Despite shaky relations between the nations, China is still a popular trade partner for U.S. businesses. It isn’t easy to find new sources for over half a trillion dollars worth of goods, after all, so importers still need to have a strong grasp on the requirements of importing from China.

Key Takeaways:

Understanding the basic concepts associated with importing from China can help make the import process hassle-free. We’ll show you those basics and how to find out if your Chinese goods are subject to additional tariffs.

For updates on tariffs, consult our tariff tracker.

Calculating tariffs from China Takes Work. Ask Our Experts to Help.

Our 45 Minute Licensed Consultants Will Personally Guide You.

In the years since the COVID-19 pandemic, global health concerns have seriously impacted trade with China, creating a burden for many seeking to import goods. However, Chinese goods are still flowing into the U.S. and there are still opportunities for importers.

Some of the most in-demand goods come from China. Many international merchants seek to import everything from medical equipment to furniture and more.

To keep trade flowing from China to the U.S., some tariffs and regulations have been lifted. Items you can import from China that are exempt from tariffs include:

Of course, that list represents only a fraction of possible imports. Since there are still goods exempt from tariffs, many importers are continuing to seize the opportunity to expand their business. However, unfair trade practices on China’s part have prompted the U.S. government to dissuade importing certain goods from the Asian economic powerhouse.

In 2018, the Trump administration issued a series of high tariffs on Chinese goods entering the United States. Known as Section 301 tariffs, they were meant to reduce the trade deficit between the two nations, encourage U.S. domestic manufacturing, and incentivize the Chinese government to respect intellectual property rights.

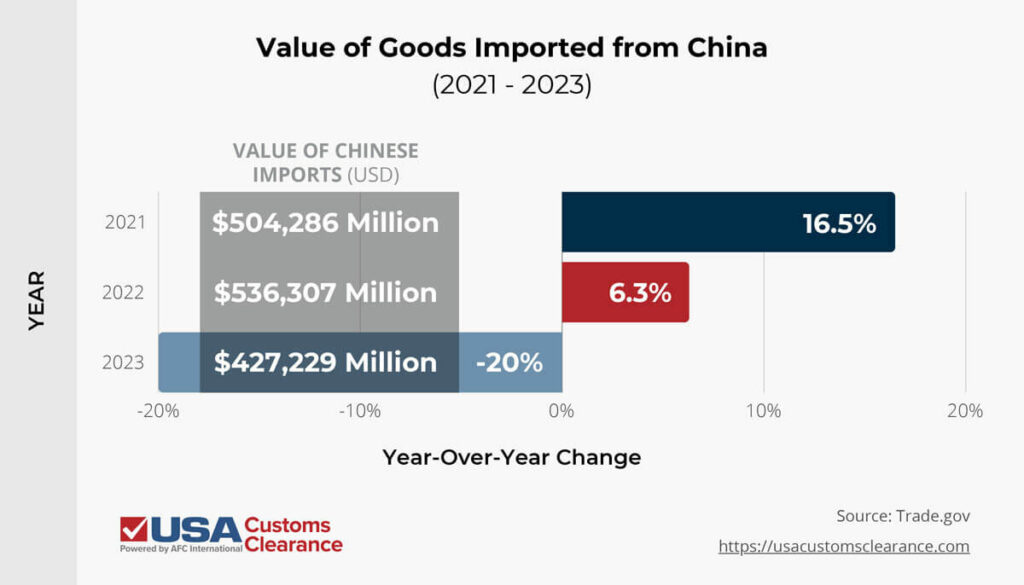

Ultimately, these tariffs have had a massive impact on the import value of products from China to the U.S. This is illustrated in the table below with information sourced from trade.gov.

After years of consistent growth, China lost its position as the number one exporter to the U.S. in 2023, being supplanted by Mexico. This is largely the result of Section 301 tariffs at work. While there’s still some value in importing certain Chinese goods, it’s never been more important for importers to understand the present and future of these tariffs.

Over time, the Office of the United States Trade Representative (USTR) released four lists of goods that would be subject to higher tariffs until further notice, encompassing almost every item that can be imported. The tariff rates applied to many of those goods will continue to increase, all the way up to 100% by 2026 in some cases.

On the bright side, the U.S. has published several lists of goods that were excluded from those tariffs, which can be seen in these section 301 tariff exclusions. Importers that brought in excluded goods can file for a retroactive drawback claim to get refunded for the taxes they may have already paid on the import.

