The United States is home to a massive variety of imported food from all over the world. Americans’ appetite for unique flavors drives the demand but, there are some important details you need to be aware of.

Key Takeaways

To get a complete understanding of how to import food products to the U.S. for resale, we’ve put together the comprehensive guide below.

When food is brought into the U.S. from another country, it’s generally for one of two purposes:

While some of the information in this article will be helpful for personal imports, we’ll be focusing on rules, regulations, and processes as they apply to commercial use and resale.

There are several regulatory agencies in the U.S. who oversee imported foods. These agencies are:

The rules concerning who can import food into the country and in what quantities vary based on the principal agency in charge of regulating any given foodstuff. One regulation that is almost 100% consistent, however, is registering your food production facility with the FDA.

Nearly all foreign manufacturers, suppliers, and distributors of food intended for import to the U.S. must register their facility with the FDA. This requirement stems from regulations outlined in the FDA’s Foreign Supplier Verification Program (FSVP).

This program requires importers to maintain and provide records showing that foreign food suppliers are abiding by all FDA requirements. Viewing these records allows the FDA to identify whether the proper procedures for handling, processing, and storage of food are being followed.

To expedite the food import process, it’s recommended to include the facility registration information at the time of import along with all other required documents.

Want to learn more about clearing FDA regulated products? Check out our article on FDA customs clearance.

Like any other process defined by government involvement, there’s no shortage of paperwork you’ll need to submit when importing food. Some of the most important documents are:

In addition to these documents, you will most likely need to purchase a customs bond to complete the transaction.

For an exhaustive description of all the paperwork involved in international commerce, check out our article “What Documents Do I Need To Import and Exports?”.

If you’re importing food for resale, you will need a customs bond regardless of the shipment’s value. More specifically, you will most likely use a continuous customs bond if you plan to import food in large amounts on a regular basis.

Related: How to Get a Customs Bond: A Guide for New Importers

Some of the most important regulations in regard to importing food have to do with how and what kind of information is contained on the Nutrition Facts label. Prepared foods must be labeled for resale (raw produce does not).

While the full list of food labeling requirements is exhaustive, we’ll cover the main information they must contain below.

Other label requirements have less to do with nutrition and more to do with ensuring transparency for consumers. These include:

In rare cases, some packaged food is exempt from labeling requirements. For instance, small businesses (defined by the FDA as retailers with annual gross sales of < $500,000) are not beholden to these regulations.

Before ordering pre-packaged food from a foreign supplier, be sure to verify their labels comply with FDA requirements.

If your food is regulated by a different partner government agency (PGA), there may be further regulations you’ll need to follow, which we’ll explore in the following sections.

Some food products, like organic food, require very specific labels. For more information on this topic, check out our article on importing organic food to the U.S.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

If you’re looking to bring dairy products into the U.S., you’re going to have some additional hoops to jump through. These products are regulated by the USDA in addition to the FDA.

This situation is further complicated by the varying requirements depending on what type of dairy products you’re importing to the U.S. Certain dairy products require a special import permit from the FDA, while others don’t.

The products listed below require an import permit under the Federal Import Milk Act (FIMA).

This act does not cover evaporated milk, sour cream, dry milk, cheese, yogurt, and ice cream.

Lastly, depending on the type of dairy product and country of origin, you may need to obtain an official APHIS veterinary permit. This requirement is in place to ensure that products with a higher likelihood of having a foodborne illness are closely examined before import.

Related: Importing Dairy Products into the US: Surviving the Regulations

APHIS also maintains an approved commodity database, which contains comprehensive information on all fruits and vegetables that have already been approved for import. The information is organized by type of fruit or vegetable and country, letting you quickly know if what you’re looking to import is allowed.

Generally, you’ll need to obtain an APHIS import permit by completing PPQ Form 587 in order to import fruits and vegetables. This form can be completed online and approval can be received in as little as one day.

For even more information on this topic, check out our article on importing fruits and vegetables into the U.S.

The USDA’s Food Safety and Inspection Service (FSIS) works to ensure that all imported meat, poultry, and applicable egg products are safe and properly labeled. The service also performs occasional inspections on imported foods under their oversight for quality assurance purposes.

This means you can source meat and poultry imports from around the world, but you may be limited to certain types depending on the country. For instance, in addition to conventional beef and poultry, Canada can export raw and processed meat from the following animals into the states.

On the other hand, Chile can export raw beef, chicken, turkey, and pork to the U.S., but not more exotic meats. Part of this is due to the special trade relationship the USA shares with Canada and Mexico via the United States Mexico Canada Agreement (USMCA).

