receive a customs brokers license. This is granted by CBP upon successful completion of an exam, and serves as a reliable indicator that the licensed individual is qualified to offer advice about importing and exporting goods.

There are dozens of situations that might prompt a business to work with a consultant when importing or exporting goods. The following five reasons are among the most common and apply to businesses of all kinds.

Goods imported into the U.S. are usually subject to some form of regulation, and businesses must be careful to comply with them.

Sometimes it’s a simple matter of addressing dangerous components and checking for proper labels. However, items like food, medicine, and chemicals are more strictly regulated due to their potentially harmful nature if not properly harvested, developed, and stored.

As an example, consider CBP’s efforts to stop the import of goods manufactured with forced labor from the Uyghur people of China. Even major auto manufacturers have found components used in their vehicles contained materials sourced from Xinjiang, where it’s believed the Chinese government is using such forced labor.

Consultants stay up-to-date on the latest information published by CBP, and their knowledge makes it far easier for them to identify items that may be partially or wholly comprised of goods from off-limits regions such as Xinjiang.

They can also advise business owners about licensing and certification procedures required for heavily regulated goods.

It pays to know which countries have favorable trade relations with the USA and which are subject to tariffs. Without this knowledge, it’s easy to make mistakes such as:

Working with a consultant gives you the best chance of avoiding unnecessary tariffs and benefitting from trade agreements such as the USMCA. Therefore, hiring one can ultimately save you money, which you can re-invest into growing your business.

CBP recommends and requires many different pieces of paperwork to document import and export transactions. These include:

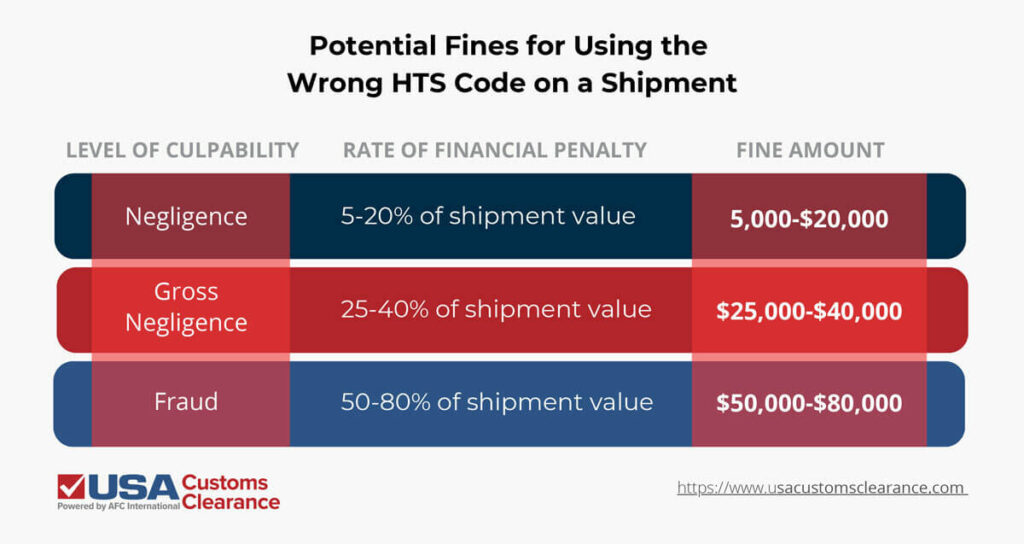

Mistakes on these documents can be costly. For instance, consider a shipment of furniture intended for resale valued at $100,000. If the importer doesn’t use the correct HTS code to determine duties, the following fines could be assessed by CBP.

In many cases, the loss of value at shipping will directly impact your profit margins, should you still be able to sell. Long term consequences also need to be considered.

Import and export consultants deal with this complicated paperwork on a daily basis, and are well-practiced at avoiding common mistakes and pitfalls. Those who are also licensed as brokers can handle filing these documents on behalf of a business, among other responsibilities of an IOR.

One of the first things any new import and export business should do is develop a compliance manual. These manuals outline the processes of purchasing, shipping, receiving, and selling specific goods in the international market.

Factors that influence the contents of such a manual include:

However, even with a manual in place, human error can lead to mistakes over time. CBP uses a process called the Focused Assessment Program to identify businesses that may be out of compliance with government rules and regulations, which can lead to a costly, time-consuming audit and heavy fines should they find any errors.

For this reason, many businesses opt to have their import/export compliance procedures voluntarily audited by outside consultants from time to time. Their impartiality and extensive regulatory knowledge helps them identify potential issues and past mistakes, helping businesses avoid or minimize harsh penalties assessed by CBP.

Consultants often work for brokerage firms with access to extensive shipping and warehousing networks. The international supply chain is complex, and business owners looking for ways to streamline operations may find that a well-connected consultant can set them up with services such as:

In this way, they often function as a one-stop shop for every aspect of international shipping, not just customs clearance.

Partnering with a consulting service can help your business understand the details of the complicated shipping process. USA Customs Clearance can save your company time and money by gathering documents and locating warehouses for your goods once they have been reached their destination.

Our goal is to help businesses cut through the red tape of import and export regulations. Trust us with services such as:

If you still have questions about your shipment or what an import export consultant can do for you, call our team of experts at 855-912-0406 or contact us online today!!

Copy URL to Clipboard

Copy URL to Clipboard

Google is changing how it surfaces content. Prioritize our high-quality guides and industry-leading coverage in search results by setting usacustomsclearance.com as a preferred source.

I am having Engg Manufacturing Factory in Near Mumbai having IEC certification and also export Engg Goods to few countries

I wish to explore Market In USA for Seafood Export

Regards 98209 58425 E mail nhattarde@gmail.com

Hello my name is Jonathan Heiland, I am one of the Customs Specialists with USA Customs Clearance. We will gladly assist you with your import but we will need more information about your shipment. For immediate attention please reach out to consulting@afcinternationalllc.com. We look forward to working with you!