For more information, make sure you check out our article on the topic: Section 301 Tariffs: A Comprehensive Guide.

Many importers travel to China to meet with suppliers while building a wholesale business. Several regions in China specialize in the manufacturing and wholesale of specific goods, such as furniture and toys. China also has unique seasons when manufacturing and importing/exporting are in flux, like Chinese New Year.

If you are unable to travel, you might want to work with a sourcing agent. They can reach out to suppliers on your behalf. Online global sourcing is also a growing market for those importing from China. Websites like Alibaba.com make it simple to order goods from Chinese suppliers.

Related: 18 Alibaba Alternatives for Product Sourcing

Be aware of minimum order quantities (MOQ) when importing from China. Generally speaking, the less expensive an item is, the higher its MOQ will be to ensure profitable sales for manufacturers and wholesalers.

After you have found the items you’d like to import, it’s time to start the process of getting your goods across the border and through customs. This involves significant legwork and planning.

To help, USA Customs Clearance offers consulting sessions to get you in the know about what it takes to import goods from China.

Related: How to Import Generators From China

Even though imported goods can be less expensive than domestic goods, there are some additional costs associated with bringing in goods from China. Importing costs you need to know about include:

If you need help calculating the costs of importing specific goods from China, our licensed brokers can make sense of all the different factors that influence HTS classification, and can assist you in filling out all the right paperwork too.

Related: Importing From Thailand to the USA: Duty Calculations

There is no general import permit to bring in products from China. However, certain goods do require a special permit or license prior to importing. Different federal agencies oversee different imported products, and requirements can vary. Agencies that oversee common imports include:

There are several Partner Government Agencies (PGAs) that importers need to be aware of in order to stay compliant. A customs broker can help you understand all the requirements that apply to your shipment, and can get in touch with all the applicable PGAs on your behalf.

Related: Importing Glass From China

Your main responsibility to the government during an import transaction is the payment of all relevant duties, tariffs, and taxes. The Harmonized Tariff Schedule (HTS) lists product codes, which are used to determine the duty percentage, ensuring a level playing field in the business sectors.

For help classifying your imports, you can work with an experienced customs broker. Most brokers have imported goods into the U.S. hundreds—if not thousands—of times. They know the process inside and out, and you can count on them to answer any of your questions about tariff classification and importing in general.

As CBP expands its efforts to enforce the Uyghur Forced Labor Prevention Act, it’s also increasingly vital for importers to trace the supply chain of any goods they purchase. Several large businesses have already received pre-audit notifications for upcoming CBP inspections based on suspicion of components as simple as silicon being sourced from the autonomous region.

Even if your supplier isn’t 100% forthcoming about the country of origin for its goods, it’s your responsibility to avoid bringing these goods into the United States. That means you’ll face any potential consequences for violation of the UFLPA.

If you plan on importing anything from China or a Chinese trade partner, check out our article: What Importers Need to Know About the Xinjiang Import Ban.

CBP mandates that you use a customs bond when your imports are valued at more than $2,500 or the imports are subject to another federal agency’s oversight. Generally speaking, if you’re importing goods for resale, you will need a bond on file with CBP.

Related: How to Get a Customs Bond

A licensed customs broker can be a great asset to you when importing from China. They will make sure that your imported goods cross borders efficiently and arrive at the port of entry in a timely manner. In addition to that, they can help you ensure that your shipment follows all customs regulations and rules when entering the country.

Your broker can provide a variety of services when importing from China: These might include:

Our brokers can go over all the necessary details for your shipment and ensure it’s compliant with CBP and other regulations.

Importing from China can be a lucrative, exciting and, at times, challenging endeavor. Allow USA Customs Clearance to help manage challenging times while you enjoy the lucrative ones.

Working with our customs specialists can help ensure that you have all the proper documents in place, making your import transaction seamless and easy.

Our comprehensive suite of importing services includes:

Give us a call at (855) 912-0406 or contact us online to get in touch with a customs specialist who can get you the information you need right now.

Copy URL to Clipboard

Copy URL to Clipboard

Hi I am Australian and I wish to sell/import product from China to the USA

The value of goods will be approximately $10,000 USD what would the duty/taxes/fees be?

The product are plastic pontoon boat floats. (Hulls)

Kind regards Brett

I ordered shirts from China 50pcs. Valued at $800.00. They say they deliver to my door. What do I need to do to make sure I get them delivered to me.

import duty tariffs and customs cost on importing 6 coils of 26 gauge painted coil steel in a single 20 foot shipping container for forming into roofing panels.