The FSIS keeps a comprehensive list of approved vendors organized by country on their website.

Use this checklist to ensure the following conditions are met when importing meat and poultry into the U.S.:

For even more information on this topic, check out our article on importing meat into the U.S.

The United States imports a vast amount of seafood from all over the world each year, including:

Seafood regulations are split among a few difference agencies (including the FDA), but importers will want to be especially mindful of the National Oceanic and Atmospheric Administration (NOAA). Via its Highly Migratory Species (HMS) International Trade Program, this administration requires importers of the following seafood to apply for a permit prior to trading in the U.S.

A third agency that oversees certain seafood imports is the FWS. Importers may need to complete USFWS Form 3-177 when importing seafood. Fish and Wildlife regulates the import of squid, octopi, abalone, and many reef-dwelling organisms.

Want to learn more? Check out our guide on how to import seafood to the U.S.

If you’re planning on a long-time career importing food, consider participating in the Voluntary Qualified Importer Program (VQIP). Managed by the FDA, this program provides some valuable benefits to participating importers, including:

Of course, access to these benefits isn’t for just any importer.

In order to qualify for the VQIP, importers must meet certain criteria, including:

User fees for VQIP membership are due before October 1 for each fiscal year in which you’re part of the program.

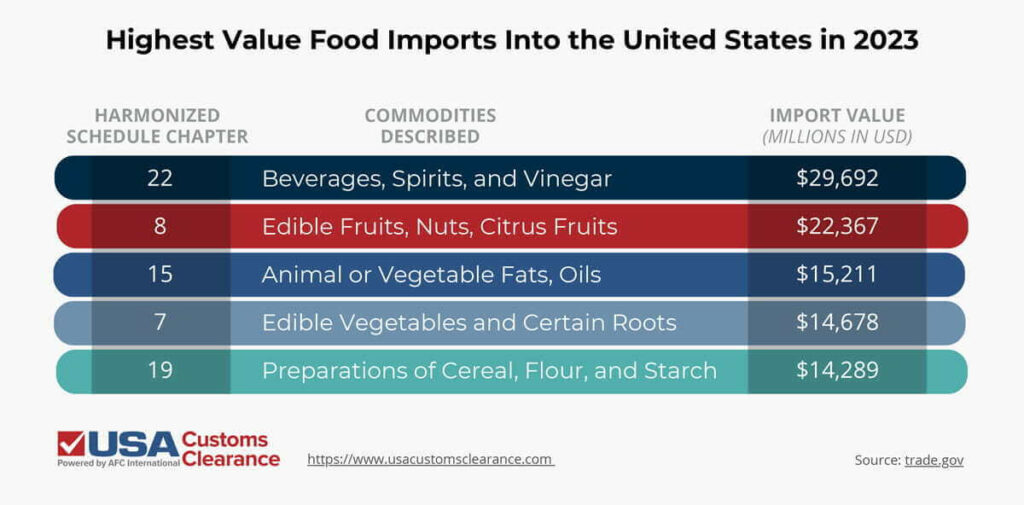

Most foodstuffs are categorized in chapters 2 through 22 of the Harmonized Schedule, which is used by countries across the world to simplify identification of commodities. In 2023, the USA imported over $178 billion of food and beverages, with the following goods accounting for the majority of that figure.

In many cases, facilities in the U.S. are capable of growing and producing these foods themselves, but demand outweighs the native supply enough to necessitate importing. This is true of edible meats, dairy products, and unprocessed cereals. However, some popular foods simply don’t grow well in the United States, despite the country’s wide variety of environments and biomes.

The following foods are in consistent demand year over year and are difficult to impossible to grow in sufficient quantities on U.S. soil. I’ve also included their most common countries of origin for reference.

There are also several cheeses that the U.S. imports from other countries, such as Italian Parmesan and French brie. Your food’s country of origin will play a part in calculating duties on your shipment.

Related: Importing Food From Italy: A Ripe Opportunity

Duty rates vary from one foodstuff to another, so there is no flat rate you can expect to pay in general duties per shipment. However, we can choose one foodstuff to focus on for the purpose of illustrating how duties would be calculated.

Flavored, organic green tea is classified under the Harmonized Tariff Schedule (HTS) code 0902.10.1050. The duty rate for this code is 6.4% of the shipment’s value.