FOB houston or all the way to Marshall TX.

cost including shipping to houston estimated at around $25,000

I'm trying to buy a motor from Hong Kong China just one motor that's all I need motor cost 2160 he said they can send it by Sea freight to Port...I'm in San Antonio Texas 78207 I'm not rich so I don't know how to go about this any little advice would help thank you brother God bless you

I bought an engine and then found out how hard it is to get here. I won't do it again unless I save at least a $1000. If you have to warranty the engine you'll have to pay for all the import crap again which is around a grand. You have to use a broker, forms have to be filled electronically so you need them. Still not sure if EPA will let it into country being the Chinese don't test them for emissions.

I have LLC in Maryland and currently I am exporting educational supplies to be shipped from China to Ethiopia.

Do you I need to import to USA and reexport later to Ethiopia ? Or I can export directly from china to Ethiopia?

Do I need to declare to CBP ?

Do I need to pay tax for each export or need to pay the profit tax at the end of the year?

What documents need to keep for future income tax ?

Please I want to start importing Men footwear from church to Nigeria, What are the necessary requirements?

what will be shipping cost from china to Canada to Vancouver port when we have 500 pcs of 1m lightning cable and 500 pcs of 2m lightning so what the shipping cost

Hi, Thanks for a very informative website.

Do I still need to pay import duties (40%) to bring HTS 9030.90.4600 products from China to the US if I'm planning to export them to Europe later?

Hi Ivan,

Regardless of the HTS, you'll still need to pay duty upon import. If you're looking to obtain a duty drawback refund when you export the products, you'll need to follow specific guidelines and provide an adequate amount of documentation in order to qualify. One of our customs experts will reach out to you shortly to obtain some additional information from you and schedule a consultation with our Licensed Customs Brokers. We look forward to helping you!

I am a new Amazon FBA seller . I will be starting out selling stainless steel drink tumblers that keeps drinks hot or cold. I am sourcing from China (Alibaba) and my cost of supplies will be around $1300., not including shipping and whatever else that is involved. Is it correct that your services would only involve importing into the US? I would like to have my goods flown in only for the first order and thereafter by sea. Is this a situation you would handle?

Hi Linda,

Thank you for reaching out. We can help you with more than just importing you products. We have a partnership with a freight forwarding company that allows us to handle the entire shipping journey for your products! If you have all of the details regarding your shipment, you can request a Customs Brokerage quote from our team. This quote can include other logistics services including transportation and warehousing if you need them.

You can request a quote at the link below.

Customs Brokerage Services

I am brand new at this. How many different company's do I need to order stuff from China and feel safe doing it? I would like a chance to see about a few things for myself and resale. a few things are golf carts, pontoon boats, car and big truck tires, wheels/rims for the tires, bicycles and trikes. etc. Those are the ones I really am likely to order. Also I need to know about the shipping and clearing then to be shipped and received in my hands either at the dock, work or home.

Hi Danny,

We can help you understand the end-to-end process for importing from China through our import consultations. Your consult is 1-on-1 with one of our Licensed Customs Brokers and they provide you with a complete roadmap of what you'll need to successfully import your products into the U.S. Because you're importing from China, you'll have some additional steps to go through. For that reason, we highly suggest consulting with our team. You can use the link below to sign up for a consultation. We look forward to helping you!

Licensed Customs Broker Consulting

Someone I know is importing beauty accessories,like brushes,pillow cases, items are in boxes printed with their logo on them. They don't have a 'Made in China's label on them. They resell on line. What are the PENALTIES without a 'Made in China' label?

Hi Danny,

The violation you described here can come with some serious consequences. Per CBP, goods that don't comply with CBP's marking of country of origin rules can be exported, destroyed, or be imposed additional duties. In this situation, we would advise that the products be sourced from a more reputable supplier that already complies with CBP's marking guidelines.

Hi,

I'm trying to import EVA foam from China around 180 small sheets . I asked to send by air and they will deliver to my door. They said shipping fee does not include customs or tariffs.

How do I pay for that?

Thanks,

Lilian

Hi Lillian,

Customs duties and fees can be prepaid by the shipper or paid by the recipient of the goods. Typically, this is determined by the Incoterms of the shipment. For example, in a DDP (Delivered Duty Paid) shipment, the supplier covers the import duties and fees for the recipient. It would be best to confirm with your supplier in China what the Incoterms of your shipment are going to be.