Let’s say you ordered $5,000 worth of goods classified under this HTS code. The calculation of duties would look like this:

This calculation is taken from a general rate of duty. There are also special rates of duty for countries with whom the United States shares a trade agreement. Trade agreements can take several forms, from offering 0% rates to preferential rates that are simply lower than average.

On the other hand, negative trade relations can lead to increased duties and tariffs. Sourcing our green tea from China would lead to an additional 25% in taxes due to Section 301 tariffs. A recent move by the U.S. has also placed reciprocal tariffs on products from most nations.

While the average reciprocal tariff is 10%, some countries have individual rates that run much higher. Fortunately, the country specific tariffs have been postponed for 90 days, except for China. However, there's no telling what could happen after that time is up.

Related: What Are Reciprocal Tariffs?

Worried about the Strict Regulations?

Our Customs Experts Will Personally Guide You.

From seafood to olive oil and everything in between, the food importing process is fraught with rules and regulations that can even trip up experienced business owners. If you’re looking for assistance with this complex task, you’ve come to the right place.

At USA Customs Clearance, our licensed customs brokers have extensive knowledge and experience in importing food from all over the world. We can ensure that your shipment is compliant, and all documents are processed quickly and accurately.

Our full list of customs services includes:

Hungry to get started? Give us a call at (855) 912-0406 or submit a contact form online today!

Copy URL to Clipboard

Copy URL to Clipboard

Live in Los Angeles and want to import Black olives from Greece for resale. Where do I need to go to find out the licensing and rules I need to follow to make everything legal and proper. Thanks for your time.

I want to start to import fresh coconut water in bulk for final bottling in the USA territory. What will be my concerns? Could you give me some Inputs.

How do I import pulses and rice to United States from Canada that were originated in India and redistributed to Canada?

Hi! please, can I get a permit for importing goods from different countries to United State.

We have two clients in Italy that would like us to import their olive oil into the US. We don't have an import partner yet and are wondering if we can play the role if partnered with a licensed customs broker.

I am looking for importing clarify butter from india to usa

Hi there, what would be the procedure for importing died fish or seafood from India?

Can a small amount of dried specialized mushrooms be imported from India?

If I want to import maybe 3-4 boxes of chips and soda from Mexico to US, do I need all of the above? I plan to keep it under $800 of merchandise per month.

Hi,

I would like to import dried larvae, insect meals, insect oil (HS CODE 2309.90.11). What are the steps necessary and regulations in place for the supplier to enter the US?

I am planning to import Indian frozen food items.. Is there a list of to do items anyone has, which might help me?

I am looking forward to Import, smoked catfish, and freezer live Catfish packaged and weighing 20kg per carton, vegetables, poultry Products; crates of eggs, chickens.

All from Nigeria. What are the procedures to deliver to US?

Hi Onyekwere,

Because all of the items you listed are food products, you're going to have many steps to go through in order to import all of these goods. One of our import experts will reach out to you shortly to setup a 1-on-1 consultation with our Licensed Customs Brokers. We look forward to helping you!

I am wanting to import bottled juices and condiments and jams and honey from france. What questions do I need to ask the manufacturer and how do I begin? They already have an importer in usa.

Hi Janet,

If they're already working with a U.S. importer to bring in their goods, that's a great sign. This likely means that their facility is already registered with the FDA. There are some questions you should in regards to the shipping terms that they use and whether you're responsible for clearing customs or if they handle it.

One of our import experts will reach out to you shortly to provide further assistance and setup a 1-on-1 consultation with our Licensed Customs Brokers. We look forward to helping you!

Hello

I'd like to import NON dairy products from Vietnam to US. Am I required an import permit? if required, what US government agency can I apply to?

Thank you

Hi Huong,

Whether or not you need an import permit will depend on exactly what you're importing. For example, some fruits and vegetables require a PPQ permit, while others don't. When it comes to importing any type of food product, you can end up dealing with USDA, FWS, FDA, and more.

One of our import experts will be reaching out to you shortly to gather some additional information to assist you. We look forward to helping you!

I would like to import processed chips and other processed foods from Zimbabwe to the USA. What do I need and what should I do?

Hi Simon,

You're going to have many steps to go through when it comes to importing food into the U.S. Our Licensed Customs Brokers can give you a full overview of this process and answer your specific questions during a consulting session. The link below provides information about our consulting services and a link to purchase a session. We look forward to assisting you further!

Import Export Consulting Services

I am looking at importing fruit syrup from Colombia to the USA. I am being told I can't pack them in vacuum-sealed bags. Does that sound right, and if so is there a reason why

Hi Andrew,

One of our customs experts will reach out to you shortly in regards to your question. We look forward to helping you!

We want to import Food Products from Puerto Rico. Is that still consider import since PR is Us territory. Can you help me with the details. Is there any specifics regulations?

Hi Pablo,

While Puerto Rico is a U.S. territory, there will still be a review process similar to importing involved. Our Licensed Customs Brokers can help you with this. You can consult with our brokers through our import consulting services to get the help you need.

Greetings from Malaysia. I want to export halal snacks and energy bars from Malaysia to the USA. Can you advise me on the estimation of costs and typical timeframe expected to obtain FDA certification? Thank you.

Hi Farriz,

Our Licensed Customs Brokers can review this information with you through our import consulting services. During your consulting session, our Broker will review the details of your import and provide with estimated costs, timelines, and more. We look forward to assisting you further.

Hi There,

We are planning on importing vegetarian, soy base products from China. Please advise FDA guidelines in terms of ingredient limitations.

Thanks

Chris

Hi Chris,

There aren't many rules in place regarding ingredient limitations. However, you'll need to comply with FDA import requirements, including, filing prior notice. It's also best to work with a Licensed Customs Broker to properly classify your imported food with the correct HTS code.

You can schedule a consulting session with our Licensed Customs Brokers at the following link- Import Export Consulting Services. We look forward to assisting you further!

Hi,

I am looking to import non dairy pre packaged baby food powder from india to usa.

Can you help me with the details.

Thanks

Hi Hk,

We can absolutely help you with this! One of our customs experts will reach out to you via e-mail to assist you further.

Hello!

My wife’s family in Peru has a small farm and want to start importing organic Avocados, pecans and grapes to the United States.

We want to set up a little business to be able to help them best do this.

What would that process look like?

Hi James,

There are many steps involved in getting setup to import food products into the U.S. One of our import experts will reach out to you shortly to provide you with an overview and schedule a consultation. We look forward to helping you!

Hello,

I was approached by a distributor in Greece about importing a variety of prepackaged gourmet foods. I've never done this before and I'm trying to figure out what that would entail. Your article is very helpful but I obviously need more help.

If someone could reach out, that would be very much appreciated.

Thanks

Hi Kelly,

We appreciate the feedback! We've reached out to you privately via e-mail to assist you futher.

I am planning on importing Tahini from Israel. Any help/quidance here?

Hi Fuat,

Tahini will be subject to FDA regulations. You'll need to ensure that it's being processed in an FDA registered facility and follows all of the relevant guidelines inclcuding labeling requirements and more.

We've responded privately with additional information to assist you.

Hello,

I’m trying to gather some basic info on importing jams, pickles, fruit syrup And olive oil from Lebanon. What do I need to do/know? Thanks !

Hi Alex,

All of the products that you listed will need to comply with FDA and standard customs regulations. Our Licensed Customs Brokers can assist you with this and walk you through all of the details.

Schedule an importing consulting session with our Licensed Customs Brokers to get definitive answers to all of your questions. We look forward to helping you!

Does importing honey and nuts to sell them on Amazon need any specific license

Thank you

Hello,

All imported honey and nuts are required to comply with FDA standards. This includes proper labeling on the goods, as well as providing documentation that the goods were process in an FDA approved facility.

Our team of Licensed Customs Brokers can assist you in ensuring you have the proper documentation and everything you need to safely import your honey and nuts. Reach out to our team at (855)912-0406 or schedule a consulting session today. We look forward to assisting you.

Hello we are a startup at UC Berkeley looking to import dehydrated insects (Black Soldier Fly Larvae) from either Europe or Singapore/Malasya. The end use is to make dehydrated pet food. Could you guide us about the steps that we eventually have to take?

Thank you very much!

Hi Adolfo,

Thank you for reaching out to our team. There are a number of steps you're going to need to take. Your import will need to include proper paperwork through the Fish and Wildlife Service. If you end up importing from Singapore and want to take advantage of the free trade agreement with the U.S., there will be additional paperwork to complete as well. This is all in addition to standard import procedures, including securing your import with a customs bond, that need to be followed.

Our team is more than happy to assist you with all of this. You can reach out to our Licensed Brokers at (855)912-0406. We look forward to working with you and helping you bring your insects into the U.S.

Hello,

I would like to import canned Hummus dip to the US. What is the custom duty cost for this product?

Hi Maria,

One of our Licensed Customs Brokers can provide you with this information. Give us a call at (855)912-0406 to speak with our customs experts.