If you still need help, you can schedule a consulting session with one of our Licensed Customs Brokers and we'll guide you through the process!

I am trying to import a Standby diesel genset it has EPA certificate what are the custom fees

Hi Mike,

The customs fees will depend on a number of factors including the value of the engine and its' country of origin. One of our customs experts will reach out to you shortly to obtain additional information from you so that we can provide you with a quote. We look forward to helping you.

I will be importing a Photo Booth from China. What will I need to do to inorder to clear customs?

Hi Rodolfo,

You'll need to have some standard import documents prepared and completed ahead of your photo booth's arrival. The link below contains a detailed list of these required documents. If your product is a commercial import that's being used for your business or intended for resale, our Customs Brokers can clear and import for you.

Documents to Clear Customs

I'm looking into importing a few diesel engines from china. The freight will be included in the sale price to my nearest US port. What amount of additional fees and taxes should I expect to pay?

Hi Luke,

The amount of duties and fees that you'll pay will depend on the value of the engines, as well as the specific HTSUS that's assigned to them. Additionally, depending on the Incoterms that you agree on with your supplier, they may cover the costs of import duties.

One of our import experts will reach out to you shortly gather additional information and provide further assistance.

looking to import newer Kei Trucks / mini truck I have been reading you can import these as utv /atv is this true

Hi Tim,

We've responded privately with the information that you requested. We look forward to assisting you further!

Hi, I would like to bring just 50 scanner for cars... so do you think do i need to pass through all this process?

Hi Alberto,

The process that you'll need to follow will depend on a few factors including the intended use of the scanners, value of the import, product components, and more. To receive specific guidance on the process, we recommend scheduling a consulting session with our Licensed Customs Brokers. They'll provide you with all of the information you're looking for.

Hello,

I am going to import silverware set from China. Does it need to get FDA prior notice or confirmation on it?

Could you also please advise if importation from China to the USA is going smoothly now a days?

Thanks for your advice.

Hi Atefeh,

Your silverware may or may not be subject to FDA requirements. It depends on the specific HS code that CBP assigns to your products. Also, because of the situation regarding section 301 tariffs on many products from China, there is still increased scrutiny on goods coming from there.

We responded privately and provided you with additional information regarding your import. We look forward to working with you.

Hello,

If I am importing leggings and hoodies, will they be taxed lower at this time or will it still be 35%?

Hi Steve,

We've responded privately with the information you requested. We look forward to working with you.

what do i need to start new business importing from china just fresh start to bring face mask and N95.Frist do i have to have import licence?

Thank you.

Ness Nur

Hi Ness,

When importing goods for commercial purposes, you'll need to have a customs bond to cover your import shipments. Face masks are also regulated by the FDA. Many businesses have had their face mask imports seized recently for not being in compliance with the necessary regulations. Before importing your masks, we recommened working with one of our Licensed Customs Brokers. They'll provide you with everything you need to legally import your masks.

Utilize our Licensed Customs Broker consulting to get the help and answers you need. We look forward to working with you

Hello there,

I would like to import a 400 cc 4 seater UTV from China through a Chinese supplier through Alibaba.com. to Jacksonville seaport. How much would it cost me to get it cleared through customs paying all the duties and fees.

Thanks

Hello Joseph,

The total cost of your import will depend on a number of factors including the value of the UTV and the specific HTS code.

Feel free to reach out to our team at (855)912-0406 or schedule an import consulting session with our Licensed Customs Brokers.

I would like to import ag equipment to sell in Colorado. Is Alibaba or similar the best route or should I become an importer ?

Hello Mr. Kendall, - thank you for your inquiry. We wanted to let you know that we replied to your question by email. If you have any questions, please let us know.

I have 5000 bottles of supplements in China.

Can you make a good price to bring and do customs clearance of it?

Thanks,

Lucas

Your info has been submitted to our import specialists who can help you with importing your supplements into the US. You can expect an email from us soon.

hi! this is a excellent site and i always enjoy the data posted below. Bookmarked and shared. Thanks once again!

I do like that you said that there are Chinese suppliers that specialize in manufacturing items in bulk to make sure that you'll be able to purchase in wholesales. My husband and I wanted to own a furniture store in the future. What we want is to reduce our capital cost in sourcing our products without cutting the number of items that we need, so we'll make sure to consider China sourcing.

I was thinking of selling on Amazon and buying product from China how much would it cost thanks mike Dickinson