We want to export from Mexico ready to eat meals, with deferments flavors. All this meals have meat from beef, chicken and pork. What I have to do??

Hi Sergio,

Since your import contains food products intended for consumers, it will need to be in compliance with FDA regulations. You'll also need to abide by all CBP regulations as well.

Our team can assist you with all of this. Please give us a call at (855)912-0406 and our team will be happy to help you.

Hi! can a product to be imported to the United States from Colombia can have two different nutrition facts label at the same package? the local and the USFDA? or need to have just the USFDA?

Regards,

Sandra

Hi Sandra,

The labeling rules vary from product to product. The best course of action is to consult with our Licensed Customs Brokers. They'll be able to review your product to determine the specific labeling rules that apply. You can schedule a consulting session at the link below. We look forward to helping you!

Import consulting services.

hello am working to import yellow cucumbers from Egypt toUSA for resale to the retailer store I like to inform you this kind of cucumber is not existing in US I never import before can you advise how to start thank you

Hi Ron,

We can absolutely help you with this! One of our customs experts will reach out to you shortly to provide you with the information you requested.

I would like to know the requirements of the United States to allow for the import of raw, un-pasteurized citrus juice from Costa Rica.

Hi Matt,

Thank you for your question. Importing citrus fruit into the United States is regulated by the Food & Drug Administration (FDA) and US Customs. We can help you with understanding the process and obtaining the information that is needed. Through our consultation services, we will explain what the requirements are, if permits and registrations are required as well as the US Customs requirements. We know it can be confusing, especially for first time importers which is why we created this program - It's a perfect place to start.

Our fee is $495 for a 45 minute consultation. During your consulting session, our Licensed Brokers cover all of the basics for importing and go over your specific situation and what will be needed to successfully import your products.

I am in Australia. I have a friend in the USA who has asked me to send him one packet of chicken salt for his personal use.

Hello, for personal shipments you are not required to work with a customs broker and I don't see any issues with shipping this commodity to the US. Is there a specific question that you have for us that we can answer? Thank you, Jonathan Heiland

I want to import Lanzones from Thailand to USA, with a high volume of it

Tell me what I have to do since I have a continuous service Bond?

Hi Nina! Great question! I have attached a link to our consulting team that can assist you! We look forward to hearing from you!

What is required from a manufacturer in Mexico to us to import to the US? Does this manufacture have to be HACCP or IS22000 approve. Looking to import shelf stable bakery fillings in large packaging format.

Hi Rick! We'd be happy to help with your import into the US. For importing food, you'll be to meet FDA requirements in addition to Customs requirements. You're in luck, we can help you with that! One of our customs experts will be in touch shortly at the email address you provided!

Hi, I would like to import Rice from Pakistan to US, what would be the proper procedure?

You'll need to register your import with the Food and Drug Administration (FDA) first and if you're importing for business, you'll need a customs bond. You can buy a customs bond right on our website, USACustomsClearance.com. You can also come back and chat with one of our import experts by clicking on the chat bubble in the bottom right corner of the page.

I would like to import Andean berries from Colombia. What do I need to do?

The next steps would depend if you're importing the berries for personal or commercial purposes and the volume of berries you plan to import. We offer consulting services and can walk you through the steps and paperwork you'd need to file. You can chat with us by clicking the chat button in the bottom right corner of the page and one of our import specialists will be happy to help.

I like to import mango Steen and other tropical fruits from Thailand. How can o do that?

Thanks for reaching out with your question. The import of Mangosteen from Thailand was illegal in the US until 2007 because of concern over importation of fruit flies. While it is now legal to import the fruit, before you ship, it must be irradiated to make sure there are no fruit flies present. Documentation of this process must be presented before fruit will be allowed into the US. Here is a helpful link with some FAQs about what is needed. When you're ready to purchase a bond, we can help. You can buy it easily right through our website, or you can chat with us for more help.

i want to import snacks like potatoe chips, cassava chips, arracacha chips, and plantain chips and trail mixes of nuts, as well. What are the steps knowing that i dont have any company so i have to create one, and what is the spending time or lead time to achive this goal?

The regulations for importing foods like the ones you mentioned are different if you are a business than if you're importing for personal use. When you're ready to start importing for your company, feel free to chat with one of our import specialists by clicking on the bottom right corner of the page and we can help you through the process.

Can you reach out to me on enail i have juice import questions

You can use our chat feature in the bottom right corner of the page to speak to one of our import specialists. They will answer any of your questions there. Thank you for reaching out.